[ad_1]

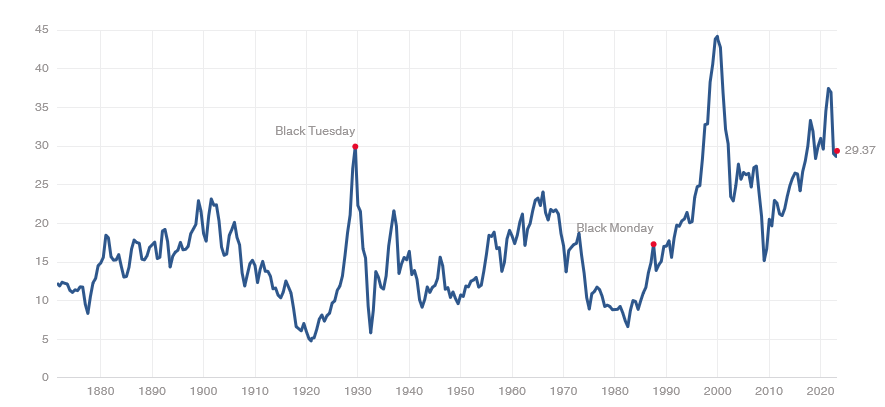

The US inventory market stays among the many most excessive valuation of the previous 150 years, at the very least as measured by the Schiller 10-year PE ratio.

Historically bear markets backside out with a worth/earnings ratio within the single digits … not at 29. Leuthold ruefully observes:

If the October S&P 500 low holds, the normalized P/E ratio of twenty-two.7x on that date will signify the priciest bear market backside in historical past; the truth is, it’s precisely the identical stage reached as on the August-1987 bull market excessive. Since October, the normalized P/E a number of has grown to 25.5x—larger than all however three earlier bull market peaks. (Inexperienced Ebook, February 2023)

On the entire, they conclude, “The hostile financial backdrop makes latest inventory market exuberance much more irrational than in early 2021” (February 2023). James Waterproof coat, senior markets columnist on the Wall Road Journal, has been shopping for “storm warning” flags in bulk: “that is not more than a quick interruption to the bear market” (2/22/2023), purchase bonds now as a result of they “present some safety towards the danger that shares aren’t merely extremely valued, however nonetheless overpriced” (2/23/2023), the latest rally in speculative shares and CCC-rated bonds is simply “a wild race to load up on threat” (2/8/2023) and “Investing is all about threat and reward, however for the time being it’s principally about threat” (2/2/2023). A lot of the euphoria is pushed by the fantasy that “this time is completely different, inflation will vanish (it hasn’t; it clocked in at almost 300% of the fed goal price and unemployment stays at a 50-year low), the Fed will decrease charges (they gained’t), and we will guess on “no touchdown” as simply as a “mushy touchdown” (you shouldn’t because the Fed has managed that feat exactly as soon as in 35 years).

On March 2nd, Christopher Waller, a member of the Fed’s board of governors, warned enterprise leaders; “Latest information recommend that client spending isn’t slowing that a lot, that the labor market continues to run unsustainably sizzling and that inflation isn’t coming down as quick as I had thought.” In a fastidiously orchestrated present, three different Fed governors made separate feedback, together with “we have to go larger,” the Fed “must perform a little extra” to boost charges, and “I lean in direction of persevering with to boost additional.”

They aren’t making an attempt to be delicate. They’re saying, as clearly as Fed officers ever do: “learn our lips: we’ll proceed tightening the vise till we break the again of inflation.”

Basically, we don’t recommend that you simply run and conceal. Having “strategic money” that’s earmarked for opportunistic shopping for is nice so long as you realize what you’re going to purchase and whenever you’re going to purchase it … and you’ve got the fortitude to take action. Most buyers are higher off giving up the phantasm that they’re Warren Buffett.

The choice is to take a position commonly, by way of thick and skinny, with people who find themselves good at managing unsure markets in your behalf. They’re usually obsessive and apt to wake at 3:00 a.m. questioning concerning the state of the Euro/greenback change price. Our motto: let them get ulcers, so that you don’t must.

We’ll give you two units of leads. The primary set, The Younger Defenders, targeted on funds which are lower than 5 years previous however which have posted completely impeccable threat and return metrics. This crowd has been, since inception, top-tier throughout all measures. The second set, The Wizards, focuses on funds which have managed to mix excessive levels of flexibility with top-tier returns and below- to much-below-average volatility for many years.

