[ad_1]

The Magnificent Seven group of mega-cap tech shares must ship stellar earnings to maintain outperforming the broader market, in accordance with a rising consensus on Wall Avenue.

The group — comprised of Apple Inc., Microsoft Corp., Nvidia Corp., Alphabet Inc., Amazon.com Inc., Meta Platforms Inc. and Tesla Inc. — doubled in worth in 2023, outperforming the broader Nasdaq 100 Index’s 54% rise. The bulk prolonged positive factors this yr — aside from Tesla and Apple.

Optimism a few stronger-than-expected economic system, peaking rates of interest and synthetic intelligence have helped bolster the shares.

Buyers are actually questioning if positive factors could be sustained via 2024 and if the grouping of seven will stay intact as their performances differentiate.

Tesla has dropped 24% this yr, whereas Meta is up 34%. The Fb father or mother on Friday noticed the largest single-session market worth achieve in historical past.

“Because the Dot Com growth confirmed, continued outperformance requires shares to exceed the excessive bar set by consensus,” a Goldman Sachs Group Inc. staff led by David Kostin mentioned. “The “destiny of the magnificent 7 shares depends upon their capability to ship speedy income progress in 2024,” he wrote.

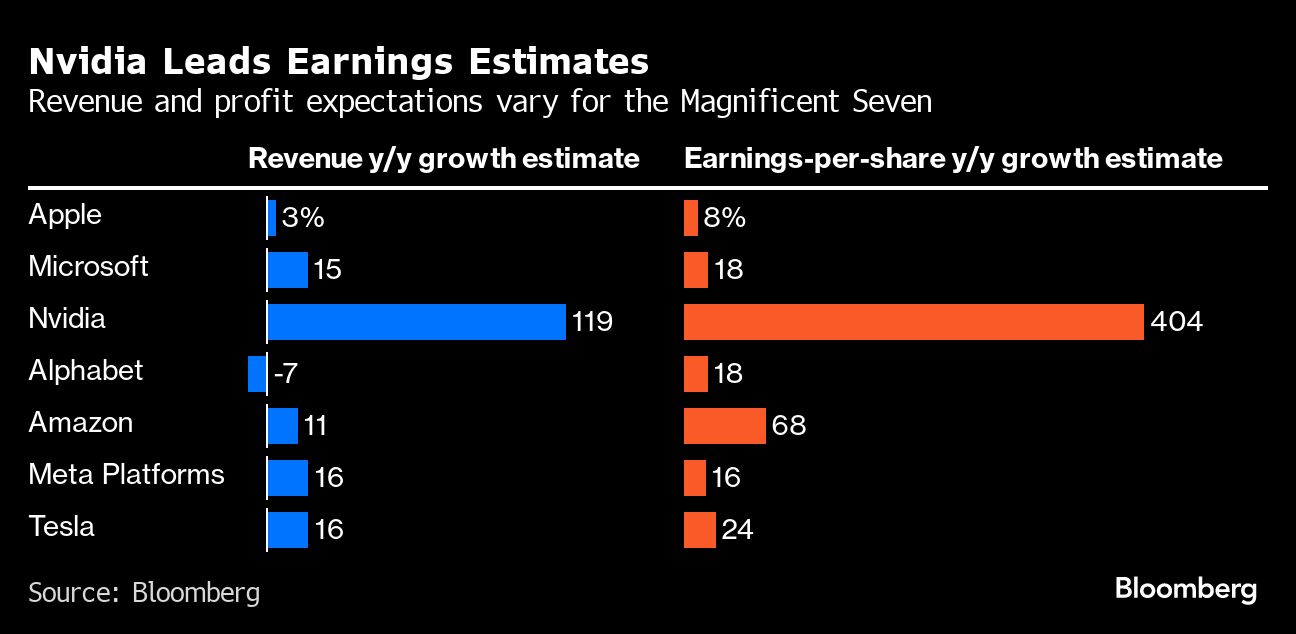

The strategists famous a large dispersion of consensus progress estimates throughout the group. That’s highlighted by various levels of income expectations for this yr.

The strategists famous a large dispersion of consensus progress estimates throughout the group. That’s highlighted by various levels of income expectations for this yr.

Whereas Nvidia’s income is anticipated to soar 119% from a yr prior, Alphabet’s is seen dropping 7%, in accordance with knowledge compiled by Bloomberg.

Others recommend a extra selective strategy to Magnificent Seven allocation. Berenberg strategists want to be uncovered to a few of these shares, however not all of them, particularly because the U.S. expertise sectors’ valuations are lofty versus world friends, offering a promote sign.

[ad_2]