[ad_1]

This text was initially printed in The Occasions of India. Click on right here to learn it.

Do you need to know a easy trick which is able to enable you enhance long run returns out of your Fairness SIP portfolio?

Right here is the trick – Embody Midcap Fairness Funds in your Fairness SIP portfolio!

By together with midcap fairness funds in your fairness SIP portfolio you stand an opportunity to earn higher long run returns.

However how?

Let’s first begin with the long run proof.

The final 15+ years in a nutshell…

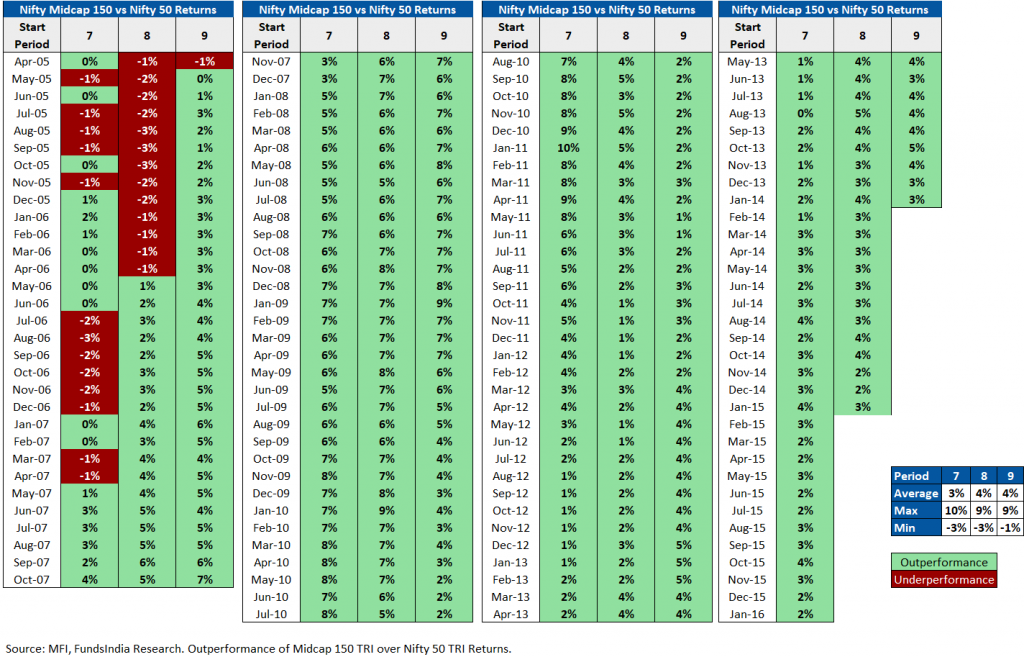

Within the final 15+ years, a Midcap SIP (Nifty Midcap 150 TRI) has on a mean outperformed massive cap SIP (Nifty 50 TRI) by 3% over 7 yr time frames!!

The desk beneath reveals the outperformance of Nifty Midcap 150 TRI over Nifty 50 TRI from completely different beginning months throughout 7Y, 8Y and 9Y time frames. As seen beneath, majority of the occasions a midcap SIP has outperformed which is obvious from the overwhelming inexperienced shades within the desk.

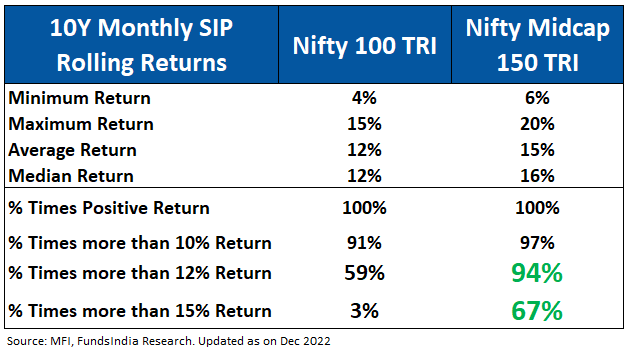

The opposite solution to confirm that is to take a look at the rolling returns of a month-to-month SIP over a ten yr timeframe and evaluate Nifty Midcap 150 TRI with Nifty 100 TRI.

