[ad_1]

Rebecca and Robert are newlyweds residing with their two cats in Washington, DC. Rebecca works in environmental sustainability and Robert is in donor relations at a non-profit. Their final objective is to purchase a house in a rural space with a number of pure magnificence and the chance to develop their very own meals. In addition they have desires of touring full-time sooner or later–maybe with their future younger youngsters. Proper now, they’re residing in a one-bedroom house within the metropolis and need our assist mapping out their subsequent transfer.

What’s a Reader Case Research?

Case Research tackle monetary and life dilemmas that readers of Frugalwoods ship in requesting recommendation. Then, we (that’d be me and YOU, pricey reader) learn by way of their state of affairs and supply recommendation, encouragement, perception and suggestions within the feedback part.

For an instance, take a look at the final case examine. Case Research are up to date by individuals (on the finish of the publish) a number of months after the Case is featured. Go to this web page for hyperlinks to all up to date Case Research.

Can I Be A Reader Case Research?

There are three choices for people enthusiastic about receiving a holistic Frugalwoods monetary session:

- Apply to be an on-the-blog Case Research topic right here.

- Rent me for a non-public monetary session right here.

- Schedule an hourlong name with me right here.

To be taught extra about one-on-one consultations with me, test this out.

Please word that house is proscribed for all the above and most particularly for on-the-blog Case Research. I do my finest to accommodate everybody who applies, however there are a restricted variety of slots obtainable every month.

The Purpose Of Reader Case Research

Reader Case Research spotlight a various vary of economic conditions, ages, ethnicities, areas, objectives, careers, incomes, household compositions and extra!

The Case Research sequence started in 2016 and, to this point, there’ve been 91 Case Research. I’ve featured people with annual incomes starting from $17k to $200k+ and web worths starting from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured homosexual, straight, queer, bisexual and polyamorous folks. I’ve featured girls, non-binary people and males. I’ve featured transgender and cisgender folks. I’ve had cat folks and canine folks. I’ve featured people from the US, Australia, Canada, England, South Africa, Spain, Finland, the Netherlands, Germany and France. I’ve featured folks with PhDs and folks with highschool diplomas. I’ve featured folks of their early 20’s and folks of their late 60’s. I’ve featured people who stay on farms and folk who stay in New York Metropolis.

Reader Case Research Tips

I most likely don’t must say the next since you all are the kindest, most well mannered commenters on the web, however please word that Frugalwoods is a judgement-free zone the place we endeavor to assist each other, not condemn.

There’s no room for rudeness right here. The objective is to create a supportive surroundings the place all of us acknowledge we’re human, we’re flawed, however we select to be right here collectively, workshopping our cash and our lives with optimistic, proactive strategies and concepts.

And a disclaimer that I’m not a educated monetary skilled and I encourage folks to not make critical monetary selections primarily based solely on what one particular person on the web advises.

I encourage everybody to do their very own analysis to find out the most effective plan of action for his or her funds. I’m not a monetary advisor and I’m not your monetary advisor.

With that I’ll let Rebecca, in the present day’s Case Research topic, take it from right here!

Rebecca’s Story

Hello, Frugalwoods! My title is Rebecca, and my husband Robert and I are each 29 and stay in Washington, DC with our two cats. We each presently work full-time – I work in environmental sustainability and Robert works in donor relations for a non-profit. We met on day one in every of school over 10 years in the past (regardless that we grew up residing shut to one another, we didn’t meet till we each moved to DC!) and have been collectively ever since. We have been married earlier this 12 months in a phenomenal setting in New England and launched into a two-week highway journey by way of the Pacific Northwest for our honeymoon.

Hobbies

The primary pastime we do collectively is mountaineering. We love spending our weekend days within the woods both in DC or in close by Maryland, Virginia, or West Virginia. Robert is an avid homebrewer and volunteers as somewhat league baseball coach, and I can by no means have too many books in my ‘to be learn’ pile. I additionally adore swing dancing (though this has been on hiatus with the pandemic), and volunteer as a tutor throughout the college 12 months. We get pleasure from cooking collectively and each provide you with concepts and like to eat, though Robert does a lot of the cooking and I do a lot of the cleansing. With the additional time spent at house throughout COVID, we ventured into making sourdough, kombucha, pickling, and selfmade sodas and jam. We additionally love touring – we’ve been to three nations and 24 states collectively and have a really lengthy journey bucket listing. The primary factor that stops us from touring extra typically is our lack of paid time-off.

Our Goals

We’re beginning to consider rising our household from the 2 of us and our two cat youngsters, to ideally add just a few human youngsters. Our dream is to go away the skilled workforce when our future youngsters are nonetheless younger and to journey with them around the globe collectively.

A number of years in the past, I used to be touring with a buddy in South America and we met a household with three younger boys (I believe they have been 10, 7, and 4) who have been nearly achieved with a year-long journey around the globe. Listening to about their expertise and seeing their boys so comfortable, almost fluent in a number of languages, and so effectively tailored to their life-style was unimaginable. Since then, we’ve been fascinated by the thought and have been following different touring households for continued inspiration.

We’re unsure what would come after that journey, however perhaps transferring to a small home within the woods and homesteading. We dream of a giant vegetable backyard, a small orchard, and acres of woods we will protect. I studied overseas in Europe in school and my host household had an enormous apple tree in entrance of their home. Yearly, they invited your entire group to hitch them as they pressed the apples into contemporary cider. It was such a enjoyable group expertise and nothing beats selfmade cider all 12 months lengthy. Each of us additionally grew up with vegetable gardens at house and I’ve not too long ago had the chance to handle the group backyard at work. What could possibly be higher than to eat (and drink) contemporary produce day by day that we’ve grown ourselves?

