[ad_1]

Sometimes, debtors refinance their house loans to make the most of decrease mortgage charges.

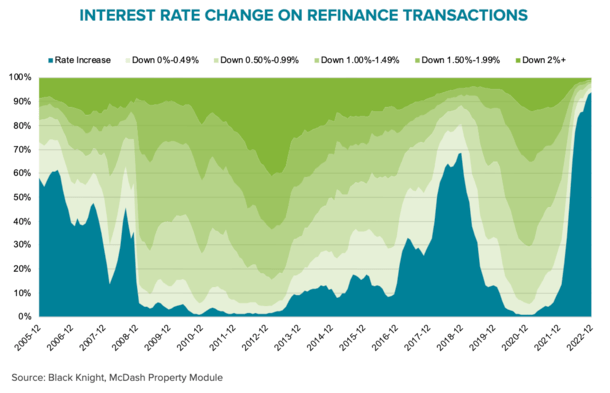

However lately, the typical refinance has resulted in an rate of interest 2.4% larger than the speed previous to the transaction.

As to why, it’s largely as a result of the one householders refinancing today are doing so to faucet fairness.

The final time we noticed an identical phenomenon was in 2018, when roughly 70% of refinances concerned an rate of interest improve.

Again then, debtors noticed a mean price improve of 0.4%. What’s happening?

Price and Time period Refinancing Hits an All-Time Low

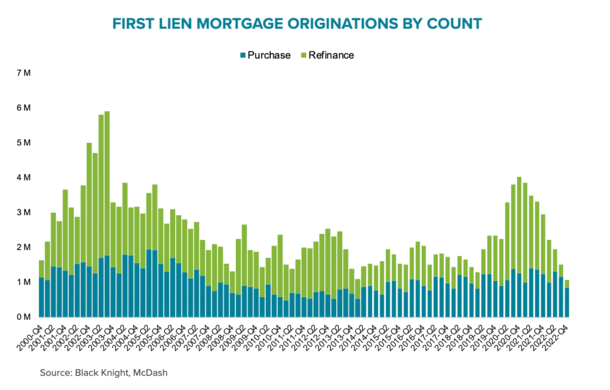

A brand new report from Black Knight revealed that 96% of the 216,000 mortgage refinances accomplished within the fourth quarter of 2022 have been cash-out loans, the very best quarterly share on file.

In the meantime, there have been lower than 10,000 price and time period refinances, the bottom on file.

Previous to This fall 2022, the bottom quarterly complete was 76,000 in 2018. The common has been 650,000 per quarter going again 15 years.

And within the first quarter of 2021 alone, there have been 1.8 million price/time period refis, 190 occasions the This fall 2022 complete.

For all of 2022, 1.98 million money out refinances have been accomplished, accounting for greater than 80% of all refinances for the yr.

In different phrases, the refinance market has been dominated by money out refinances, which makes complete sense.

With mortgage charges near 7%, there’s little or no cause to refinance except you’re tapping house fairness.

The one different cause, apart from say eradicating somebody from an present mortgage, could be to modify from an adjustable-rate mortgage to a fixed-rate mortgage.

However these conditions gave the impression to be few and much between.

The 216,000 refinances within the fourth quarter of 2022 (together with 62K in December) have been additionally each all-time lows.

And the 863,000 buy mortgage originations have been the bottom since 2015, pushing total quarterly mortgage quantity to its lowest level on file (courting again to 2000).

The Common Mortgage Refinance Led to an Curiosity Price 2.4% Increased

Black Knight famous that cash-out refinance quantity has additionally fallen of late, however ought to “make up the lion’s share of refinance lending in early 2023 as properly.”

What’s fairly wild is 94% of those that refinanced this previous December raised their rate of interest within the course of.

And the standard refinance resulted in a 2.4 proportion level improve within the debtors’ rate of interest!

For instance, a borrower might have had a price of three.5% earlier than the refinance, and now has a price of 5.875%.

After all, in the event that they want the money, they want the money. And whereas an rate of interest of near-6% isn’t as favorable as 3.5%, it doubtless beats charges on all different forms of loans.

So the cash-out proceeds might nonetheless be used to extinguish different money owed with a lot larger rates of interest, presumably within the double-digits.

For perspective, the typical borrower who refinanced in early 2021 obtained a mortgage price discount of 1.3% on common.

As seen within the chart above, mortgage price will increase post-refinance have been additionally frequent in 2005-2008.

Again then, there have been quite a lot of money out refinances too. And debtors have been typically serially refinancing to cowl discretionary purchases.

Quarterly Money Out Quantity Lowest Since 2015

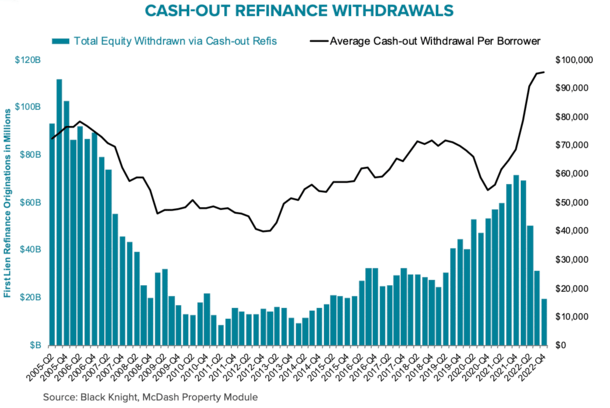

Regardless of money out refis main the way in which, simply $19 billion in fairness was withdrawn through the fourth quarter, the bottom complete since early 2015.

And cash-out withdrawals equaled a mere 0.2% of tappable fairness coming into the quarter, the bottom on file.

In different phrases, there’s a ton of house fairness on the market that has been left untapped.

This contrasts 2006-2008, when householders tapped each penny doable by way of 100% CLTV money out refinances.

Nonetheless, the typical quantity of fairness being withdrawn surged from lower than $55,000 in late 2020 to greater than $95,000 lately.

So those that are cashing out are pulling more cash out.

However the common unpaid steadiness (pre-equity extraction) of those debtors decreased from round $240,000 in early 2020 to $165,000 within the fourth quarter.

This implies these with small present house mortgage balances in want of masses of cash are going the money out refinance route.

In the meantime, these with giant present house mortgage balances are opting to maintain their low mortgage price intact and faucet fairness by way of a second mortgage.

By selecting to extract fairness by way of a house fairness mortgage or HELOC, they will maintain onto their low, fixed-rate mortgage for years to come back.

As for the householders growing their mortgage charges, they might presumably profit from a refinance within the close to future if charges pattern again right down to 4-5%.

[ad_2]