[ad_1]

Bharat Electronics Ltd. – Defence Electronics Chief

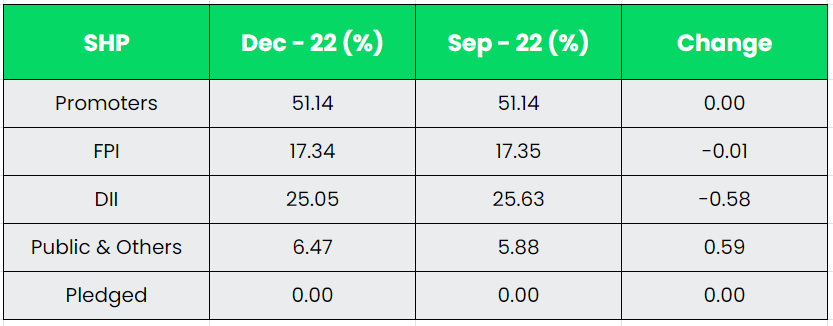

BEL, a Navratna defence public sector endeavor (DPSU), was established in 1954 underneath the Ministry of Defence, the GOI, to cater to the digital tools necessities of the defence sector. The GOI stays BEL’s largest shareholder with the present shareholding of 51.14%. BEL was conferred the Navratna PSU standing in June 2007.

BEL is the dominant provider of radar, communication and digital warfare tools to the Indian armed forces. The corporate has 9 manufacturing models throughout India and two analysis models. The Bangalore and the Ghaziabad models are BEL’s two main models, with the previous contributing the biggest share to the corporate’s whole income and earnings.

Merchandise & Companies:

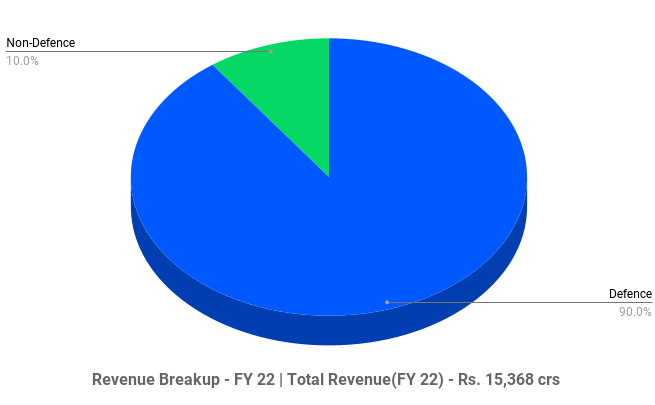

The Firm designs, manufactures and provides state-of-the-art merchandise and programs in all kinds of fields together with Radars, Missile Techniques, Army Communications, Naval Techniques, Digital Warfare & Avionics, C4I Techniques, Electro Optics, Tank Electronics & Gun/Weapon System Upgrades, and Digital Fuzes within the Defence phase. BEL’s non-Defence enterprise phase consists of areas equivalent to Digital Voting Machines, Homeland Safety & Good Cities, Satellite tv for pc Integration & Area Electronics, Railways, Synthetic Intelligence, Cyber Safety, Software program as a Service, Vitality Storage Merchandise, in addition to Composite Shelters & Masts.

Subsidiaries: As on 31st Mar 2022, the Firm has 2 subsidiaries and a pair of Affiliate corporations.

Key Rationale:

- Sturdy Market Place with excessive entry barrier – Bharat Electronics Ltd (BEL) is the main participant within the India’s defence electronics sector with a market share of greater than 50%. It helps in a lot of the nation’s defence electronics wants. The corporate has a robust aggressive benefit with its dominant place, established infra and facility, Affiliation with the Indian military and powerful R&D. Added to the above, the excessive entry barrier standing of the underlying sector will give extra benefit to the corporate.

- MOU with Triton EV – BEL has signed a MOU (Memorandum of Understanding) with US primarily based Triton EV for Manufacturing Hydrogen gasoline cells to satisfy the necessities of the Indian market and mutually agreed export markets. It additionally issued an LOI (Letter of Intent) to BEL for procurement of 300 KW Li-Ion Battery packs for its Semi-truck challenge in India at a price of Rs.8060 crs. The stated battery packs are to be delivered to Triton in 24 months which was stated to start from Jan’23. These offers are an enormous constructive for the corporate to diversify its income from its over dependency on Defence phase.