The Younger Defenders

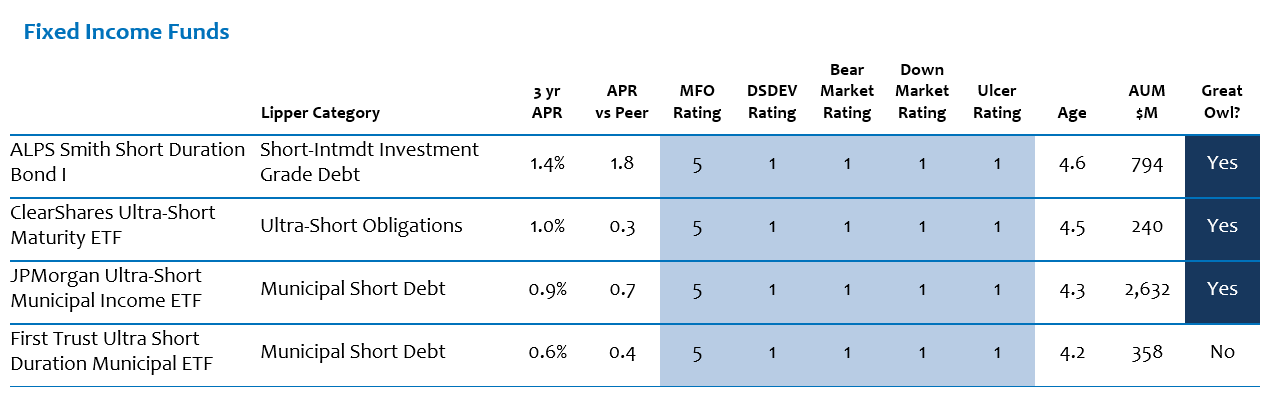

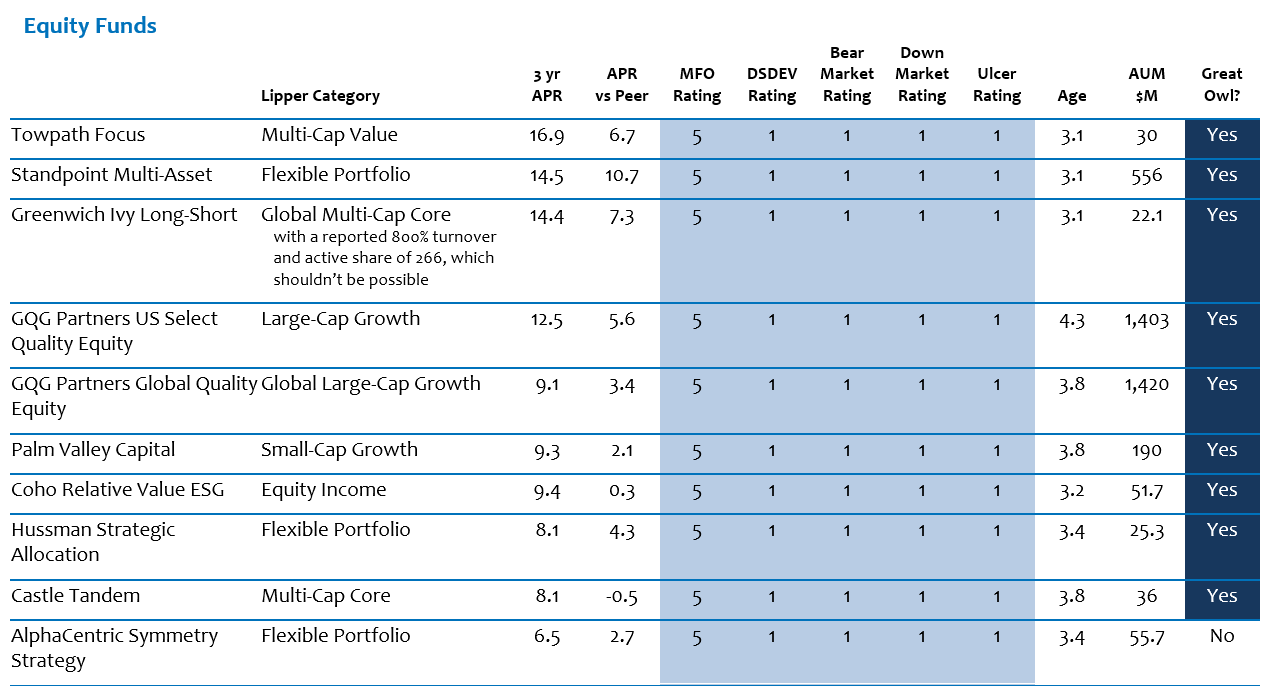

A handful of younger funds, by luck or design, have managed the uncommon feat of peer-beating returns since inception with risk-rated, risk-adjusted returns (MFO ranking, Ulcer ranking) and threat metrics (draw back deviation, bear market deviation, down market deviation).

