[ad_1]

Why is Subject of Taxes Related for Life Insurance coverage?

Life insurance coverage is likely one of the most generally used life and dwelling advantages insurance coverage merchandise, however there are nonetheless numerous questions associated to life insurance coverage and taxes. Three completely different elements play into the dialogue of taxes and life insurance coverage. It is very important perceive the way it all works, since Canada Income Company (CRA) is concerned.

To start with, a person – an individual such as you or I – can maintain an insurance coverage coverage, or an organization also can maintain a life insurance coverage coverage. Within the first case, that is particular person life insurance coverage and within the second case, it’s corporate-owned life insurance coverage. There are a number of conditions when it is smart for a person or an organization to make use of a life insurance coverage coverage to mitigate dangers.

Second, tax matters associated to life insurance coverage differ throughout varied insurance policies. The only insurance policies are referred to as time period life insurance coverage, whereas extra refined insurance policies are everlasting life insurance coverage (with entire life insurance coverage being essentially the most often used). We’ll focus on these two insurance policies additional to know variations.

Third, life insurance coverage and tax matters span throughout varied monetary transactions:

- Paying life insurance coverage premiums (paying for prices of life insurance coverage)

- Receiving a life insurance coverage declare payout (when a beneficiary receives life insurance coverage proceedings when a policyholder passes away)

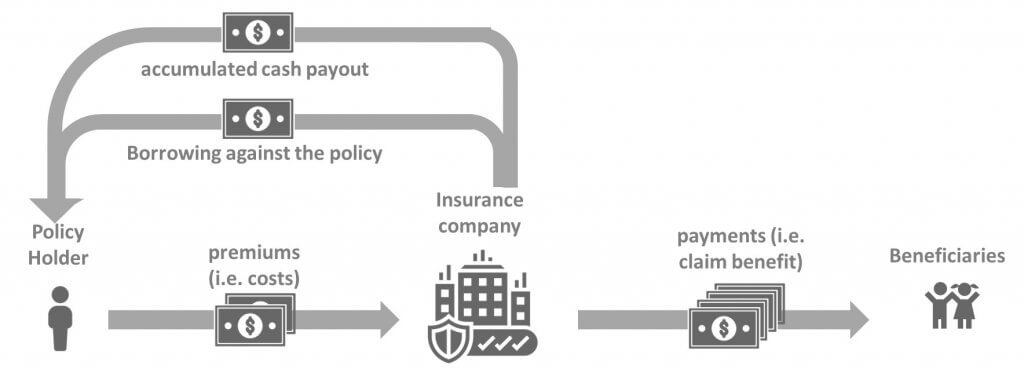

- Cashing out a life insurance coverage coverage – that is solely related for an entire life or different everlasting insurance coverage insurance policies the place the money worth account is leveraged individually from the dying profit.

Now, let’s dive in…

Varieties of Particular person Life Insurance coverage

As briefly talked about above, there are two completely different coverage varieties:

Is Life Insurance coverage Tax Deductible?

Within the overwhelming majority of conditions, life insurance coverage premiums will not be tax-deductible. An exception is that if a life insurance coverage coverage is used as collateral for an funding mortgage. On this case, a portion of the premium could also be deductible, however tread fastidiously right here and search skilled recommendation.

