[ad_1]

Firm overview

India Shelter Finance is a retail targeted inexpensive housing finance firm engaged within the enterprise of offering loans for home development, extension, renovation, and buy of recent properties or plots. Included in 1998 as Satyaprakash Housing Finance India Restricted, the corporate was renamed as India Shelter Finance Company Restricted in 2010. The corporate’s granular retail-focused portfolio includes of residence loans and loans towards property with the first goal phase being the self-employed buyer with a deal with first time residence mortgage takers within the low- and middle-income group in Tier II and Tier III cities in India. The rates of interest for loans differ, and usually vary from 10.50% to twenty.00% each year, with a ticket measurement primarily starting from ₹0.50 million to ₹5.00 million. As of 30 September 2023, the corporate has an intensive and well-established community of 203 branches unfold throughout 15 states with important presence within the states of Rajasthan, Maharashtra, Madhya Pradesh, Karnataka and Gujarat.

Objects of the supply

- To fulfill future capital necessities in the direction of onward lending.

- Normal company functions.

- Obtain the advantages of itemizing the Fairness Shares on the Inventory Exchanges.

- Perform supply on the market of as much as 8,113,590 Fairness Shares by the Promoting Shareholders.

Funding Rationale

- Quick rising Belongings Underneath Administration – The corporate primarily funds the acquisition and self-construction of residential properties by first-time residence mortgage takers via residence loans and likewise supply loans towards property. As of September 30, 2023, 70.7% of its prospects have been first-time residence mortgage takers and residential loans account for 57.6% of the corporate’s AUM, whereas loans towards property characterize 42.4% of AUM. In accordance with the CRISIL Report, the corporate achieved AUM with a development of 40.8%, amongst housing finance firms in India, between FY21-23.

- Give attention to lowering financing prices – The corporate has a targeted method to sustaining a long-term and diversified borrowing profile by participating with a number of lenders to make sure well timed funding all year long. Its common price of borrowings and common incremental price of borrowings for the six months ended September 30, 2023 and September 30, 2022 was 8.9% and eight.3%, and eight.4% and seven.6%, respectively. The common borrowing prices lowered to eight.3% as of March 31, 2023 from 8.7% as of March 31, 2021, and common incremental price of borrowings for March 31, 2023 was 7.9%, as in comparison with 8.0% for the Monetary Yr 2021. By lowering borrowing prices, the corporate has been in a position to generate constant margins and obtain increased profitability.

- Digitization – As a step in the direction of combining digital options with private interactions, the corporate has launched IndiaShelter iServe utility, a devoted customer support resolution designed to promptly handle buyer considerations and queries. Moreover, the corporate has iSales utility which integrates, streamlines and optimizes buyer acquisition course of and IndiaShelter iCredit utility which facilitates underwriting.

- Monetary Monitor File – The corporate reported a income of Rs.585 crores in FY23 as towards Rs.448 crores in FY22, a rise of 31% YoY. The income has grown at a CAGR of 36% between FY2021-23. The EBITDA of the corporate in FY23 was Rs.419 crores and EBITDA margin was at 72%. The PAT of the corporate in FY23 is at Rs. 155 crores and PAT margin is at 26%. The CAGR between FY2021-23 of EBITDA is 37% and PAT is 33%. The ROE of the corporate stands at 13% in FY23. GNPA improved from 2.79% in H1FY23 to 1.00% in H1FY24. NNPA improved from 2.16% for H1FY23 to 0.72% for H1FY24.

Key Dangers

- OFS danger – Along with contemporary challenge, the IPO will see the sale of shares price upto Rs.0.02 crores by Catalyst Trusteeship Restricted (as trustee of MICP Belief), Rs.171 crores by Catalyst Trusteeship Restricted (as trustee for Madison India Alternatives Belief Fund), Rs.54 crores by Madison India Alternatives IV, Rs.31.7 crores by MIO Starrock and upto Rs.143 crores by Nexus Ventures III, Ltd.

- Compliance with covenants – The corporate’s means to adjust to the monetary and different covenants beneath the debt servicing agreements may adversely have an effect on its enterprise, outcomes of operations and monetary situation.