One other dream is shopping for an RV and touring across the nation to go to all of the nationwide parks. Robert additionally desires of seeing a sport at each Main League Baseball stadium. We began tenting throughout the pandemic and have liked the low-cost alternative to discover the nationwide and state parks all through the mid-Atlantic.

What feels most urgent proper now? What brings you to submit a Case Research?

Now that we’re married, we’re making an attempt to work by way of what’s subsequent for us.

Due to all of our huge desires, we’d like to ensure we’re setting ourselves up for fulfillment on whichever paths we select to pursue. We undoubtedly wish to retire early, and I believe probably the most life like objective for us is coastFIRE, which we perceive as saving sufficient in our retirement accounts throughout the subsequent few years to permit us to cease contributing and go away the skilled workforce. We’d additionally like sufficient saved in money to have the ability to take off utterly and journey for just a few years. Once we return, we’d each begin working part-time jobs in fields we love – ideally at a brewery for my husband and at a science middle for me. We’re each gaining expertise in these chosen paths now and the objective could be to make sufficient cash working part-time to cowl our annual residing bills whereas having the ability to spend so much of time with our kids throughout regular day-to-day life in addition to touring.

We’re leaning in the direction of coastFIRE as a result of we would like the flexibleness of not working full-time, however we aren’t certain our dream is to cease working utterly. From what we will see, a number of the FIRE bloggers we comply with proceed to work in some capability after reaching FIRE, so if coastFIRE can get us to an identical place considerably quicker than full FIRE, then that is a vital consideration for us!

What we’re actually battling is our subsequent steps–particularly because it associated to housing–earlier than we obtain coastFIRE.

The way in which we see it, we’ve got three choices for housing:

1) Proceed renting in DC:

- We’re comfortable in our present hire managed, one-bedroom, month-to-month lease house and if nothing modified, we might see ourselves persevering with to stay right here for the foreseeable future.

- Professionals: We like our house and our neighborhood, know the workers within the constructing and haven’t had points with administration, and have sufficient house for the 2 of us and our cats to stay comfortably. Renting additionally offers us with important flexibility over a home.

- Cons: Lack of out of doors house, a tiny kitchen (lower than 20 sq. toes), no dishwasher, and no house for household to remain once they go to. Plus, if we develop our household, we’d take into account transferring right into a two-bedroom house, which might considerably enhance our hire. Though we expect we’d be capable of handle to remain in our one-bedroom plus den house with one youngster.

2) Purchase a home within the DC metro space (most likely the DC suburbs as we’re possible priced out of DC itself):

- Final 12 months we have been satisfied this was the correct transfer – to the purpose the place we put in a suggestion on a home in June – however we’ve been reconsidering this.

- Professionals: Extra space to develop our household, a bigger kitchen, a yard, and house for our mother and father and siblings to remain once they go to. This may be particularly essential if we’ve got a baby. We additionally wouldn’t want to go away our present jobs.

- Cons: Actual property prices within the space would possible imply maxing out our price range on a home that wants work or doesn’t meet all of our wants, transferring away from the conveniences we get pleasure from within the metropolis with out the advantages of residing in a rural space (decrease prices, entry to outside areas), and understanding that we dream of touring and residing within the woods, not residing within the suburbs.

3) Purchase a home within the woods:

- One among our desires is to purchase a home the place we will create a small homestead.

- Professionals: Residing nearer to locations we will hike and luxuriate in time outside, spending ‘house time’ outdoors, and rising a few of our personal meals.

- Cons: Shifting out of the DC metro space would require important life and job adjustments and we’ve got a little bit of determination paralysis in regards to the precise location we wish to transfer. Additionally, if we’re contemplating beginning a household, making two massive life-style adjustments directly – and probably transferring additional away from my mother and father – could possibly be overwhelming.

What’s the most effective a part of your present life-style/routine?

We get pleasure from residing in DC – we love our house, we’ve got good buddies right here, and we each get pleasure from our jobs. We’re in a position to stroll to a farmer’s market, we’ve got an unlimited variety of eating places at our fingertips, and we’re in a position to get to concert events, theaters, and ball video games all through public transit or strolling. Aside from the COVID years, we’ve got been in a position to journey yearly. Once we’re near house, we spend a number of time mountaineering and exploring the pure areas round us.

What’s the worst a part of your present life-style/routine?

The uncertainty about what’s subsequent. We’re rapidly transferring right into a section of life the place our buddies and siblings are getting married, shopping for homes within the suburbs, having youngsters, and settling down. Whereas we’ve gotten married and are contemplating youngsters, the considered settling down in DC is daunting.

Actual property is so costly that it might imply doubling (or extra) our month-to-month housing and commute prices. We’ve checked out a number of homes, run the numbers with a mortgage lender, talked with a realtor and buddies that personal properties about their further prices, and many others. We’ve additionally thought-about considerably compromising on the areas the place we wish to stay, however we’re unsure we’re prepared to do this.

Additionally, in contemplating the place we wish to find yourself long run, we all know we wish to transfer to a rural space finally. Whereas we each grew up within the suburbs, we take into account the suburbs to be the worst of each worlds – away from the conveniences of town and with out the advantage of being surrounded by pure areas (no offense to these residing within the suburbs 😉).

The difficulty is, neither of our jobs could be prepared to have us be full-time distant, which implies we would wish to seek out distant jobs or jobs close to wherever we select to stay. We’re each pretty new in our jobs on account of each of us being laid off from our earlier jobs final 12 months (thanks, pandemic price range cuts). I’ve been at my present job for simply over a 12 months and Robert at his for just below a 12 months – and we don’t wish to begin over once more fairly but after the stress of our surprising job hunts final 12 months.

