[ad_1]

The $199 million SPDR MSCI USA Gender Variety Index ETF (SHE), which is the biggest of such funds, has gained about 3% to date this yr, in contrast with a 3.8% advance for the S&P 500.

Affect Shares’ $34.5 million YWCA Girls’s Empowerment ETF (WOMN), designed to spend money on corporations with robust insurance policies on gender equality, is up 4.3% year-to-date.

Even with higher returns, Hypatia remains to be hoping to lift extra capital for its ETF. Earlier makes an attempt at socially-targeted funds noticed these merchandise battle with out seed cash from an endowment or different massive establishment.

“We’re at $1.6 million in AUM, a tiny fraction of different funds,” Lizarraga stated. “We are going to really feel profitable when enterprise leaders and social influencers that care and discuss equality start to take a position their portfolios accordingly.”

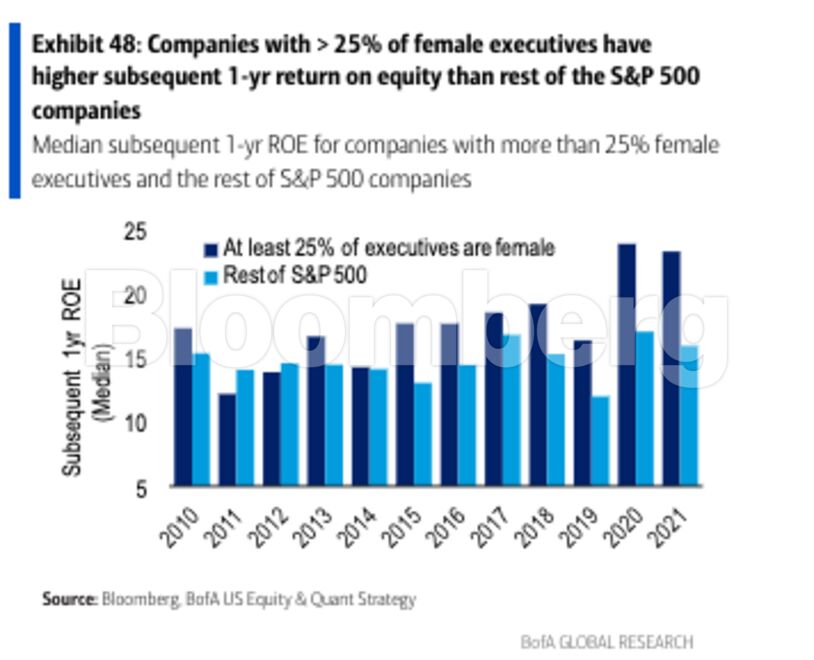

The shortage of funding could be remedied by significant outperformance, in accordance with Bloomberg Intelligence.

Regardless of the bevy of analysis pointing to raised efficiency for woman-led companies, these funds nonetheless have one thing to show with a view to garner belongings. Prime holdings in WCEO embody Citigroup Inc. Progressive Corp. and Occidental Petroleum Corp.

“Even when there may be educational analysis behind them, the one factor that may actually assist merchandise like this survive and thrive is outperformance,” stated James Seyffart, a BI analyst. “A product that has an excellent story behind it’s a recipe for achievement.”

[ad_2]