[ad_1]

In accordance with the Bureau of Labor Statistics, almost 70% of personal trade staff had entry to a office retirement plan in 2021. Simply 51% of them participated in these plans.

It’s estimated greater than 100 million Individuals are coated by an outlined contribution retirement plan. These plans maintain one thing like $11 trillion.

That’s some huge cash however is it sufficient to retire comfortably?

Let’s have a look at two of the most important retirement plan directors to get a way of how individuals are doing.

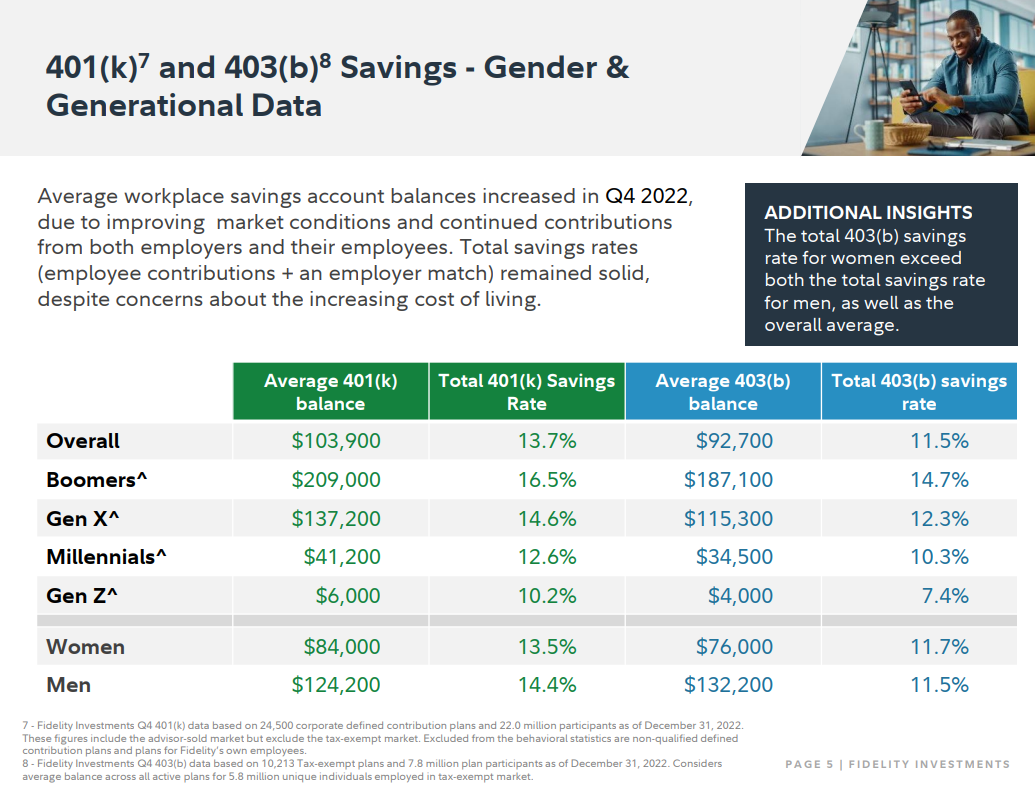

Constancy oversees trillions of {dollars} for tens of tens of millions of traders in office retirement plans.

The corporate’s newest replace exhibits a mean stability of just a little greater than $100k.

As you’d count on, the typical balances are increased for older generations and decrease for youthful generations.

The excellent news is the typical financial savings charges are within the double digits. I like seeing that.

The newborn boomer common stability of almost $210k doesn’t sound like sufficient to retire on however you must issue within the actuality that many individuals have a number of retirement plans from earlier employers, IRAs, brokerage accounts and good outdated Social Safety to fall again on.

