[ad_1]

How it’s that Illinois, a jurisdiction not sometimes related to a robust dedication to free-market rules, got here to be the primary state within the nation to permit its insurance coverage charges to be regulated fully by open competitors is one thing of an accident of historical past.

In 1970, in a continuation of a pattern that many states had adopted within the Sixties, the Illinois Normal Meeting moved to switch the state’s current “prior approval” system for regulation of property-casualty charges—initially adopted in 1947 within the wake of the U.S. Supreme Courtroom’s choice in United States v. South-Japanese Underwriters, which discovered that insurance coverage did, in truth, represent interstate commerce—with a “file-and-use” system.

Beneath the brand new system, insurers might start utilizing charges they filed with the regulator even earlier than receiving specific approval or disapproval. The one catch was that trade agreements to stick to charges set by a ranking bureau—precisely the kind of collusion at concern in South-Japanese Underwriters—had been utterly prohibited.

A yr later, in August 1971, the legislation was scheduled to sundown and the legislature uncared for to increase it. The end result, whether or not intentional or not, is that Illinois turned the one state within the nation with no insurance coverage ranking legislation in any respect. And it remained such (with some minor exceptions) for the continuing 52 years.

Till now.

Beneath HB 2203, up for a listening to at present earlier than the Illinois Home Insurance coverage Committee, each insurer in search of to supply personal passenger motor-vehicle legal responsibility insurance coverage within the state should file a whole fee utility with the Division of Insurance coverage, which as soon as once more can be empowered to approve or disapprove charges on a prior-approval foundation. The invoice additionally would prohibit insurers from setting charges based mostly on any “nondriving” elements, together with credit score historical past, occupation, schooling, and gender.

The measure additionally creates a brand new system for public intervenors within the ratemaking course of, stipulating that “any particular person could provoke or intervene in any continuing permitted or established underneath the provisions and problem any motion of the Director underneath the provisions.”

In a nutshell, the legislation would remodel Illinois from probably the most open and aggressive insurance coverage market within the nation to 1 clearly modeled after probably the most restrictive: the rigid and state-directed system created by California’s Proposition 103.

The query, in fact, is why would the state do that? It’s true that insurance coverage charges are rising in Illinois, however they’re additionally rising in all places else. Insurify estimates that the typical value of auto insurance coverage rose by 9% to $1,777 in 2022 and the agency initiatives that charges will rise one other 7% to $1,895 this yr. Certainly, auto insurance coverage charges in Illinois truly stay 15.5% decrease than the nationwide common.

Inflation and continued supply-chain challenges are an enormous a part of the story there. Elevated charges of distracted driving additionally appear to be partly responsible. In keeping with the Nationwide Freeway Visitors Security Administration, U.S. visitors fatalities reached a 16-year excessive in 2021, with 43,000 deaths.

However these are all tendencies within the underlying loss and claims knowledge. Maybe a transportation regulator might do one thing to cut back visitors accidents. The Federal Reserve does its greatest to stanch out-of-control inflation. However an insurance coverage regulator can do neither. Since no insurer might keep in enterprise notably lengthy charging charges that had been unprofitable, the one means that fee regulation might truly cut back insurance coverage charges is that if a market had been uncompetitive, permitting some writers to make use of monopoly energy to extract extra income.

The proof that this hypothetical describes Illinois is remarkably skinny. There are 230 insurers that supply personal passenger auto in Illinois. Based mostly on the Herfindahl-Hirschman Index (HHI), which the U.S. Division of Justice (DOJ) and the Federal Commerce Fee use to evaluate the diploma of monopolistic focus in a given market, the Illinois auto insurance coverage market scored a 1,224 in 2021, the final yr for which NAIC knowledge is offered. That falls brief even of the FTC and DOJ’s threshold (1,500) for a “reasonably concentrated” market. Auto insurance coverage in Illinois is aggressive.

