[ad_1]

PERRY, Iowa — Fran Ruhl’s household obtained a startling letter from the Iowa Division of Human Providers 4 weeks after she died in January 2022.

“Pricey FAMILY OF FRANCES RUHL,” the letter started. “Now we have been knowledgeable of the demise of the above particular person, and we want to categorical our honest condolences.”

The letter bought proper to the purpose: Iowa’s Medicaid program had spent $226,611.35 for Ruhl’s well being care, and the federal government was entitled to recoup that cash from her property, together with almost any belongings she owned or had a share in. If a partner or disabled youngster survived Ruhl, the gathering could possibly be delayed till after their demise, however the cash would nonetheless be owed.

The discover mentioned the household had 30 days to reply.

“I mentioned, ‘What is that this letter for? What is that this?’” mentioned Ruhl’s daughter, Jen Coghlan.

It appeared bogus, however it was actual. Federal regulation requires all states to have “property restoration applications,” which search reimbursements for spending beneath Medicaid, the joint federal and state medical insurance program for folks with low incomes or disabilities. The restoration efforts accumulate greater than $700 million a 12 months, based on a 2021 report from the Medicaid and CHIP Fee and Entry Fee, or MACPAC, an company that advises Congress.

States have leeway to determine whom to invoice and what sort of belongings to focus on. Some states accumulate little or no. For instance, Hawaii’s Medicaid property restoration program collected simply $31,000 in 2019, based on the federal report.

Iowa, whose inhabitants is about twice Hawaii’s, recovered greater than $26 million that 12 months, the report mentioned.

Iowa makes use of a personal contractor to recoup cash spent on Medicaid protection for any participant who was 55 or older or was a resident of a long-term care facility after they died. Even when an Iowan used few well being providers, the federal government can invoice their property for what Medicaid spent on premiums for protection from personal insurers often called managed-care organizations.

Supporters say the clawback efforts assist guarantee folks with vital wealth don’t reap the benefits of Medicaid, a program that spends greater than $700 billion a 12 months nationally.

Critics say households with sources, together with legal professionals, usually discover methods to protect their belongings years forward of time — leaving different households to bear the brunt of property recoveries. For a lot of, the household house is probably the most invaluable asset, and heirs wind up promoting it to settle the Medicaid invoice.

For the Ruhl household, that might be an 832-square-foot, steel-sided home that Fran Ruhl and her husband, Henry, purchased in 1964. It’s in a modest neighborhood in Perry, a central Iowa city of 8,000 folks. The county tax assessor estimates it’s price $81,470.

Henry Ruhl, 83, needed to depart the home to Coghlan, however since his spouse was a joint proprietor, the Medicaid restoration program might declare half the worth after his demise.

Fran Ruhl, a retired youngster care employee, was recognized with Lewy physique dementia, a debilitating mind dysfunction. As a substitute of inserting her in a nursing dwelling, the household cared for her at dwelling. A case supervisor from the Space Company on Getting old advised in 2014 they appear into the state’s “Aged Waiver” program to assist pay bills that weren’t lined by Medicare and Tricare, the navy insurance coverage Henry Ruhl earned throughout his Iowa Nationwide Guard profession.

Coghlan nonetheless has paperwork the household crammed out. The shape mentioned the applying was for individuals who needed to get “Title 19 or Medicaid,” however then listed “different applications inside the Medical Help Program,” together with Aged Waiver, which the shape defined “helps hold folks at dwelling and never in a nursing dwelling.”

Coghlan mentioned the household didn’t understand this system was an offshoot of Medicaid, and the paperwork in her file didn’t clearly clarify the federal government may search reimbursement for correctly paid advantages.

Among the Medicaid cash went to Coghlan for serving to look after her mom. She paid earnings taxes on these wages, and he or she mentioned she possible would have declined to just accept the cash if she’d recognized the federal government would attempt to scoop it again after her mom died.

Iowa Medicaid Director Elizabeth Matney mentioned that lately the state added clearer notices in regards to the property restoration program on varieties folks fill out after they apply for protection.

“We don’t like households or members being caught off guard,” she mentioned in an interview. “I’ve a variety of sympathy for these folks.”

Matney mentioned her company has thought of adjustments to the property restoration program, and he or she wouldn’t object if the federal authorities restricted the apply. Iowa’s Medicaid property collections topped $30 million in fiscal 12 months 2022, however that represented a sliver of Medicaid spending in Iowa, which is over $6 billion a 12 months. And greater than half the cash recouped goes again to the federal authorities, she mentioned.