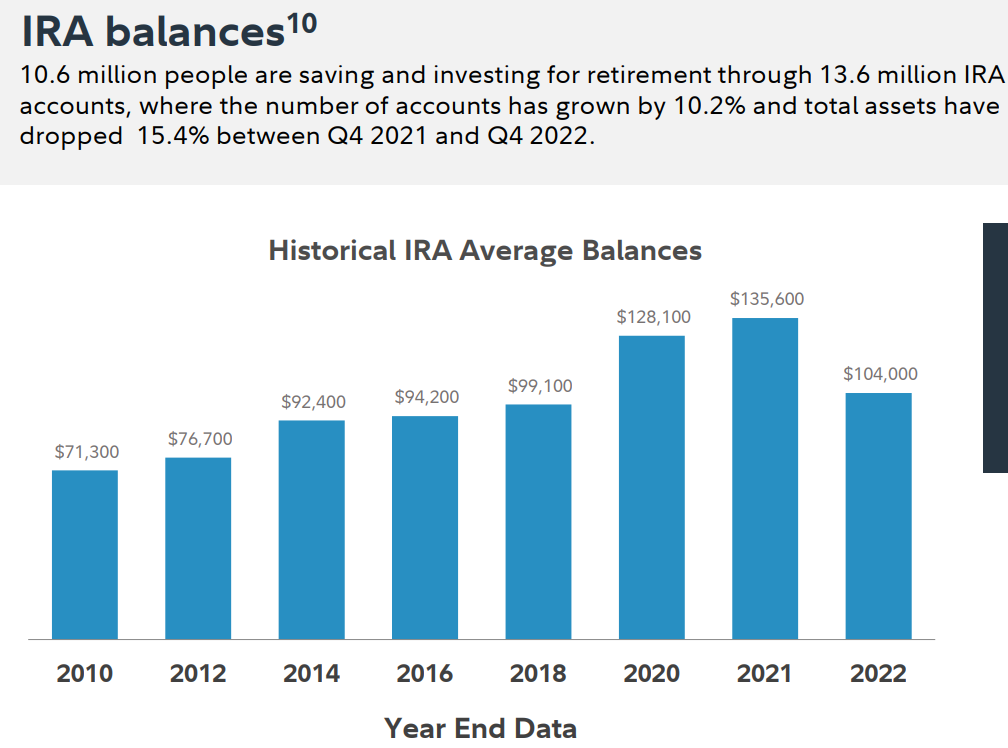

Constancy additionally shared knowledge on the typical IRA balances:

Coincidentally, the typical IRA stability is nearly similar to the typical outlined contribution plan.

Balances had been increased on the finish of 2021 than on the finish of 2022 for apparent causes (bear markets are likely to have the impact).

Add the 2 collectively and also you get a mean stability of roughly $207k. That’s excessive for some individuals and low for others relying on the approach to life.

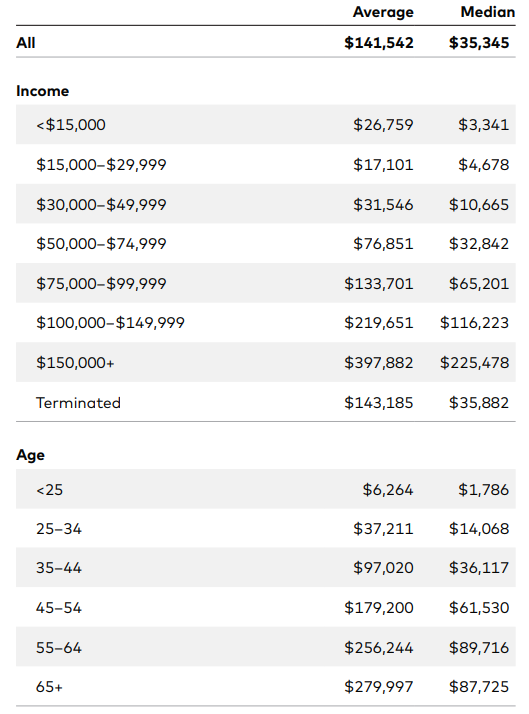

Vanguard covers 5 million members of their retirement plans. In accordance with their newest figures, the typical office retirement plan has a stability of greater than $141k.

Listed below are the typical and median balances by earnings stage and age:

No surprises right here. The upper the earnings stage and age the upper the stability.