That mentioned, neither of us are in our ‘dream’ jobs. I actually get pleasure from my job and the general public I work with, however I don’t like–and have some ideological variations with–the group the place I work. Regardless of the group, although, I believe the work I’m doing right here is essential and making a small however optimistic impression on the world. Robert however, works for a non-profit doing unimaginable work with some great co-workers. Nonetheless, whereas his position in donor relations is crucial for the group, it’s not his most popular sort of labor.

We additionally haven’t determined precisely the place we wish to calm down. In contemplating proximity to household, climate, price of residing, proximity to mountains and the ocean but in addition cities for conveniences like airports, and many others., we’ve got just a few concepts, however none are a transparent winner.

Plus, understanding that we wish to journey full time sooner or later and that our households stay elsewhere – my mother and father are within the mid-Atlantic and Robert’s household (and the remainder of mine) are in New England – makes us extraordinarily hesitant to place down that important of an funding for the time being.

The place Rebecca and Robert Need To Be in Ten Years:

Funds:

- We wish to be fortunately semi-retired.

- We would like to have the ability to work the place we would like, once we need, whereas understanding that we’ve already saved sufficient for retirement and solely want sufficient cash to cowl our day by day residing bills.

Life-style:

- I’d like to be both actively touring full-time or not too long ago returned from doing so.

- Different desires embody residing on a small homestead or in an RV touring the nation.

Profession:

- If we’re working, I’d like to be working part-time someplace I can train children about nature and the outside.

- Robert would like to work part-time at a brewery.

Rebecca and Robert’s Funds

Earnings

| Merchandise | Gross Earnings | Deductions & Quantity | Internet Earnings |

| Rebecca’s revenue | $7,725 | 403b contributions: $1,716.25 Pre-tax transit: $50.00 Taxes: $1,639.36 |

$4,319 |

| Robert’s revenue | $5,333 | 401k contributions: $1,653.34 Healthcare: $593.17 Taxes: $582.90 Pre-tax transit: $10.00 |

$2,504 |

| Month-to-month subtotal: | $6,823 | ||

| Annual whole: | $81,875 |

Money owed

| Merchandise | Excellent mortgage stability | Curiosity Price | Month-to-month required cost |

| Automotive Mortgage | $10,572 | 2.99% | $325 |

Property

| Merchandise | Quantity | Notes | Curiosity/sort of securities held/Inventory ticker | Identify of financial institution/brokerage | Expense Ratio |

| Rebecca IRA (contains rolled over 401k and TSP from earlier jobs) | $81,109 | I don’t contact this account | 90% inventory, 10% bond together with VTI (83%), VXUS (7%), BND (7%), BNDX (3%) | Vanguard | VTI 0.03%, VXUS 0.07%, BND 0.03%, BNDX 0.07% |

| Rebecca Taxable Funding Account | $41,201 | I add $1,000 month-to-month | 90% inventory, 10% bond together with VTI (83%), VXUS (7%), BND (7%), BNDX (3%) | Vanguard | VTI 0.03%, VXUS 0.07%, BND 0.03%, BNDX 0.07% |

| Robert IRA (contains rolled over 401k from earlier job) | $39,868 | Robert doesn’t contact this account | 90% inventory, 10% bond together with VTI (83%), VXUS (7%), BND (7%), BNDX (3%) | Vanguard | VTI 0.03%, VXUS 0.07%, BND 0.03%, BNDX 0.07% |

| Robert Taxable Funding Account | $39,438 | Robert provides $1,000 month-to-month | 90% inventory, 10% bond together with VTI (64%), VXUS (8%), BND (5%), BNDX (3%), VOO (18%), VYM (3%) | Vanguard | VTI 0.03%, VXUS 0.07%, BND 0.03%, BNDX 0.07%, VOO 0.03%, VYM 0.06% |

| Rebecca Financial savings Account | $39,000 | That is emergency fund and extra money | Earns 2.25% curiosity proper now | Capital One | NA |

| Robert Financial savings Account | $36,023 | That is emergency fund and extra money | Earns 2.25% curiosity proper now | Capital One | NA |

| Rebecca Present 403b | $24,896 | I max out my contributions to this account and obtain a ten% match from my employer; the choices are very restricted. If/once I go away this job, I’ll transfer this into my IRA for the higher expense ratios. | QCBMPX and QCSTPX | TIAA | QCBMPX 0.28%, QCSTPX 0.29% |

| Robert Present 401k | $10,160 | Robert maxes out his contributions and receives 0% match for his first 12 months of service, then 8% per 12 months (beginning Feb. 2023 for him), and can be vested after three years of service. | FXAIX (80.8%), FXNAX (9.75%), FTIHX (9.44%) | Constancy | FXAIX 0.015%, FXNAX 0.025% , FTIHX 0.06% |

| Robert Taxable Funding Account 2 | $3,857 | Robert’s mother and father began this account when he was in highschool and simply transferred possession to him – we have to transfer it to Vanguard. The stability is at a low level given the market proper now – does it make sense to change it to Vanguard now or wait till it recovers? | Pioneer Choose Mid Cap Development Fund A | Amundi | 0.99% |

| Rebecca Checking Account | $1,500 | That is the place paychecks are deposited and payments are paid from | Earns 0.10% curiosity | Capital One | NA |

| Robert Checking Account | $1,140 | That is the place paychecks are deposited and payments are paid from | Earns 0.10% curiosity | Capital One | NA |

