[ad_1]

However the place Wilson is taking a look at a half-empty glass, Subramanian says she sees a “half-full” one. She raised her 2023 year-end value goal for the S&P 500 to 4,300 from 4,000. The equities benchmark topped 4,200 on Friday earlier than drifting decrease.

“The period of simple cash is behind us, however that could be a great factor,” she wrote in a word to purchasers on Sunday. “Company America has shifted focus to structural advantages — effectivity/automation/AI — and have purchased themselves time to adapt through long-dated fixed-rate debt. Previous economic system cyclicals, capital-starved since 2008, have change into disciplined and self-sufficient, evidenced by decrease betas and extra secure earnings.”

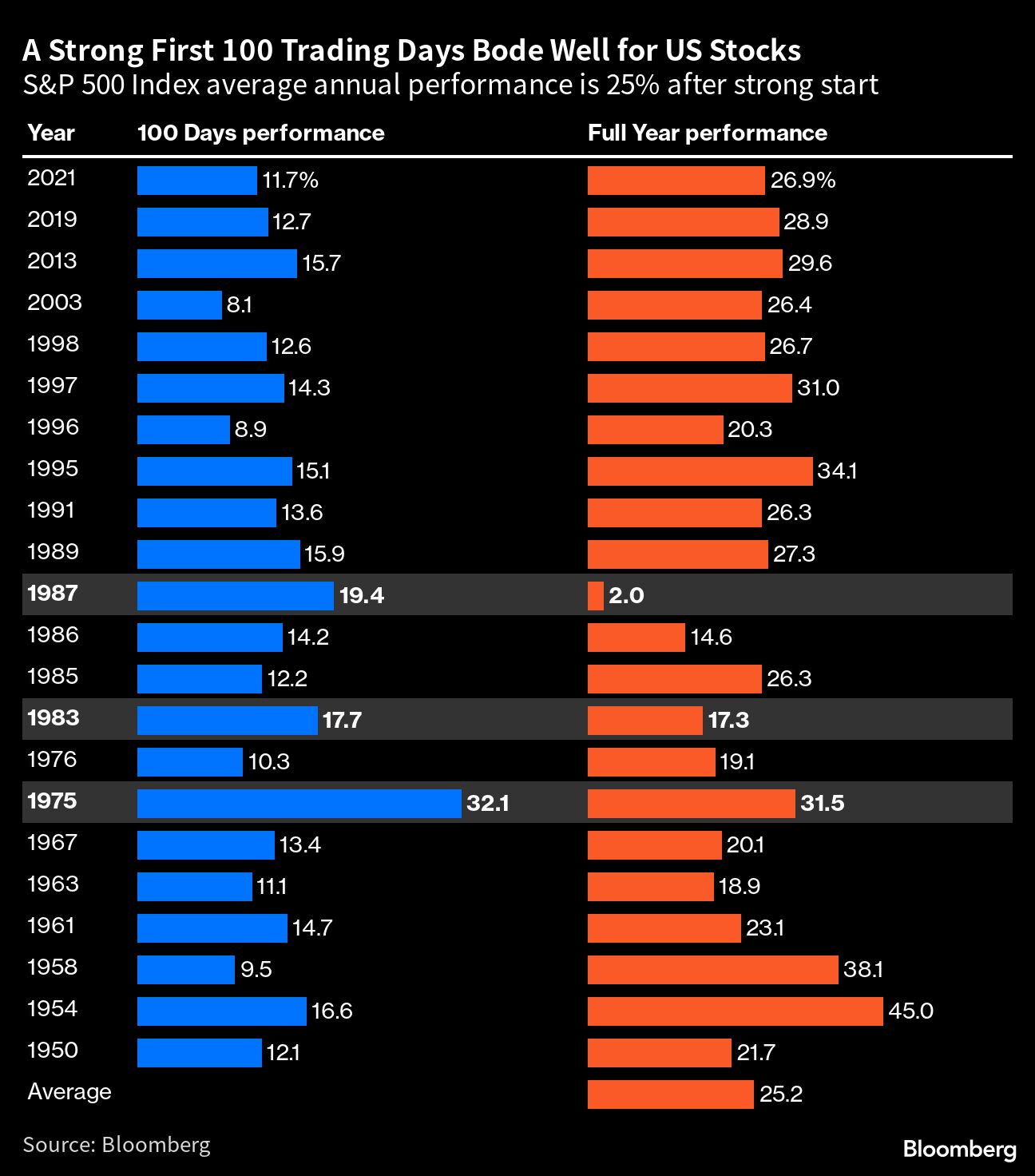

Historical past seems to be on Subramanian’s facet, as a robust first 100 days within the S&P 500 sometimes means important upside for the remainder of the 12 months.

One short-term danger for the market is the continued debate in Washington over elevating the US debt ceiling. Wilson stated a decision within the negotiations might briefly drive shares larger, however “we might view that as a false breakout/bull entice.”

Others, together with JPMorgan Chase & Co. strategists led by Dubravko Lakos-Bujas are additionally warning about extra market volatility because the talks drag on. President Joe Biden and Republican Home Speaker Kevin McCarthy are set to fulfill Monday.

(Picture: Shutterstock)

[ad_2]