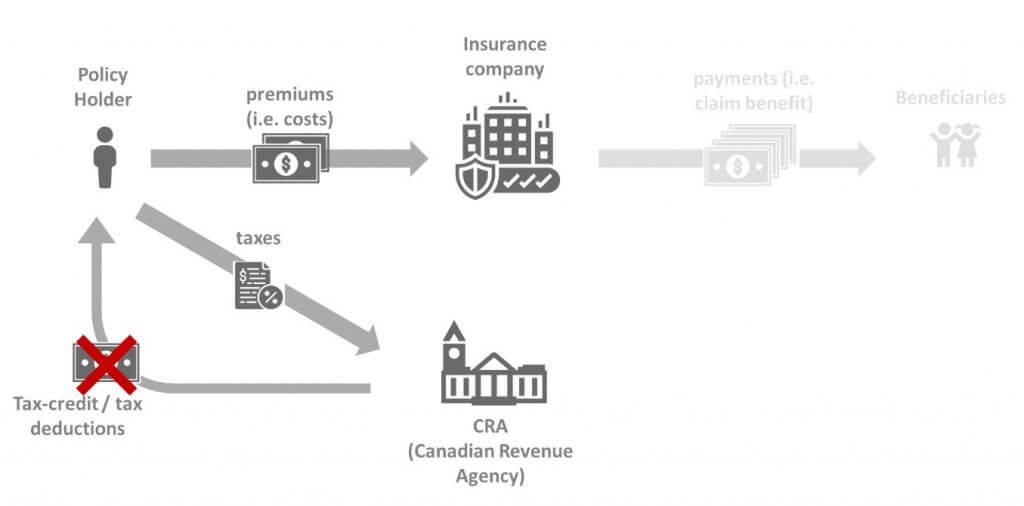

Particular person Life Insurance coverage Premiums and Taxes

The life insurance coverage premiums that an individual pays to an insurance coverage firm both on a month-to-month or annual foundation will not be tax deductible. Thus, there is no such thing as a have to report this to CRA (Canadian Income Company) in hopes of getting the premiums credited.