Nor are the state’s largest auto insurers precisely swimming in income. Allstate posted a $2.91 billion underwriting loss in 2022, pushed primarily by leads to the personal passenger auto market. For GEICO, a subsidiary of Berkshire Hathaway, it was a full-year pre-tax underwriting lack of $1.88 billion. Bloomington-based State Farm, the most important auto insurer each in Illinois and in the USA, suffered an enormous full-year underwriting lack of $13.2 billion.

It could be one factor if adopting extra stringent fee regulation merely failed to perform its acknowledged objective of decreasing charges, however the proof is that it truly does manifest hurt. The obvious drawback with fee regulation is that it restricts the provision of insurance coverage. Insurers naturally reply to fee regulation by tightening their underwriting standards, forcing some customers to have to show to the higher-priced residual marketplace for protection. In excessive circumstances, fee suppression can lead some insurers to exit the market altogether.

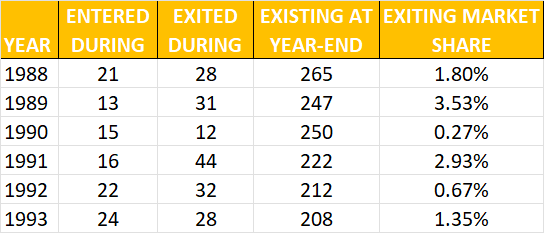

The empirical proof of this impact is manifest. After California ordered obligatory 20% fee rollbacks following the passage of Prop 103 in 1988 (the consequences of which had been initially considerably blunted by the courts), the variety of insurers writing auto protection within the state fell from 265 in 1988 to 208 in 1993.

FIRMS SELLING AUTO INSURANCE IN CALIFORNIA, 1988-1993

SOURCE: NAIC knowledge

New Jersey, likewise, noticed 20 insurers exit the market within the decade after the state handed the very related Honest Vehicle Insurance coverage Reform Act. When New Jersey later liberalized its regulatory system with passage of the Auto Insurance coverage Reform Act in June 2003, the variety of auto writers greater than doubled from 17 to 39 and hundreds of beforehand uninsured drivers entered the system.

An identical impact was seen in South Carolina, the place a restrictive ranking system within the Nineties had compelled 43% of drivers into residual market insurance policies undergirded by a state-run reinsurance facility. After adopting a liberalized flex-band ranking legislation in 1999, as in New Jersey, the variety of insurers providing protection in South Carolina doubled, the residual market shrank (it’s, at present, solely 0.007% of the market), and general charges truly fell.

Even in Massachusetts, which retains a reasonably restrictive rate-approval course of, reforms handed in April 2008 to permit insurers to submit aggressive charges (they had been beforehand set by the commissioner for all carriers) had a notable affect. Inside two years of the reforms, charges had fallen by 12.7% and a dozen new carriers started providing protection within the state.

As a result of it’s nonetheless a really regulated state, Massachusetts nonetheless has a comparatively giant residual market. In keeping with knowledge from the Vehicle Insurance coverage Plan Service Workplace (AIPSO), in 2022, 3.38% of Massachusetts auto-insurance clients needed to resort to the residual market, the second-highest fee within the nation. However earlier than 2008, Massachusetts’ residual-market share was routinely within the double digits. The one state that also has double-digit residual-market share at present is North Carolina, not coincidentally additionally the one state that also depends fully on charges set by a fee bureau.

Lastly, regulation will not be free. To finance the extra actuaries and monetary inspectors wanted to really perform this new regulatory system in Illinois, HB 2203 proposes that insurers topic to its provisions be assessed an extra price of 0.05% of their complete annual earned premium. Based mostly on 2021 premiums, that’s an extra $14 million a yr, which is along with the $106.4 million of charges and assessments the division already levies on the trade (to not point out the $515 million in premium taxes). The price of these charges are, in fact, handed on to customers within the type of fee will increase.

And what does that extra income truly get you? In 2021, Illinois spent $67.8 million on insurance coverage regulation (which is, one ought to be aware, almost $40 million lower than it already collects in charges and assessments). California, against this, spent $245.5 million. But, California’s market is not any extra aggressive than Illinois’, and arguably rather a lot much less.

The Land of Lincoln ought to acknowledge that that’s a reasonably unhealthy deal.

Matters

Illinois

[ad_2]