| Complete: | $318,191 |

Automobiles

| Automobile make, mannequin, 12 months | Valued at | Mileage | Paid off? |

| Subaru Impreza 2017 | $18,300 | 41,000 | No, the quantity I owe is listed below part 3. Valued at quantity is predicated on KBB valuation of a normal mannequin at $16,500-18,300, however we’ve got a restricted mannequin so I assume it’s on the larger finish. |

| Complete: | $18,300 |

Bills

| Merchandise | Quantity | Notes |

| Hire | $2,181 | Contains annual renter’s insurance coverage |

| Journey | $775 | That is considerably larger than most years (esp. contemplating pandemic years) due to our wedding ceremony/honeymoon journey, touring for different weddings (that is our busiest wedding ceremony 12 months), and the primary time we’ve ever achieved a major group journey with buddies (that means we didn’t have full management over prices) |

| Groceries | $483 | Contains some cleansing provides |

| Automotive Cost | $325 | |

| Eating places | $188 | |

| Items | $120 | Greater than a traditional 12 months on account of a number of bridal showers, bachelorette events, and weddings this 12 months, plus the traditional small birthday and vacation items for household |

| Cable and web | $119 | Contains cable and web; we have to discover a solution to get this down, however our constructing solely offers entry to 2 corporations they usually increase costs yearly |

| Family provides | $110 | Contains toiletries, rest room paper, {hardware} provides, some cleansing provides, the occasional improve or organizational software, and provides for the occasional DIY venture |

| Automotive Gasoline | $81 | |

| Actions and leisure | $80 | Contains tickets (ball video games, theatre, and many others.) and occasional tenting provides |

| Pet | $75 | Contains meals, litter, and vet visits |

| Garments | $66 | |

| Automotive Insurance coverage | $60 | Paid biannually, averaged month-to-month |

| Taxes and different life admin | $58 | |

| Automotive bills | $39 | Contains annual registration and parking allow, servicing, different parking, and many others. |

| Laundry | $33 | Our constructing fees $4 per load (we hold dry about half our garments to assist decrease prices) |

| Mobile phone service | $27 | Rebecca not too long ago switched to Ting (5 gigabyte plan primarily based on noticed utilization). Robert remains to be on his household plan, however we plan to change him to Ting too, that means this can double. |

| Private Objects | $20 | Occasional go to to a bookstore, hair cuts, and many others. |

| Subscriptions | $14 | New York Instances and Disney+ (Rebecca’s household shares Disney+, Netflix, and Hulu, with the others paying for these plans) |

| Month-to-month subtotal: | $4,854 | |

| Annual whole: | $58,248 |

Credit score Card Technique

| Card Identify | Rewards Kind? | Financial institution/card firm |

| Rebecca:Capital One SavorOne Money Rewards (affiliate hyperlink) | Money Again | Capital One/ Mastercard |

| Robert: Uncover | Money Again | Uncover |

Rebecca’s Questions For You:

-

Ought to we purchase a home or preserve renting?

- If we proceed to stay in DC however don’t purchase, will we remorse not doing so if we find yourself staying within the space for an additional 5+ years?

- Different concerns: if we don’t purchase now and wait till after we journey, our understanding is that it is going to be very troublesome/unimaginable to get a mortgage if we don’t have a gradual supply of W2 revenue. Alternatively, if we personal a home after which determine to journey for an prolonged time, we’ll want to contemplate what to do with the home once we’re gone and take into account the likelihood that touring might change our priorities and we could not wish to return to the home we personal.

- What’s the easiest way to avoid wasting for a objective – comparable to touring full-time – that may be 5-10 years away?

- We have now our cash in high-yield financial savings accounts, however ought to we make investments that cash since we count on it to be a while earlier than we’d like it?

- Contemplating we’ve got quite a bit in money proper now, ought to we repay our automotive regardless that the rate of interest is low?

- If the choice is to not purchase a home and proceed renting, another choice could possibly be to speculate something above our emergency fund in our Vanguard taxable funding accounts.

- How can we decide how a lot we must always save when the longer term is unsure?

- We’re planning important life adjustments – youngsters, shopping for a home/RV, touring full-time, and many others. How will we all know when what we’ve saved is sufficient? How quickly would possibly that be (the earlier the higher 😊)?

- With us being so younger, how can we presumably estimate how a lot cash we’ll want in retirement with the intention to really feel snug leaving our full-time jobs within the skilled workforce?

- Is there anybody on this group that has transitioned (with youngsters or not) to full-time journey?

- Any steering on how a lot to avoid wasting and how you can know once you’re able to take the leap could be a lot appreciated!

- What are peoples’ experiences with coastFIRE?

- What may be some surprising challenges we must always concentrate on? And is it price pushing aside coastFIRE for just a few extra years with the intention to obtain full FIRE?

Liz Frugalwoods’ Suggestions

Rebecca and Robert are on the precipice of a brand new life and I can really feel their exuberance coming by way of the display screen. They wish to embrace the entire world and do all of it. I like their enthusiasm and their want to plan. Nonetheless, lots of their questions don’t have a proper or mistaken reply as lots of them are questions of discernment. I can’t inform them what to do with their lives, which path to decide on or whether or not that path will make them comfortable. I can define totally different monetary situations in gentle of their totally different objectives, however solely they’ll decide what to do with their money and time. And I’ve each confidence they may achieve this fantastically! With that in thoughts, let’s dive in.

Rebecca’s Query #1: Ought to we purchase a home or preserve renting?

It relies upon.