- Q3FY23 – The corporate reported consolidated income progress of 12% YoY to ~Rs.4153 crs. The YoY progress was primarily pushed by higher execution. EBITDA elevated by 4% YoY foundation at Rs.863 crs because the income progress of 12% has been negated by contraction in margins. Sequentially, EBITDA remained largely flattish. EBITDA margins declined by 160 bps on YoY foundation to twenty.8% in Q3FY23. The orderbook place of the corporate was at Rs.50116 crs as of December 2022 finish (~2.9x TTM revenues). Nearly 80% of the full orderbook caters to Defence phase. Implied order inflows have been at Rs.1452 crs throughout Q3FY23 and Rs.3736 crs throughout 9MFY23.

- Monetary Efficiency – The corporate’s 4 Yr Income and PAT CAGR stood at 10% and 14% between FY18-22, respectively. The Cashflow from operations of the corporate grew at a CAGR of 41% between FY19-22. The Free money stream of the corporate grew at a CAGR of 67% for a similar interval. The corporate is financially robust with constant profitability, cashflow era and a zero-debt stability sheet with robust inside accruals for growth.

Business:

The Indian Defence sector, the second largest armed drive is on the cusp of revolution. The Authorities has recognized the Defence and Aerospace sector as a spotlight space for the ‘Aatmanirbhar Bharat’ or Self-Reliant India initiative, with a formidable push on the institution of indigenous manufacturing infrastructure supported by a requisite analysis and improvement ecosystem. India is positioned because the third largest army spender on the earth, with its defence price range accounting for two.15% of the nation’s whole GDP. The imaginative and prescient of the federal government is to attain a turnover of $25 Bn together with export of $5 Bn in Aerospace and Defence items and providers by 2025. Until October 2022, a complete of 595 Industrial Licences have been issued to 366 corporations working in Defence Sector.

Progress Drivers:

- To advertise export and liberalise overseas investments, FDI in Defence Sector has been enhanced as much as 74% via the Automated Route and 100% by Authorities Route.

- Aside from the Atmanirbhar increase for the sector, the federal government has additionally put a ban on import of 411 gadgets of Companies and whole 3,738 gadgets of Defence Public Sector Undertakings (DPSUs) to assist the sector.

- In FY2023-24, Ministry of Defence (MoD) has been allotted a complete Price range of Rs.5.94 lakh crore, which is 13.18% of the full price range (Rs.45.03 lakh crore). Capital outlay pertaining to modernisation and infrastructure improvement has been elevated to Rs.1.63 lakh crore.

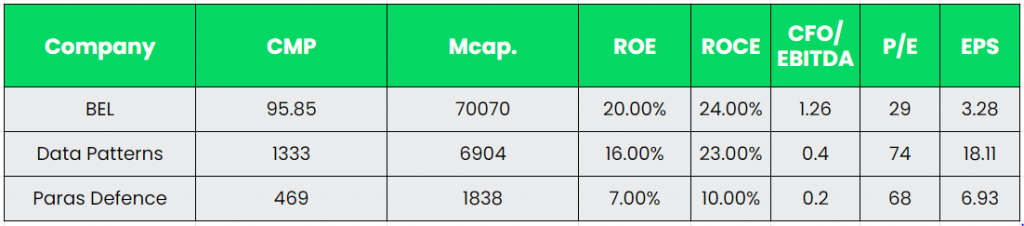

Rivals: Knowledge Patterns, Paras Defence, and many others.

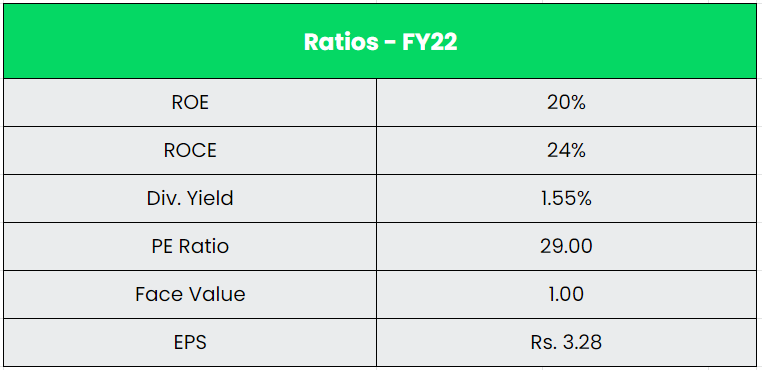

Peer Evaluation:

Within the Defence Electronics sector, BEL is the biggest participant with robust return ratios and strong cashflow era. The corporate’s CFO/EBITDA is greater than 1 for BEL which is powerful and fewer than 1 for its friends.