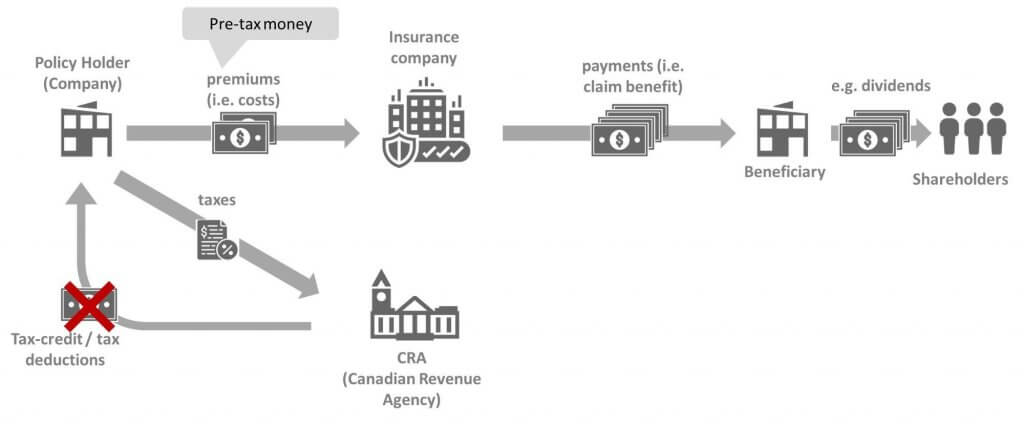

Company-owned Life Insurance coverage Premiums and Taxes

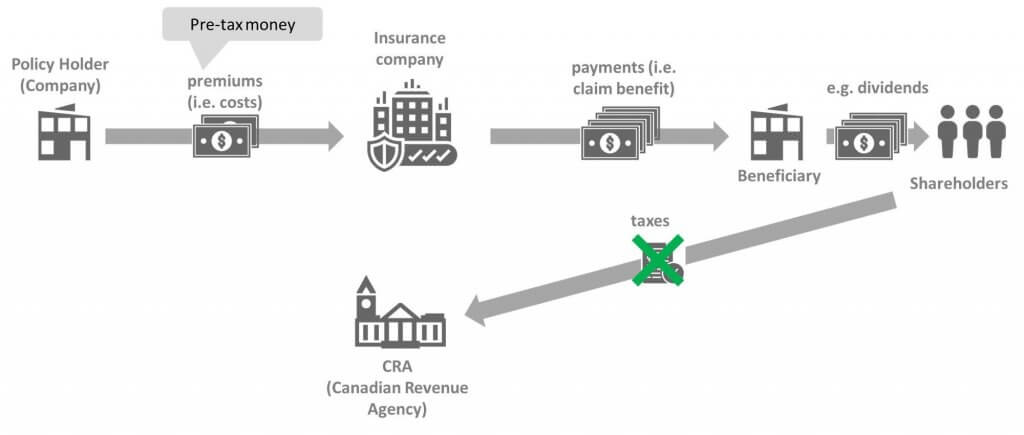

Company-owned life insurance coverage premiums will not be tax-deductible. Nevertheless, if owned by a small enterprise, company possession can nonetheless be advantageous because of the distinction between the small enterprise and private tax charges. An organization will get to make use of decrease tax {dollars} to pay for the life insurance coverage premium.

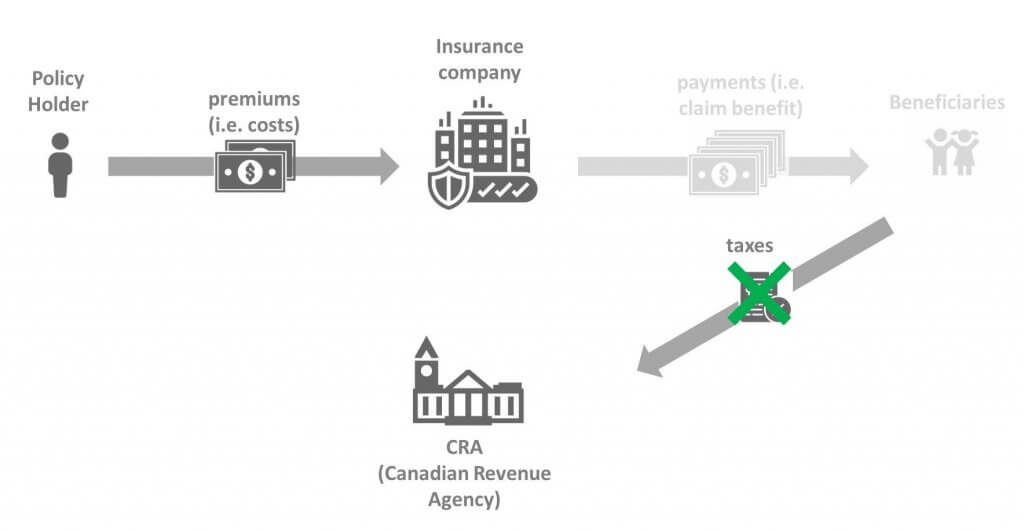

Is Life Insurance coverage Taxable in Canada (i.e. Insurance coverage Funds/ Declare Payouts)?

If a policyholder passes away, beneficiaries will obtain a cost (additionally referred to as a declare payout). On the whole, these funds will not be taxable and a beneficiary (or beneficiaries) will obtain the complete quantity. So, if a coverage holder had a $1,000,000 life insurance coverage coverage, his or her beneficiary will get $1,000,000 in insurance coverage funds with out having to pay taxes on it. Thus, proceeds from life insurance coverage will not be taxable in Canada.

Particular person Life Insurance coverage Funds to a Beneficiary

Proceeds from life insurance coverage will not be taxable (additionally referred to as life insurance coverage funds) and the beneficiary will obtain the complete profit tax-free. Thus, CRA won’t be getting part of life insurance coverage proceeds/declare payout.

Company-owned Life Insurance coverage Funds to a Beneficiary

When the beneficiary is a company, a lot of the dying profit will be capable of be a dividend paid out to Canadian resident shareholders tax-free. An exception could possibly be if a corporately owned coverage (misguidedly) names a beneficiary apart from the company. This causes tax issues.

