[ad_1]

After the current Supreme Courtroom ruling, there was an enormous confusion amongst many EPF subscribers relating to eligibility. To keep away from all of the confusion, lately EPFO launched a round the place it’s clearly talked about the eligibility for EPS increased pension.

On this article, I’m simply concentrating on the eligibility for EPS increased pension fairly than different issues. Primarily as a result of EPFO has to nonetheless clear many doubts and I hope that quickly we’ll get the notification on this matter.

The notification is prolonged. Nevertheless, to simplify your life, I’m highlighting the details.

Eligibility for EPS Greater Pension

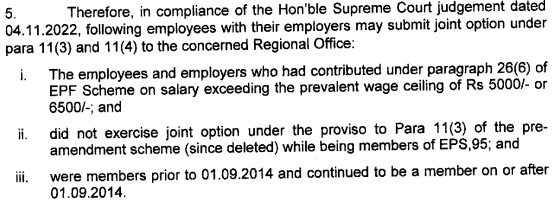

Allow us to consider the three main circumstances of this notification. Let me share the notification right here.

Now, let me simplify the above strains to your understanding. Do keep in mind that all these three circumstances needs to be fulfilled.

# As you might remember that there are few employers who prohibit their contribution solely to 12% of your wage (Fundamental+DA) or 12% of your precise wage (Fundamental+DA). In case your employer had contributed 12% of your precise wage, then solely you might be eligible for a better pension.

# Throughout the 1st Sept 2014 modification to EPS, there was a provision to provide a joint declaration for increased pension. Those that gave a joint declaration throughout that point or not, are all by default eligible for increased pension. (Para 11(3)).

# You should be a member of EPF earlier than 1st Septmber 2014 and in addition after 1st September 2014. In case you are retired from employment or withdrew your EPS earlier than 1st September 2014, then you aren’t eligible for a similar.

There may be nonetheless quite a lot of clarification to be required like the shape to be stuffed and in addition the quantity to be transferred. Now we have to attend for EPFO readability on this regard. As of now, you might get readability concerning the eligibility for EPS increased pension.

[ad_2]