Outlook:

The Administration guided a income progress of 15% in FY23 and 15-20% thereafter. Gross margin for FY23 is anticipated to stay at comparable degree to that in 9MFY23 i.e., at ~42%. They’ve reiterated the order guide influx of Rs.20,000 crs in FY23 regardless of having solely orderbook influx of simply Rs.3736 crs throughout 9MFY23. The robust reiteration from the administration relies on the anticipated order influx of round Rs.15500 crs in Q4FY23. The influx of Rs.15500 crs relies on the ordering of Himshakti programme of Rs.3300 crs, Atulya medium-power radar of ~Rs.2000-3000 crs and ~Rs.10000 crs anticipated from naval shipyards for radars and SONAR. The discussions are virtually confirmed for Rs.12000 crs value of orders and the stability Rs.3500 crs is within the numerous levels of approval. BEL can be anticipating its new amenities for defence orders to be accomplished in subsequent 2-3 years. The corporate goes to incur a capex of Rs.600 crs in FY23 and Rs.600-800 crs in FY24. BEL is enticing on the premise of a) New order Influx b) Strong growth for income progress c) Improve within the share of Non Defence income. The Administration’s focus is to extend the non-defence share to ~20% over two to 3 years.

Valuation:

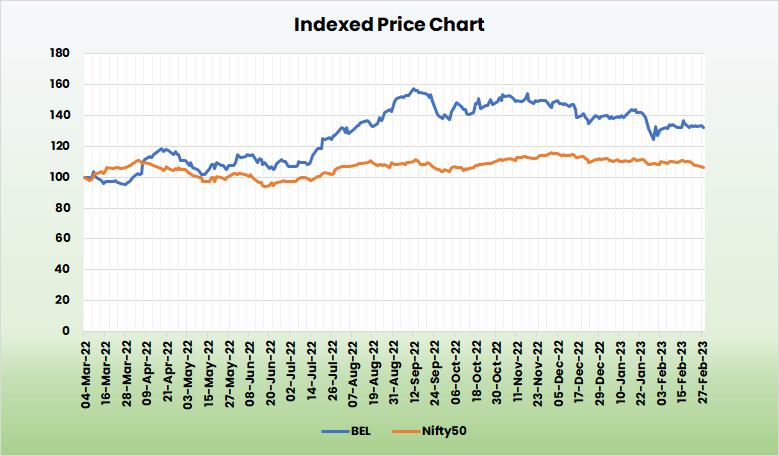

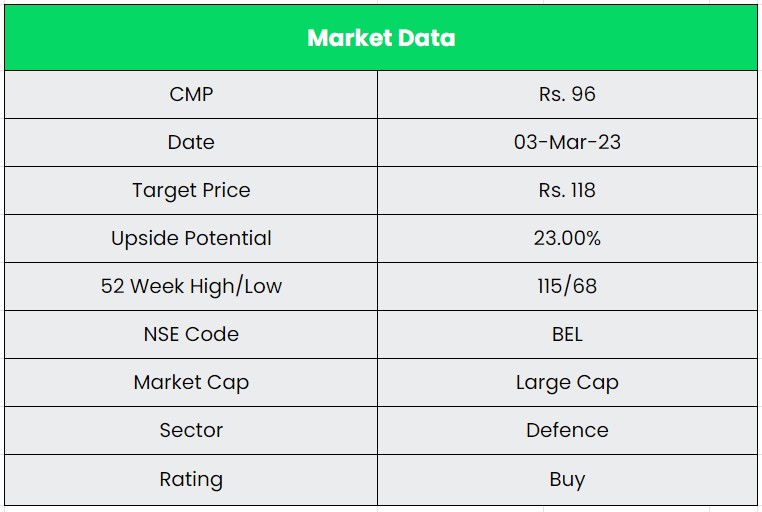

The Firm’s sound monetary place and a large product portfolio helped it to realize a serious chunk of Atmanirbhar Increase. The Administration’s technique to diversify its income, concentrate on growing exports will help the long-term progress of the corporate. Therefore, we suggest a BUY score within the inventory with the goal worth (TP) of Rs.118, 27x FY24E EPS.

Dangers:

- Consumer Focus Threat – BEL is deriving greater than 85% of its income from the Indian defence sector. Any main reduce within the defence spending by the Authorities will considerably impression the order guide and thereby income.

- Capital Intensive Threat – The corporate’s operations possess an elongated working capital threat. For the reason that main buyer is the GOI, there’s a excessive probability of delay within the receivables.

- Execution Threat – Any delay within the execution of the orderbook will likely be a key threat and it’ll straight impression the income of the corporate.

Different articles it’s possible you’ll like

Put up Views:

252

[ad_2]