One thing that jumps out at me are Rebecca’s repeated mentions that they don’t wish to stay within the suburbs. But, they’re contemplating shopping for a house within the suburbs. I ponder if this curiosity in home-buying stems from a way that they ought to purchase a home? That purchasing a home is the path to wealth constructing and correct maturity? I encourage them to interrogate their curiosity in shopping for a house since they’ve articulated that the suburbs are usually not the place they wish to stay.

Rebecca makes a salient level that it may be tougher to get a mortgage in case you don’t have a W2 job since banks don’t appear to love or perceive FIRE (and infrequently don’t take property into consideration–solely incomes, which is ludicrous, however a truth). Nonetheless, once more, we’re again to the basis concern: why purchase a house in place you don’t wish to stay?

May this be a rental property?

After all one purpose to purchase a house you don’t wish to stay in is to show it right into a rental. I’m not tremendous conversant in the rental panorama within the DC suburbs, however I think about it’s most likely fairly good given the proximity to town. If Rebecca and Robert are enthusiastic about buying this house with the intention of turning it right into a rental, that might make a ton of sense.

They’ll must discover the viability of this concept:

- How frequent are leases within the areas they’re looking to buy a house? What number of items are rented versus owned?

- Would they be in a Residence Proprietor’s Affiliation (HOA) with guidelines/restrictions concerning renting out your house?

- What’s the tenant inhabitants? In different phrases, who could be enthusiastic about renting their house?

- What’s market fee hire for the realm? Does this embody utilities, garden care, snow elimination, and many others?

- Would they handle the rental themselves or rent a property supervisor? In that case, how a lot can they count on to spend?

And in addition consider these monetary concerns:

-

Will rents preserve tempo with the mortgage, taxes, insurance coverage, property supervisor charges, repairs and upkeep?

- What’s going to your web return be every month?

- Do you could have sufficient money for a sturdy upkeep reserve (for when the roof must be changed, the boiler dies and the range breaks all in the identical month)?

- Do you could have sufficient money to cowl vacancies and tenant transitions?

I encourage Robert and Rebecca to dig into this analysis and see what they provide you with. It may be that the areas they’re focusing on are fabulous rental propositions and that this could possibly be a superb cash-flowing enterprise for them.

If It’s Not A Rental…

If the numbers don’t pan out for this house to be became a rental, the impetus to purchase appears a lot much less engaging. It’s powerful to interrupt even (not to mention become profitable) in case you promote a house quickly after buying it, so I can’t say I’d ever advocate somebody purchase a house in a spot they know they don’t wish to stay.

This Is Too Many Adjustments at As soon as (IMHO)

Stepping again a bit and searching on the holistic overview Rebecca offered us with, I believe she hit the nail on the top when she mentioned, “…if we’re contemplating beginning a household, making two massive life-style adjustments directly – and probably transferring additional away from my mother and father – could possibly be overwhelming.” I 100% agree.

Rebecca and Robert are contemplating making 4 totally different seismic adjustments:

- Having youngsters

- Shopping for a house within the DC suburbs

- Touring full-time

- Shopping for a house in a rural space

As Rebecca famous, #2-4 are in battle with one another and #1 makes every thing extra sophisticated. Great, however vastly extra sophisticated. I do know that I personally wildly underestimated how transformational having youngsters could be to my life, my time, my cash and my priorities.

Concerning Kids and Journey

If it have been me, I might have the kids first and then see how I felt about touring with them full-time. There are households who do it with infants, however most of them have already been full-time vacationers–in different phrases, they didn’t begin touring once they had a child, they have been already touring and had a child alongside the way in which. There are such a lot of unknowns on this recipe that I encourage Rebecca and Robert to get rid of/pare down as many variables as attainable forward of time.

Theoretical youngsters are compliant, comfortable, colic-free and sleep by way of the evening from beginning! Precise youngsters have, uh, very totally different concepts about what includes a superb time… “3am screaming social gathering in my criiiiiibbbbbb! Everyone’s invited as a result of I wakened all of the neighbors after pooping myself awake! WOOHOOO!! Additionally I must eat once more. Please ignore the truth that we simply had this social gathering at 1am and may have it once more at 5am.”

Then there’s the query of college as soon as the youngsters are kindergarten age. There are many road-schooling/homeschooling choices, however that’s yet one more variable you possibly can’t know till you could have the youngsters. One other factor to remember is that, when the youngsters are older (say age 5+), they’ll be capable of really admire the travels and received’t simply nap by way of your entire Grand Canyon. Plus, they’ll have three months off each summer season together with a variety of week-long holidays all through the college 12 months (my children have a full week off each December, February and April).

Shopping for A Rural Residence

That is one other space ripe for analysis for Robert and Rebecca! She famous that they “…have a little bit of determination paralysis in regards to the precise location we wish to transfer to.” Rural doesn’t imply the identical factor to everybody and it definitely doesn’t look the identical in each state/area. I encourage Rebecca and Robert to dig in on what rural means to them and what sort of property they’d like to have. Your area issues quite a bit once you go rural as a result of, in contrast to the largely homogeneous American suburbs, rural areas fluctuate WILDLY. This can even be an opportunity to do a number of enjoyable AirBnB weekend explorations! My husband and I had a lot enjoyable traipsing round Vermont for a number of years investigating totally different areas and visiting tons of accessible properties/properties. You’ll be able to learn my sequence documenting our search right here: The Frugal Homestead Collection.

I’ll additionally add that renting out a rural property is usually a tricky proposition. It’s unlikely you’ll be capable of money movement it, though in case you’re pleased with shedding some cash, you possibly can possible discover a caretaker-type one who will take care of the place for you in change for nominal hire. Once more, that is area dependent, however typically there isn’t as a lot infrastructure–or tenant variety–for managing a rental in rural areas.