Over a ten yr timeframe when you had been investing in Nifty Midcap TRI by way of a month-to-month SIP your common returns would have been 15%. An analogous month-to-month SIP in Nifty 100 TRI would have on a mean given returns of round 12%.

Additionally, the occurrences/probabilities of larger returns had been in favor of Midcaps. 94% of the occasions the returns had been greater than 12% whereas for big caps solely 59% of the occasions the returns had been greater than 12%.

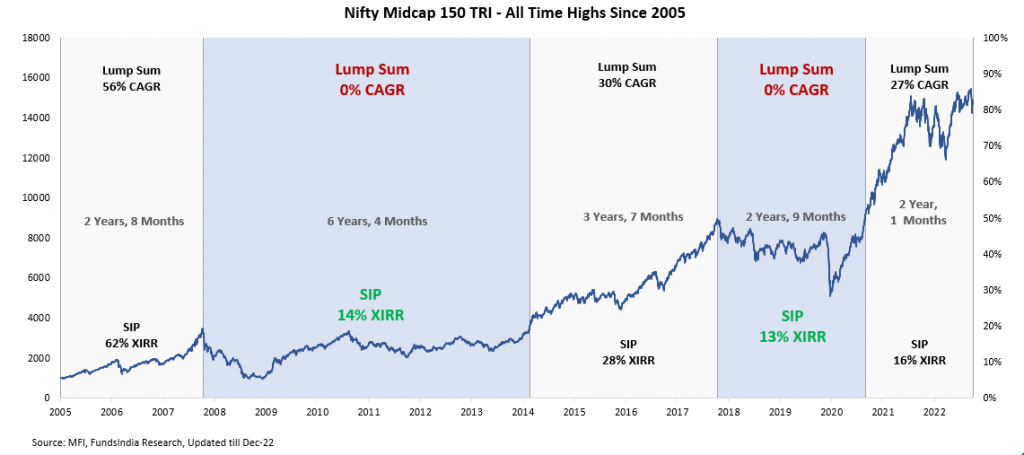

What about durations the place midcaps undergo lengthy phases of subdued or flat returns?

Midcap SIPs offered respectable returns even in periods when lumpsums in midcaps didn’t do nicely.

Within the chart beneath you may see the durations when the lump sum gave NIL returns however an SIP nonetheless gave affordable returns (13% to 14% XIRR).

Whereas the previous proof when it comes to efficiency is convincing sufficient, however to make sure the identical logic applies to the long run as nicely, we have to reply one other easy query

Why does this occur?

It’s easy. There are primarily two issues that determine your long run SIP returns – 1) Variety of mutual fund models collected and a pair of) Ending NAV (on the time of withdrawal).

The extra the models you’ve on the finish of your timeframe and the upper the NAV at the moment, then the higher your SIP returns.

As an example, suppose you and your buddy each begin a month-to-month SIP of the identical quantity for a timeframe of seven years and begin at an NAV of Rs.100. On the finish of your timeframe, assume you’ve collected 2000 models and the NAV is Rs 200. However, your buddy has collected 2300 models and the NAV is Rs 220. The SIP return to your buddy might be greater than your SIP return as a result of they’ve extra models and a better NAV. The extra models and better NAV give an additional kicker to the SIP returns.

So, how can we get this mix for an additional kicker to SIP returns?

For any fairness technique to offer you an additional kicker in SIP returns (vs massive caps) it must tick these two standards

- It ought to have larger volatility (learn as larger momentary declines) vs largecaps over brief durations of time. It’s because for an SIP investor momentary market falls assist accumulate extra fund models at decrease costs and when the market recovers the additional models collected additionally take part within the upside, thereby enhancing general returns.