- Default danger – The danger of non-payment or default by prospects could adversely have an effect on the corporate’s enterprise, outcomes of operations and monetary situations.

Outlook

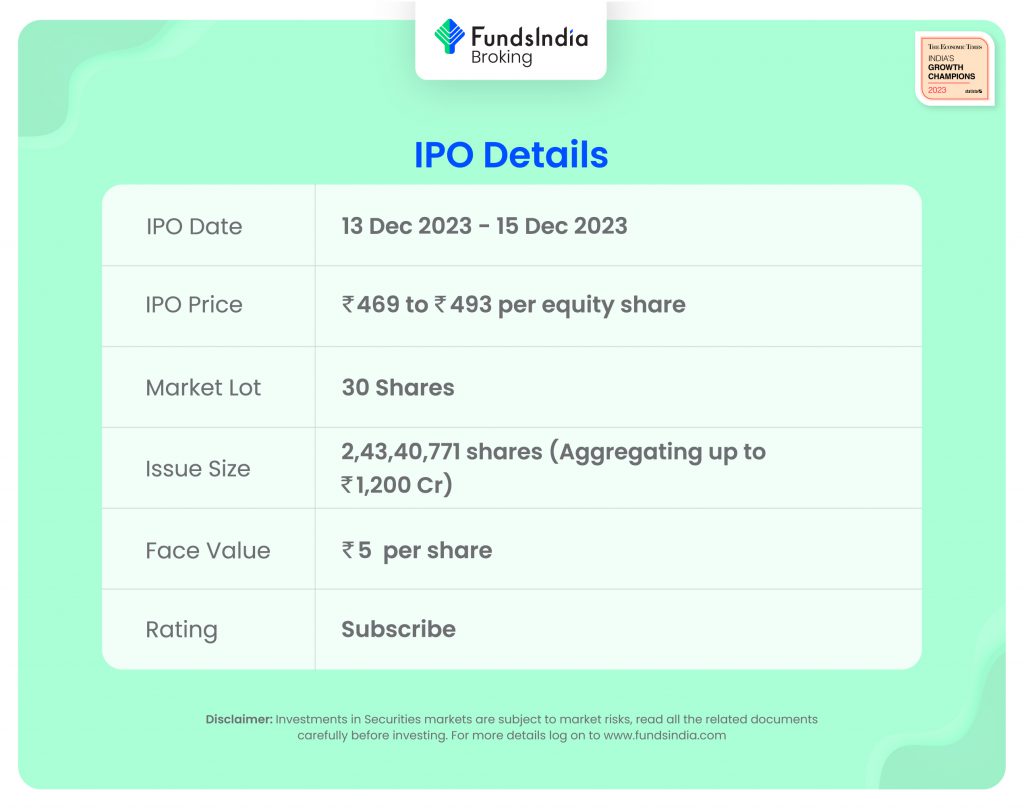

The corporate’s technique of penetrative growth throughout India by concentrating on areas with excessive financial development and substantial demand for inexpensive housing finance for low-and middle-income teams in Tier II and Tier III cities is predicted to assist the corporate to proceed its ongoing development for future years as effectively. In accordance with RHP, Aptus Worth Housing Finance India Restricted, Aavas Financiers Restricted and Residence First Finance Firm India Restricted are the one listed opponents for India Shelter Finance. The friends are buying and selling at a mean P/E of 31.67x with the best P/E of 37.70x and the bottom being 27.40x. On the increased value band, the itemizing market cap of India Shelter Finance will likely be round ~Rs.5239.22 crores and the corporate is demanding a P/E a number of of 33.73x based mostly on publish challenge diluted FY23 EPS of Rs.14.62. Compared with its friends, the difficulty appears to be absolutely priced in (pretty valued). Primarily based on the above views, we offer a ‘Subscribe’ ranking for this IPO for a medium to long-term Holding.

In case you are new to FundsIndia, open your FREE funding account with us and luxuriate in lifelong research-backed funding steering.

Different articles you might like

Put up Views:

126

[ad_2]