Nonetheless, in case you purchase in a fascinating space–say, close to a ski resort or mountaineering trails–you would possibly be capable of AirBnB a rural place, offered you could find somebody native to handle your AirBnB. This appears to be the main sticking level for lots of oldsters I do know who wish to AirBnB a rural place–there’s nobody to wash it, flip it over and handle renter relations. That’s one of many main explanation why we determined to not pursue placing an AirBnB spot on our property–I don’t wish to spend my days cleansing one other home!

Rebecca’s Query #2: What’s the easiest way to avoid wasting for a objective – comparable to touring full-time – that may be 5-10 years away?

Early and infrequently. I jest, however in actuality, the easiest way to save cash is to just do that: reserve it. The automobile it’s in is at all times secondary to your means to not spend it. And Rebecca and Robert are doing this splendidly! Typically, in case you anticipate needing cash inside a ~5 12 months timeframe, you need it to be in both a high-yield financial savings account or one thing short-term and assured, comparable to a authorities bond. You possible don’t wish to make investments this cash within the inventory market as a result of it’s fully attainable you might lose cash in that brief timeframe. Investing is a long-term proposition that doesn’t favor pulling cash out and in of the market.

Let’s check out Rebecca and Robert’s full asset rundown:

1) Money: $77,662

Between their 4 totally different checking and financial savings accounts, they’ve $77,662. Since they solely spend $4,854 per thirty days (v. frugal!), this implies they’ve nearly 16 months of residing bills in money. This makes them overbalanced on money, which Rebecca famous. In the event that they have been focusing on having solely an emergency fund in money, they’d wish to cut back their money place to someplace between three months price of their bills ($14,562) to 6 months ($29,124).

The explanation to not preserve extreme money mendacity round is the chance price.

Money loses worth day by day because it doesn’t sustain with inflation. Plus, once you’re overbalanced on money, you’re lacking out on the potential funding returns you’d get pleasure from in case your cash was invested in, for instance, the inventory market or a rental property. Therefore, the crux of Rebecca’s query is whether or not or not they should preserve this a lot cash in money, which is one thing solely they’ll reply.

Think about:

→In the event that they wish to purchase a home within the near-term, they may completely want this a lot money (and certain extra).

→In the event that they wish to stop their jobs and start touring full-time within the close to time period, they may completely want this a lot money (and certain extra).

Conversely:

→In the event that they wish to proceed renting for the subsequent ~10 years and THEN retire (absolutely or partially) to a house within the woods and/or to full-time journey, then it’d most likely be wisest to speculate this cash.

The place to Maintain This Cash

Undoubtedly in a high-yield financial savings account. Robert and Rebecca have their money unfold out over 4 totally different accounts, which is three too many accounts for my part. Until there’s a compelling purpose–for instance in the event that they intend to maintain their funds separate completely–I strongly counsel consolidating to ONE high-yield account. They’ve a Capital One account incomes 2.25%, however there are accounts incomes even larger percentages proper now, such because the American Categorical Private Financial savings account, which–as of this writing–earns 3.30% (affiliate hyperlink). That implies that in a single 12 months, their $77,662 would earn $2,563 in curiosity!! Woohoo!

2) Retirement: $156,033

Let’s see how they’re doing in keeping with Constancy’s Retirement Rule of Thumb:

Goal to avoid wasting at the least 1x your wage by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by 67.

Since Robert and Rebecca are nearly 30, they need to have 1x their mixed gross incomes, which is ($7,725 + $5,333 = 13 058) x 12 = $156,696. In gentle of that, they’re proper on monitor for conventional retirement.

3) Taxable (non-retirement) Investments: $84,496

Very effectively achieved! Since Robert and Rebecca have accomplished the primary three steps of economic administration:

- No high-interest debt

- A completely-funded emergency fund

- Maxing out their retirement accounts yearly (which in 2023 is $22,500/12 months per particular person)

They properly opened taxable funding accounts! And as Rebecca herself identified, “If the choice is to not purchase a home and proceed renting, another choice could possibly be to speculate something above our emergency fund in our Vanguard taxable funding accounts.” I couldn’t have mentioned it higher myself.