- It ought to have excessive odds of long run lumpsum outperformance vs massive caps over a 7-10 yr foundation.

Standards 1 takes care of the upper models half and Standards 2 takes care of the upper NAV half!

Now let’s verify if Midcaps fulfill these two criterias

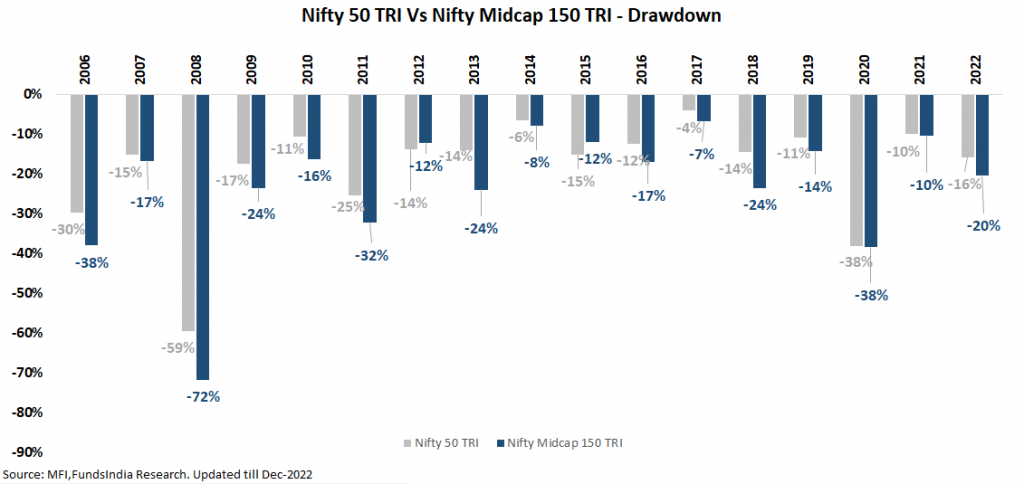

Examine 1: Are midcaps extra risky than largecaps?

To verify for volatility we seemed on the intra-year drawdown and in contrast Nifty Midcap 150 TRI with Nifty 50 TRI (which is a big cap index). We are able to see within the chart beneath that traditionally Midcap has had larger volatility (learn as momentary declines) over brief durations of time in comparison with massive cap.

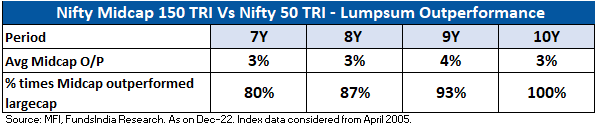

Examine 2: Do midcaps outperform largecaps over the long run?

To verify for this we in contrast the outperformance of Nifty Midcap 150 TRI versus Nifty 50 TRI. We are able to see within the desk beneath that over a 7 to 10 yr timeframe, lumpsum funding in Midcap has outperformed Largecap with common outperformance of three%.

Additionally, over a ten yr timeframe, 100% of the time Midcaps have outperformed Largecaps.

As seen above, midcaps fulfill each the criterias which makes it an acceptable candidate for bettering your long run Fairness SIP Efficiency.

So, what must you do?

Keep a minimum of 20-30% publicity to midcaps in your Fairness SIP Portfolio.

If required, you may as well improve the midcap allocation additional relying in your timeframe (longer the higher) and talent to place up with bigger momentary declines.

Summing it up

- Midcap SIPs have excessive odds of outperforming Massive caps over lengthy durations of time. Even throughout flat market phases Midcap SIPs have delivered respectable returns.

- Midcaps give an additional kicker to long run Fairness SIP portfolio returns pushed by

- Increased volatility in comparison with massive caps over brief durations of time

- Increased odds of lumpsum outperformance over massive caps in 7-10 yr durations

- So, have a minimum of 20-30% publicity to midcaps in your Fairness SIP portfolio

Different articles you could like

Submit Views:

2,563

[ad_2]