Traders leery of the state of the market may solid a watch of their course.

Cells marked in blue signify the highest 20% of efficiency.

Columns 3 & 4 measure a fund’s uncooked returns. Column 5, MFO Ranking, is a risk-return stability. We then report relative efficiency primarily based on draw back deviation (a measure of day-to-day downtime volatility), bear market deviation (efficiency when markets are very ugly), down market deviation (performances when markets are merely ugly), and Ulcer Index (which mixed the size and depth of a fund’s most drawdown; the thought is that funds that don’t fall a lot – or fall however get well rapidly – are a lot much less doubtless to offer you ulcers than funds than fall onerous and keep down.)

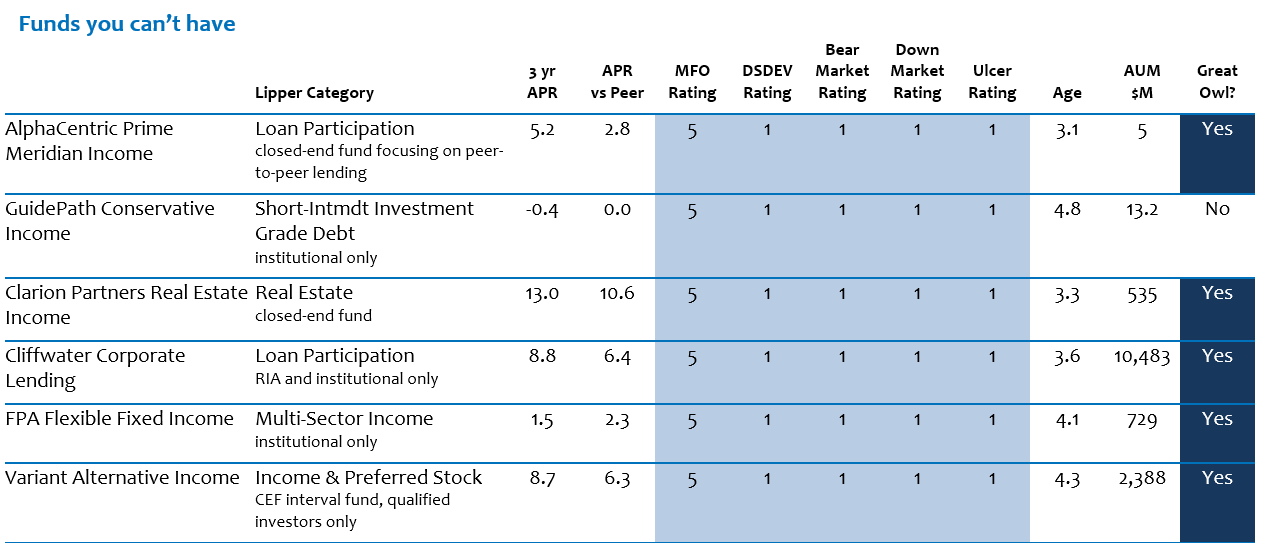

A handful of different funds additionally made the lower however seem like unavailable to mere mortals, regular buyers, and the oldsters I do know. For the sake of the richly resourced, we needed to incorporate the restricted funds with some notes about their distinction.

The Wizards

On the different finish of the acute are a fair smaller handful of funds which have two virtues. First is the liberty of maneuver. Their managers, by prospectus and self-discipline, have the power to vary the form of their portfolios, probably shifting from 90% European equities in a single market to a break up between short-term bonds and actual property in one other. Second is a demonstrable file of getting it proper. Whereas a fund’s returns profile adjustments unpredictably (it’s about not possible to “beat the market” 12 months in and 12 months on), a supervisor’s threat profile is actually constant. Managers who’ve a self-discipline that values absolute returns over relative ones and a willingness to shrink back from overpriced property are inclined to reveal that perspective persistently over time.

On the different finish of the acute are a fair smaller handful of funds which have two virtues. First is the liberty of maneuver. Their managers, by prospectus and self-discipline, have the power to vary the form of their portfolios, probably shifting from 90% European equities in a single market to a break up between short-term bonds and actual property in one other. Second is a demonstrable file of getting it proper. Whereas a fund’s returns profile adjustments unpredictably (it’s about not possible to “beat the market” 12 months in and 12 months on), a supervisor’s threat profile is actually constant. Managers who’ve a self-discipline that values absolute returns over relative ones and a willingness to shrink back from overpriced property are inclined to reveal that perspective persistently over time.

Efficiency is barely skin-deep; threat administration goes proper to the bone.