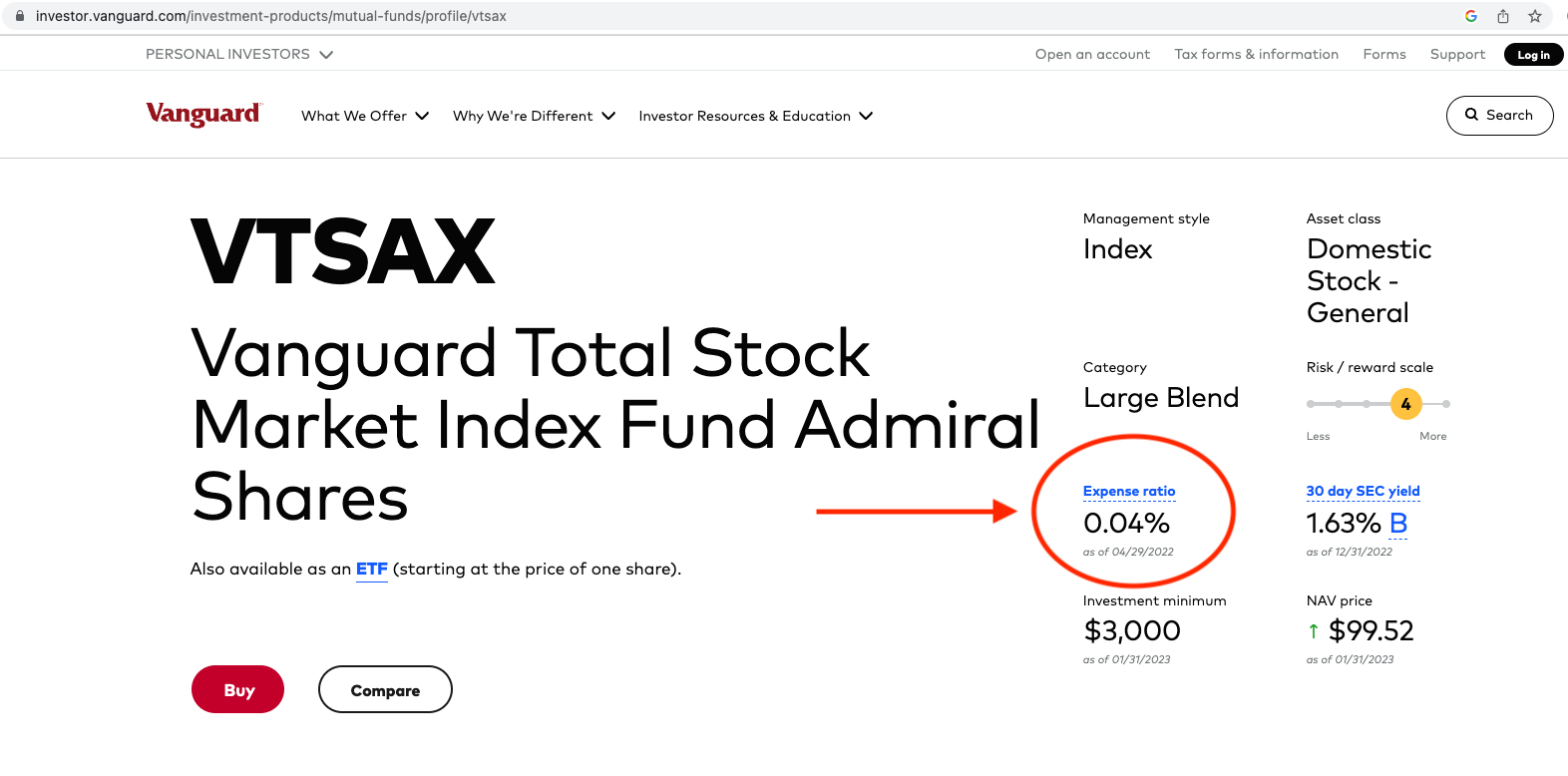

Expense Ratios

Rebecca and Robert get an A+ on deciding on funding funds with low expense ratios. Expense ratios are the proportion you pay to a brokerage for investing your cash and, as they’re charges, you need them to be as little as attainable.

As Forbes explains:

“An expense ratio is an annual charge charged to buyers who personal mutual funds and exchange-traded funds (ETFs). Excessive expense ratios can drastically cut back your potential returns over the long run, making it crucial for long-term buyers to pick mutual funds and ETFs with cheap expense ratios.”

In gentle of their significance to at least one’s total long-term monetary well being, I encourage everybody to find the expense ratios for your entire retirement and taxable investments and be certain that they’re low! Right here’s how you can discover an expense ratio:

- Google the inventory ticker (for instance: “VTSAX”)

- Go to the fund overview web page

- Take a look at the expense ratio.

Screenshot beneath for reference:

And achieved! Woohoo! To present you a way of whether or not or not your investments have cheap expense ratios, the next three funds are thought-about to have low expense ratios:

And achieved! Woohoo! To present you a way of whether or not or not your investments have cheap expense ratios, the next three funds are thought-about to have low expense ratios:

- Constancy’s Complete Market Index Fund (FSKAX) has an expense ratio of 0.015%

- Charles Schwab’s Complete Market Index Fund (SWTSX) has an expense ratio of 0.03%

- Vanguard’s Complete Market Index Fund (VTSAX) has an expense ratio of 0.04%

It’s also possible to use this calculator from Financial institution Price to find out what you’ll pay in charges over the lifetime of your investments, primarily based on their expense ratios. If you happen to discover that your investments have excessive expense ratios, it is going to be effectively price your time to research whether or not or not you possibly can transfer them to lower-fee funds. This isn’t at all times attainable with employer-sponsored 401ks/403bs as you’re beholden to no matter funds your employer affords. However, it’s at all times price trying by way of all obtainable funds to pick those with the bottom expense ratios.

This brings me to a different tidbit Rebecca requested about:

“Robert’s mother and father began this [investment] account when he was in highschool and simply transferred possession to him – we have to transfer it to Vanguard. The stability is at a low level given the market proper now – does it make sense to change it to Vanguard now or wait till it recovers?”

The important thing consideration right here is the “price foundation” for this inventory. That’s what you initially paid to purchase the inventory. If the inventory is price MORE than the fee foundation, that is thought-about a capital achieve and promoting it is going to be a taxable occasion. Conversely, if the inventory is price LESS than the fee foundation, it’s thought-about a loss. So, if Rebecca and Robert wish to switch these shares over to a different brokerage (by way of what’s referred to as an ACATS), they’ll wish to first decide the fee foundation and whether or not they’ll be posting a capital achieve or loss, which is able to decide the quantity they’ll must pay in taxes. For extra on this, take a look at this text from Charles Schwab: Save on Taxes: Know Your Price Foundation.

Rebecca’s Query #3: Contemplating we’ve got quite a bit in money proper now, ought to we repay our automotive regardless that the rate of interest is low?