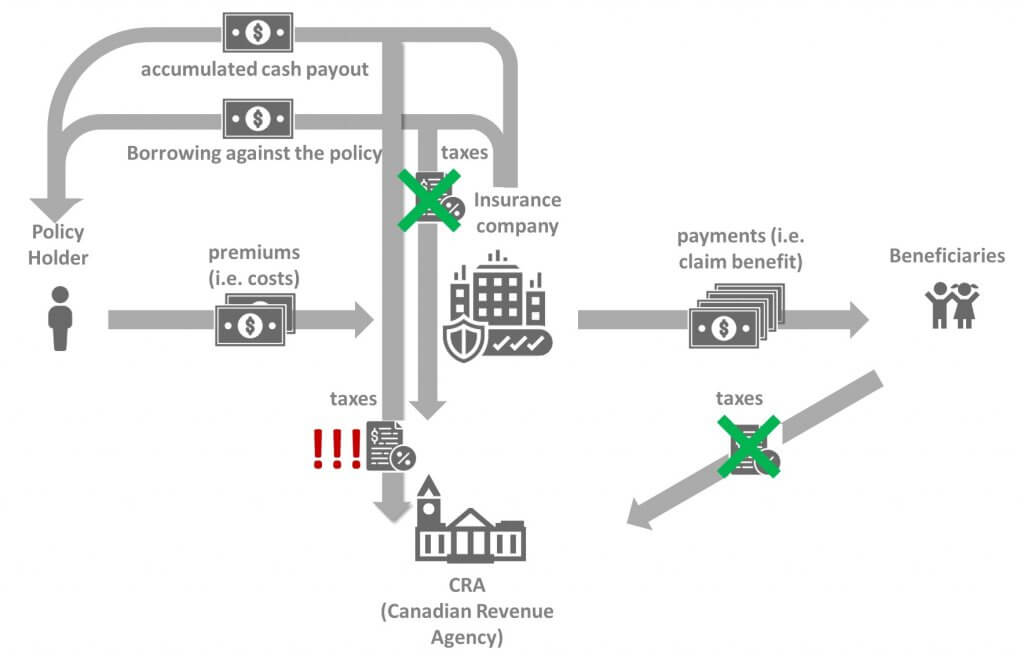

Are Life Insurance coverage Money Payouts from Entire Life Insurance coverage Tax-Free?

Should you take out money out of your entire life insurance coverage coverage, there’s typically a tax to pay. For that reason, it’s typically higher to take out a collateral mortgage towards the coverage. That is related tax-wise to a line of credit score towards a rental property – no sale means no acquire and no taxes. Upon dying, the mortgage will get paid off by the dying profit and the beneficiaries get the stability. Be aware: the lender should be a 3rd celebration (not a coverage mortgage) for this to be onside with CRA.

How Life Insurance coverage Can Assist with Tax Sheltering?

Life insurance coverage as a tax sheltering device is one other tax-related subject and there are quite a few methods to make use of everlasting life insurance coverage (corresponding to entire life insurance coverage) for tax-savings functions. We’ve got an in depth article on this subject – Entire Life Insurance coverage and Taxes: Every thing You Should Know.

Additionally, our skilled life insurance coverage brokers are comfortable to elucidate you the main points of life insurance coverage merchandise and related tax impacts. Merely full the quote request on the fitting aspect of your display.

In regards to the creator:

Casey Cameron graduated from the College of British Columbia and has labored in monetary companies and insurance coverage ever since.

He labored for six years with one of many world’s largest banks in Australia and Canada. After a stint in worldwide banking, Casey spent an extra six years with a boutique monetary planning firm in Vancouver, British Columbia and based Camlife Monetary in 2014.

He holds knowledgeable monetary planning designation and is a Fellow of the Canadian Securities Institute. Casey enjoys serving to households, people and enterprise homeowners with their monetary planning, insurance coverage and funding wants.

[ad_2]