Matney famous households can apply for “hardship exemptions” to scale back or delay restoration of cash from estates. For instance, she mentioned, “if doing any sort of property restoration would deny a household of fundamental requirements, like meals, clothes, shelter, or medical care, we take into consideration that.”

Sumo Group, a personal firm that runs Iowa’s property restoration program, reported that 40 hardship requests had been granted in fiscal 2022, and 15 had been denied. The Des Moines firm reported accumulating cash from 3,893 estates that 12 months. Its director, Ben Chatman, declined to remark to KHN. Sumo Group is a subcontractor of a nationwide firm, Well being Administration Programs, which oversees Medicaid property recoveries in a number of states. The nationwide firm declined to establish which states it serves or focus on its strategies. Iowa pays the businesses 11% of the proceeds from their property restoration collections.

The 2021 federal advisory report urged Congress to bar states from accumulating from households with meager belongings, and to let states choose out of the hassle altogether. “This system primarily recovers from estates of modest dimension, suggesting that people with larger means discover methods to bypass property restoration and elevating issues about fairness,” the report mentioned.

U.S. Rep. Jan Schakowsky launched a invoice in 2022 that might finish the applications.

The Illinois Democrat mentioned many households are caught unawares by Medicaid property restoration notices. Their family members certified for Medicaid participation, not realizing it could wind up costing their households later. “It’s actually a devastating consequence in lots of instances,” she mentioned.

Schakowsky famous some states have tried to keep away from the apply. West Virginia sued the federal authorities in an try to overturn the requirement that it accumulate towards Medicaid recipients’ estates. That problem failed.

Schakowsky’s invoice had no Republican co-sponsors and didn’t make it out of committee. However she hopes the proposal can transfer forward, since each member of Congress has constituents who could possibly be affected: “I believe that is the start of a really worthy and doable combat.”

States can restrict their assortment practices. For instance, Massachusetts applied adjustments in 2021 to exempt estates of $25,000 or much less. That alone was anticipated to slash by half the variety of focused estates.

Massachusetts additionally made different adjustments, together with permitting heirs to maintain at the very least $50,000 of their inheritance if their incomes are lower than 400% of the 2022 federal poverty stage, or about $54,000 for a single particular person.

Previous to the adjustments, Massachusetts reported greater than $83 million in Medicaid property recoveries in 2019, greater than every other state, based on the MACPAC report.

Supporters of property restoration applications say they supply an necessary safeguard towards misuse of Medicaid.

Mark Warshawsky, an economist for the conservative American Enterprise Institute, argues that different states ought to comply with Iowa’s lead in aggressively recouping cash from estates.

Warshawsky mentioned many different states exclude belongings that needs to be honest sport for restoration, together with tax-exempt retirement accounts, comparable to 401(ok)s. These accounts make up the majority of many seniors’ belongings, he mentioned, and folks ought to faucet the balances to pay for well being care earlier than leaning on Medicaid.

Warshawsky mentioned Medicaid is meant as a security web for People who’ve little cash. “It’s absolutely the essence of this system,” he mentioned. “Medicaid is welfare.”

Individuals shouldn’t be in a position to shelter their wealth to qualify, he mentioned. As a substitute, they need to be inspired to save lots of for the chance they’ll want long-term care, or to purchase insurance coverage to assist cowl the prices. Such insurance coverage could be costly and comprise caveats that go away customers unprotected, so most individuals decline to purchase it. Warshawsky mentioned that’s most likely as a result of folks determine Medicaid will bail them out if want be.

Eric Einhart, a New York lawyer and board member of the Nationwide Academy of Elder Regulation Attorneys, mentioned Medicaid is the one main authorities program that seeks reimbursement from estates for correctly paid advantages.

Medicare, the enormous federal well being program for seniors, covers nearly everybody 65 or older, irrespective of how a lot cash they’ve. It doesn’t search repayments from estates.

“There’s a discrimination towards what I name ‘the unsuitable sort of illness,’” Einhart mentioned. Medicare might spend lots of of 1000’s of {dollars} on hospital therapy for an individual with severe coronary heart issues or most cancers, and no authorities representatives would attempt to recoup the cash from the particular person’s property. However folks with different circumstances, comparable to dementia, usually want prolonged nursing dwelling care, which Medicare received’t cowl. Many such sufferers wind up on Medicaid, and their estates are billed.

