[ad_1]

The Inflation Discount Act was Signed into Regulation!

Lately, President Biden marked the Inflation Discount Act (IRA) into regulation. The IRA is noteworthy well being care, tax, and local weather change coverage provision that comes with preparations to broaden the expanded and prolonged financial help at first included within the American Rescue Plan (ARP). That is very welcome information that the American Rescue Plan subsidies, which have been set to terminate towards the tip of 2022, will at the moment be accessible via the tip of 2025. A couple of very important options of this new regulation that proceeds with the American Rescue Plan, making medical insurance via {the marketplace} extra inexpensive and in addition serving to Medicare policyholders, embody: Well being care protection fees lined at 8.5% of household pay, which expanded how a lot financial help is accessible for certified customers.

Free Silver plans accommodated people who procured underneath 150% of the federal poverty degree (FPL).

Financial help reached out to middle-income customers who have been beforehand ineligible for federal help.

Limits Insulin copays to $35/month in Half D (carried out in 2023)

Reduces costa and improves protection for grownup vaccines in Medicare, Half ., Medicaid & CHIP ( 2023 )

Requires drug corporations to pay rebates if drug costs rise sooner than inflation for (2023 )

Eliminates in 5 % coinsurance for Half D catastrophic protection – can be carried out in 2024

Provides $ 2,000 out-of-pocket cap in Half D and different drug profit modifications (can be carried out in 2025)

2026 – to 2029 – Medicare will begin to have the ability to negotiate costs for sure high-cost medication, beginning with 10 medication, then 15, after which 20 medication in 2029

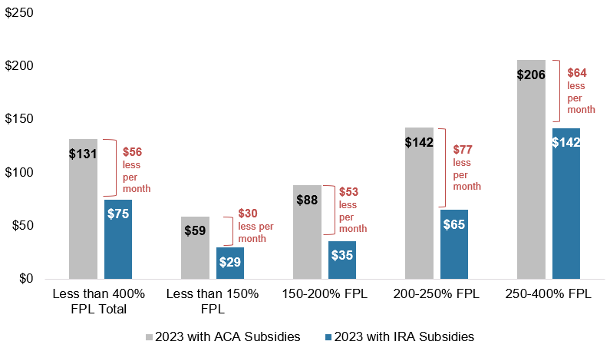

Determine 1: Month-to-month Web Premium Financial savings for Backed Enrollees Underneath 400 % FPL With Extension of American Rescue Plan Subsidies

Who advantages from the expanded and prolonged financial help?

Lined California’s 1.7 million enrollees: With extra people certified for financial help than any time in latest reminiscence, 90% of Lined California’s 1.7 million enrollees are at the moment getting federal subsidies. With the growth of the prolonged federal subsidies, Californians making underneath 400% of the federal poverty degree (FPL) — which provides as much as $51,520 as a person and $106,000 for a household of 4 — will save a traditional of an additional $56 every month when in comparison with Inexpensive Care Act subsidies. Low-income earners in Californian will profit probably the most

Determine 2: Month-to-month Web Premium Financial savings for Backed Enrollees Over 400 % FPL With Extension of American Rescue Plan Subsidies

Lined California intends to start out sending renewal notices that mirror the continued financial savings to its current customers from October; Open Enrollment begins November 1. We are going to preserve you up to date on the proceedings.

In case you need to learn the complete Press Launch of the Inflation Discount Act Signed into Regulation!

Learn the complete Press Launch HERE

Please contact us, or go to our web site at Solidhealthinsurance.com if you must make modifications to your revenue, tackle, or household standing. As a result of still-going pandemic, Lined California remains to be permitting us to make modifications to your 2022 well being plans.

[ad_2]