The averages are increased than the medians as a result of there are a small variety of individuals with excessive balances that skew the averages.

Constancy estimates there are round 280,000 401k millionaires out of 21.5 million accounts, which is a bit more than 1% of their complete plan members.

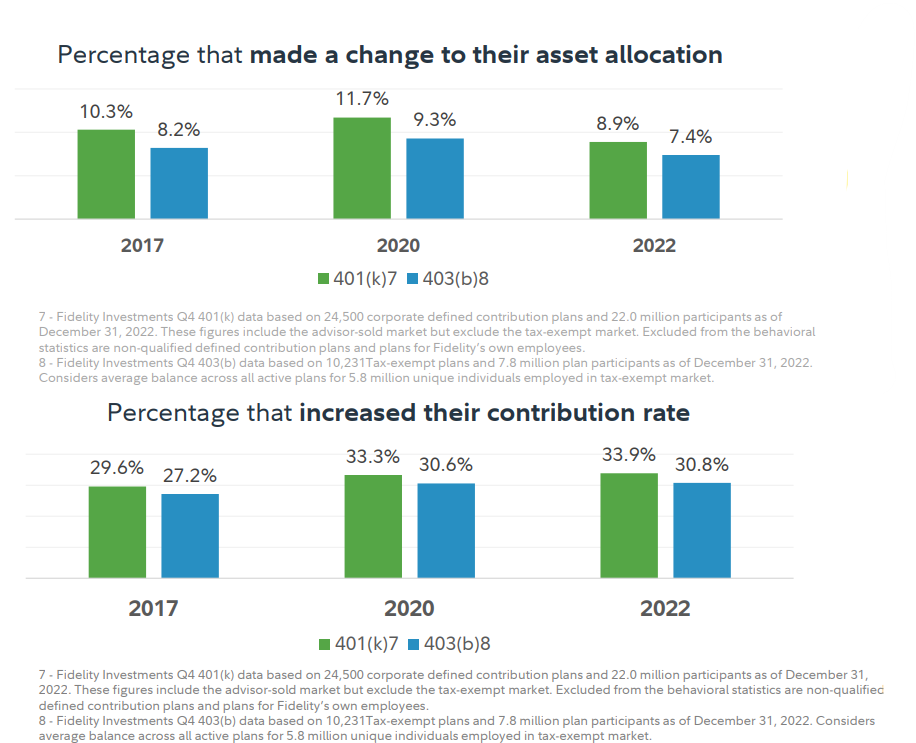

The excellent news about savers in retirement plans is the overwhelming majority of them appear to be accountable, long-term traders, not degenerate gamblers.

Lower than 9% of Constancy retirement plan members made a change to their asset allocation in 2022:

It’s additionally good to see one-third of members are rising the quantity they save annually.

Vanguard retirement savers are additionally well-behaved.

Simply 8% of plan members made modifications to their portfolio over the newest annual interval that means 92% of traders made no modifications to their plan. Plus, the traders who did tinker with their portfolios made principally small changes.

The arrival of target-date funds has finished wonders for diversification functions.

In 2005, simply 39% of retirement savers at Vanguard had a balanced portfolio. By 2021, that quantity was as much as almost 80% of traders.

Vanguard and Constancy traders won’t be consultant of all traders however we’re speaking tens of millions of retirement savers and trillions of {dollars} right here.

Regardless of the stability in your retirement account there are some classes we will take away from Vanguard and Constancy traders:

- A double-digit financial savings charge is a noble purpose for retirement financial savings.

- Growing your financial savings charge over time is an excellent option to juice your financial savings.

- Diversification gained’t make you wealthy in a single day however a balanced portfolio is without doubt one of the greatest types of threat administration.

- Making a long-term plan after which typically leaving it alone except there’s a good cause to make a change is an efficient funding technique.

A double-digit financial savings charge mixed with a rise in financial savings over time, a balanced portfolio and a plan that you simply typically depart alone is an efficient recipe for retirement success.

Additional Studying:

All the things You Have to Know About Saving For Retirement

[ad_2]