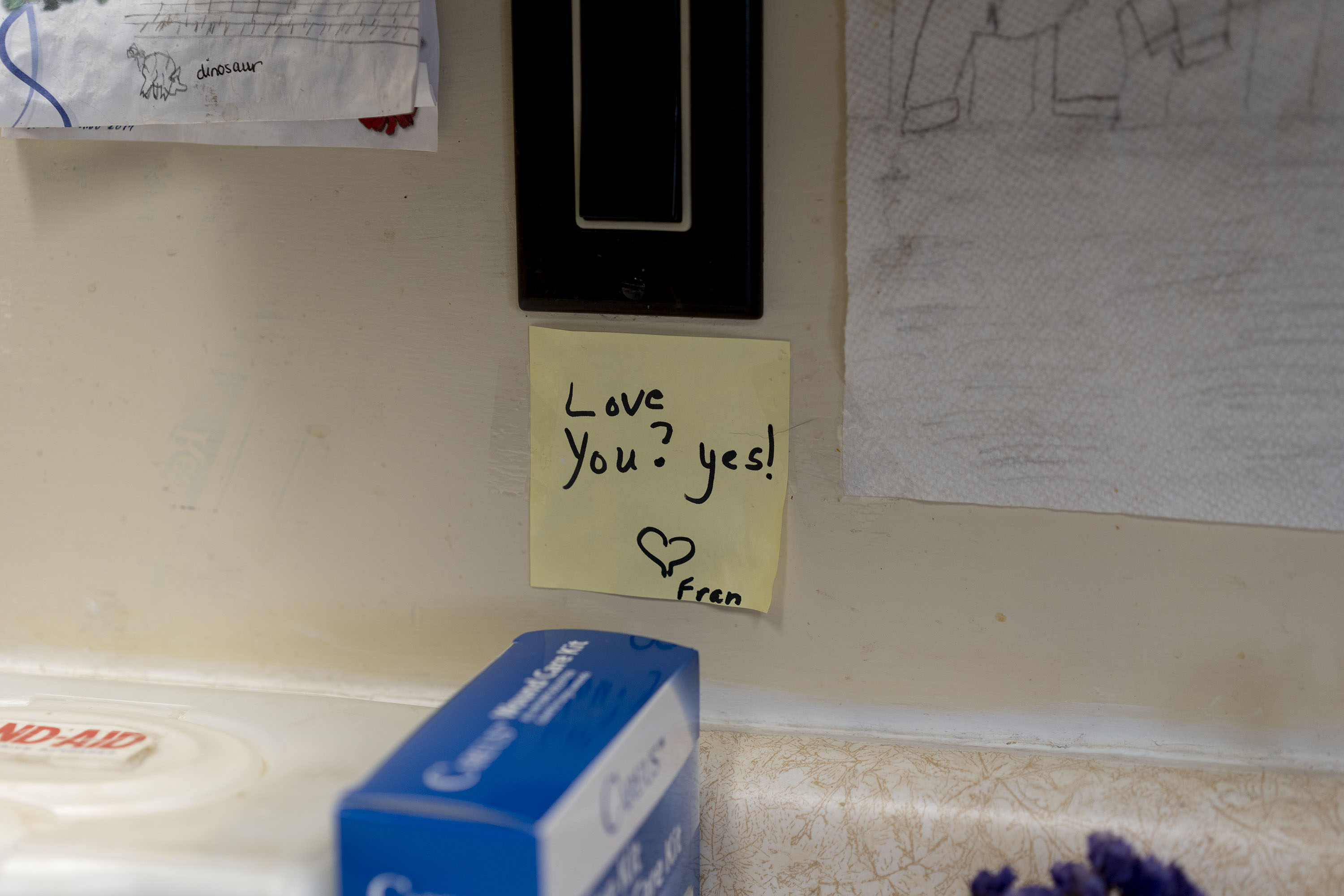

On a latest afternoon, Henry Ruhl and his daughter sat at his kitchen desk in Iowa, going over the paperwork and questioning how it could all end up.

The household discovered some consolation in studying that the invoice for Fran Ruhl’s Medicaid bills shall be deferred so long as her husband is alive. He received’t be kicked out of his home. And he is aware of his spouse’s half of their belongings received’t add as much as something close to the $226,611.35 the federal government says it spent on her care.

“You’ll be able to’t get — how do you say it?” he requested.

“Blood from a turnip,” his daughter replied.

“That’s proper,” he mentioned with a chuckle. “Blood from a turnip.”

[ad_2]