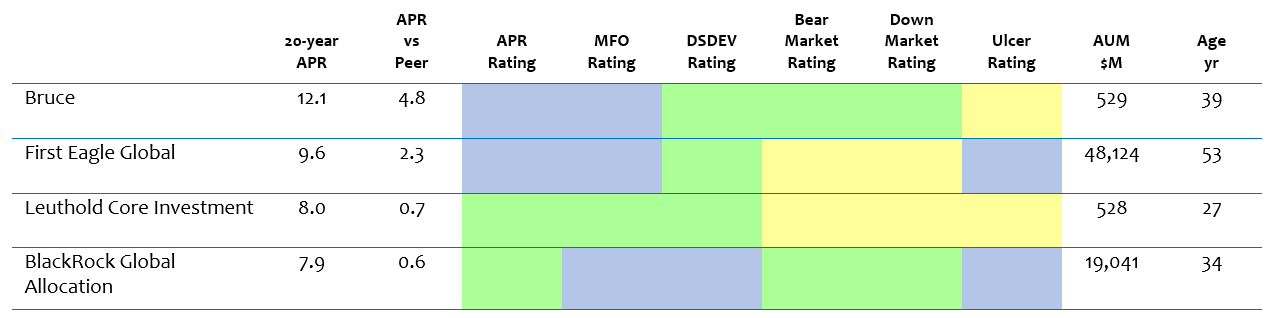

We looked for “versatile portfolio” funds with a monitor file of 25 or extra years and a mixture of above-average returns and decrease – generally dramatically decrease – volatility than their friends. Solely 4 funds make the lower.

Cells marked in blue signify the highest 20% efficiency, whereas inexperienced is the subsequent highest 20%, and yellow is within the group’s mid-range. These are the identical metrics we described above beneath the “younger defenders” desk.

Who’re these wily creatures? First, all of them appeared as our “best-of-class versatile allocation fund” primarily based on their 25-year Sharpe ratios. That was in our January 2023 article, “The Investor’s Information to 2023: Three Alternatives to Transfer Towards.”

Bruce Fund will make investments as closely in shares because the market warrants, which is perhaps 40% and it is perhaps close to 80%. The fairness portfolio isn’t constrained by market capitalization, however the managers choose small-cap shares. The bond portfolio is primarily convertible and long-dated “zero coupon” company bonds. The managers may put money into distressed securities, each in fairness and fixed-income portfolios. They might be “a big money place for a transitional time frame.”

First Eagle World is an absolute return fund managed on a kind of Benjamin Graham / Warren Buffett mannequin. It has “the power to take a position throughout asset courses, areas, sectors/industries, market-capitalization ranges, and with out regard to a benchmark.” Turnover is low, and lively share is excessive. Traders with a protracted reminiscence will recall its early days as Jean-Marie Eviellard’s SoGen Worldwide Fund; a brand new millennium introduced a brand new title. As you’ll be able to inform from its sheer measurement, this isn’t a “star within the shadows” fund.

Leuthold Core Funding is a purely quant fund managed by a workforce from The Leuthold Group led by Doug Ramsey (who has the excellence of being the best fund supervisor ever to graduate from Coe Faculty in close by Cedar Rapids, Iowa). Leuthold’s core enterprise is rigorous market analysis pushed by an irreproducibly deep database offered to institutional buyers. Their evaluation was so good that they have been urged to provide an funding car primarily based on it. That’s this fund. They begin with “correct asset class choice and a extremely disciplined, unemotional technique of evaluating threat/reward potential throughout funding selections. We regulate the publicity to every asset class to replicate our view of the potential alternative and threat provided inside that class. Flexibility is central to the creation of an asset allocation portfolio that’s efficient in a wide range of market situations. We possess the pliability and self-discipline to take a position the place there may be worth and to promote when there may be an undue threat.” They don’t faux to be inventory selectors and have a tendency to purchase baskets of shares to execute their asset allocations.

BlackRock World Allocation has a go-anywhere self-discipline. A way of how not “60/40” they’re comes from their customized benchmark index: 36% US equities, 24% worldwide equities, 24% 5-year Treasuries, and 16% international bonds. It comes with each international overlays and particular person safety choice with a bunch of unconventional information sources (e.g., web search frequency, bank card expenses). The allocation can change rather a lot relying on their studying of situations and tendencies. The workforce is deep, richly resourced, and has, since 2019, been getting stronger (per Morningstar). It should be good to have a “guardian” with $10 trillion in property behind you.

Backside line:

Our suggestion is stick along with your self-discipline. Keep out there. Make investments persistently; most particularly, make investments whenever you’re feeling most panicked. And easily your life by selecting a supervisor who has the abilities, fortitude and authority to make the choices in unhealthy occasions that almost all profit you in good ones.

[ad_2]