I imply, the rate of interest on the automotive mortgage is basically low (2.99%), however the stability remaining ($10,572) can also be actually low in gentle of their money place. This determination hinges on whether or not or not they’re going to purchase a home within the close to time period. If Rebecca informed me, “We’re undoubtedly shopping for a home within the subsequent ~5 years,” then I’d say not to repay the automotive mortgage as a result of they want the money for a downpayment. My recommendation could be precisely the other in the event that they’re not shopping for a house within the close to time period. 2.99% is low, nevertheless it’s nonetheless cash being misplaced each month to service this debt.

Rebecca’s Query #4: How can we decide how a lot we must always save when the longer term is unsure?

“We’re planning important life adjustments – youngsters, shopping for a home/RV, touring full-time, and many others. How will we all know when what we’ve saved is sufficient? How quickly would possibly that be (the earlier the higher 😊)?”

As I famous above, these are 4 discrete objectives that contradict one another considerably and have very totally different value tags. Once more, I counsel Robert and Rebecca spend the subsequent few years isolating the variables:

- Have children (assuming you undoubtedly need children).

- You’ll know A LOT extra about your loved ones and your objectives as soon as the infants are born.

- Purchase a home within the DC suburbs or don’t.

- Decide if it may be bought now and transitioned right into a cash-flowing rental later.

- Analysis areas to your rural homestead.

- Decide buy costs and native or distant job alternatives.

- Journey or don’t.

- Decide if the home(s) might be rented whilst you journey.

- If they’ll’t be rented, this turns into a tricky proposition of paying for a house you’re not residing in. That math solely works in case you’re a multi-multi-multi-multi millionaire.

When it comes to how a lot cash is required to completely FIRE, there’s debate about this, however probably the most generally sited rule of thumb is the 4% rule. What this implies is that it is advisable to have sufficient in investments to have the ability to withdraw 4% of these investments yearly to cowl your residing bills. Right here’s how that math would work for Robert and Rebecca:

Their bills = $58,248 yearly

It at all times comes again to what we spend, doesn’t it? That’s why I harp about the necessity to monitor your spending. It’s unimaginable to understand how a lot cash you want for retirement (or the rest) in case you don’t understand how a lot you spend. I exploit and advocate the free expense tracker from Private Capital as a result of I wish to automate every thing I presumably can (affiliate hyperlink).

If Robert and Rebecca wish to proceed spending $58,248 yearly (assuming will increase for inflation), they’d want an funding portfolio of ~$1,470,000 as 4% of $1,470,000 = $58,800. That is fairly fundamental, back-of-the-envelope math, nevertheless it offers a tough sense of their FIRE (monetary independence, retire early) quantity.

Their present property = $318,191

They’d want to avoid wasting and make investments one other $1,151,809 to succeed in their FIRE variety of $1.47M. After all, the much less you spend annually, the decrease that quantity. Nonetheless, I at all times warning in opposition to chopping it too shut. Higher to have greater than you anticipate needing than much less! Rebecca requested how lengthy this can take to succeed in and the reply is predicated on how a lot they’ll save and make investments annually. In the event that they assault it from each side of the equation–earn extra and spend much less–they’ll get there quicker.

One other Choice: CoastFIRE

Rebecca mentioned they may be extra enthusiastic about reaching CoastFIRE versus full FIRE, which she accurately recognized as incomes sufficient annually to cowl your entire bills, however not sufficient to contribute something extra to your retirement and taxable investments. The thought being you possibly can stop your full-time job and transition to one thing with approach fewer hours (and decrease pay). Then, you let your investments “coast” and proceed to develop out there till you wish to absolutely retire at a extra conventional retirement age.

Rebecca mentioned that neither of their jobs permit for absolutely distant work and so, I ponder in the event that they’ve thought-about discovering jobs that do? Most white-collar jobs nowadays do permit for (and even require) primarily distant work, which might be great for both full-time journey or residing someplace rural.

Abstract:

-

Spend the subsequent few years isolating your variables and refining your objectives:

- Have children (assuming you undoubtedly need children).

- You’ll know A LOT extra about your loved ones and your objectives as soon as the infants are born.

- Purchase a home within the DC suburbs or don’t.

- Decide if it may be bought now and transitioned right into a cash-flowing rental later.

- Analysis areas to your rural homestead.

- Decide buy costs and job alternatives.

- Journey or don’t.

- Decide if the home(s) might be rented whilst you journey.

- If they’ll’t be rented, this turns into a tricky proposition of paying for a house you’re not residing in. That math solely works in case you’re a multi-multi-multi-multi millionaire.

- Have children (assuming you undoubtedly need children).

- Loads of your questions can’t be answered till you understand the solutions to those 4 questions.

- Don’t fret–you’re doing all the correct issues to allow your objectives. Proceed:

- Residing beneath your means

- Maxing out your retirement accounts

- Investing in your taxable funding accounts

- Think about consolidating your entire money into one high-yield financial savings account

- Decide to researching all the avenues we mentioned in the present day and benefit from the course of!

- You’re at an thrilling juncture and I can’t wait to see what you determine to do subsequent!

Okay Frugalwoods nation, what recommendation do you could have for Rebecca? We’ll each reply to feedback, so please be happy to ask questions!

Would you want your individual Case Research to seem right here on Frugalwoods? Apply to be an on-the-blog Case Research topic right here. Rent me for a non-public monetary session right here. Schedule an hourlong name with me right here, refer a buddy to me right here, or e-mail me with questions (liz@frugalwoods.com).

By no means Miss A Story

Signal as much as get new Frugalwoods tales in your e-mail inbox.

[ad_2]