[ad_1]

The Authorities (EPFO) has supplied a alternative to pick eligible EPF/EPS subscribers to go for larger pension beneath EPS (Workers’ pension scheme).

An choice to earn the next pension throughout retirement.

Who would say “No” to such a suggestion?

Nicely, there is no such thing as a free lunch on this world. Whereas there may be an choice to earn larger pension, it comes at a value.

The query: Must you go for larger pension beneath EPS?

On this submit, let’s have a look at the next features intimately.

- How a lot pension do you get beneath EPS? When does the pension begin and the way lengthy do you get it?

- How do you contribute to EPF and EPS?

- What’s this complete subject about larger pension? And why does this come up?

- Who’s eligible?

- What do you get if you happen to go for larger pension? What do you lose?

- When you go for larger pension, what portion of your EPF corpus might be moved to EPS?

- What are the issues/drawbacks of EPS? These drawbacks would possibly influence your choice.

- Must you go for larger pension beneath EPS? Or do you have to stick to the established order?

Mentioned this matter in a Twitter thread too.

How a lot pension do you get beneath EPS?

Month-to-month Pension = (Pensionable wage X Pensionable service)/70

Pensionable wage = Common of final 60 months of base wage (earlier it was final 12 months wage). The pensionable wage is now capped at Rs 15,000. Nevertheless, there’s a manner for outdated staff (who joined workforce earlier than September 1, 2014) to get round this cover and earn pension on precise base wage. And that is the supply of the whole dispute that we are going to focus on on this submit.

Pensionable service = No. of years of contribution to EPS

I’ve learn in lots of locations that the pensionable service is capped at 35 years for the aim of pension calculation. Nevertheless, I couldn’t discover the supporting clause within the EPS Act. If such a cap is certainly there, it could movement from one other algorithm/laws.

The pension begins on the age of 58. When you exit EPS on the age of 58 and have rendered greater than 20 years of pensionable service, 2 years might be added to the pensionable service for calculation of pension.

You could have an choice to start out pension early (however not earlier than the age of fifty). The pension might be lowered by 4% for yearly of early exit. Also can defer however not past the age of 60.

Let’s perceive this with the assistance of an illustration.

Your final 60 months’ common base wage is Rs 1 lac. And also you had been contributing as per precise wage (not as per wage cap of Rs 15,000)

You could have rendered 33 years of pensionable service. Since you’ve labored for over 20 years and are exiting on the age of 58, your pensionable service might be 35 years.

Month-to-month pension = Rs 1 lac X 35/70 = Rs 50,000

- You’ll earn this pension of Rs 50,000 for all times.

- After you, your partner will earn 25,000 (50%) till he/she is alive.

- After your partner, your youngsters (most 2) will earn 25% pension every (Rs 12,500 every) till they flip 25.

- There are just a few different provisions caring for nook instances. You’ll have to examine the EPS Act to see how pension provisions will apply in such instances.

Notice: When you had been contributing with a wage ceiling, you’ll get pension of solely Rs 15,000 X 35/70 = Rs 7,500.

Whenever you see such a formulation for calculating pension in an outlined profit scheme, you possibly can sense this may be gamed. Such a formulation might have had some relevance within the years passed by however not now. Good that the Authorities has plugged the loophole, at the very least for the brand new members.

By the best way, how is the pension from EPS funded? It really works by means of your (your employer’s) contribution to EPS.

How does contribution to EPS and EPF work?

You contribute 12% of your base wage (Primary + DA) to EPF each month.

Your employer makes an identical contribution of 12%. Nevertheless, this 12% is invested in a unique method.

Of this 8.33% goes in the direction of EPF (Worker pension scheme). And the rest (3.67%) goes to EPF.

Nevertheless, the wage on which EPS is calculated is capped at Rs 15,000 monthly.

Allow us to take into account an instance. Allow us to say your base wage is Rs 50,000.

Your contribution to EPF = 12% * 50000 = Rs 6,000.

You don’t contribute to EPS.

Your employer additionally contributes Rs 6,000 to your EPS+EPF.

What’s the breakup?

Employer contribution to EPS = 8.33% X Rs 15,000 = Rs 1,250 (because the ceiling wage of Rs 15,000 will get triggered).

Employer contribution to EPF = Rs 6,000 – Rs 1,250 = Rs 4,750

The Authorities additionally contributes 1.16% of your base wage to EPS topic to a wage cap of Rs 15,000 monthly.

This sounds all proper. The place is the issue?

The place is the issue?

The wage ceiling has saved altering. Earlier than the modification within the EPS scheme in 2014, the ceiling was Rs 6,500.

Nicely, that’s additionally fantastic. I don’t see any downside there.

Had the above wage ceilings concrete, every little thing would have been fantastic.

Nevertheless, the EPS guidelines allowed staff to contribute over and above the wage ceiling cap. (Btw, the modification in EPS scheme in 2014 plugged this loophole and the workers becoming a member of the workforce after September 1, 2014 can’t contribute above the ceiling cap of Rs 15,000).

However this doesn’t forestall staff who had been member of EPS scheme earlier than September 1, 2014 (and nonetheless are OR retired after September 1, 2014) from contributing above the wage ceiling (Rs 5,000/Rs 6,500/ Rs 15,000). And earn a HIGHER PENSION.

And this has led to all of the confusion.

Notice that EPS is an outlined profit scheme (not like NPS which is an outlined contribution)

How does this result in confusion?

There are a number of pathways.

Case 1

In some instances, your employer caps contribution to EPF to wage ceiling of Rs 15,000 (wage ceiling has saved altering. It was Rs 5,000 earlier. Then to Rs 6,500 and now to Rs 15,000).

Therefore, even when your fundamental wage is Rs 50,000, you’ll contribute solely Rs 1,800 (12% of Rs 15,000). Your employer will contribute 1,250 (8.33% of Rs 15,000) to EPS. And Rs 550 to EPF.

When you belong right here, you aren’t eligible for HIGHER PENSION. Why? As a result of you’ve been contributing solely as per the wage cap.

Case 2

Your employer doesn’t cap contribution. You contribute on precise wage (and never based mostly on wage cap). Precise base wage of Rs 50,000.

Your contribution to EPF = 12% X Rs 50,000 = Rs 6,000.

Your contribution to EPS is NIL.

Employer contribution to EPS = 8.33% X 50,000 = Rs 4,165

Employer contribution to EPF = 3.67% X 50,000 = Rs 1,835

You might be eligible for larger pension.

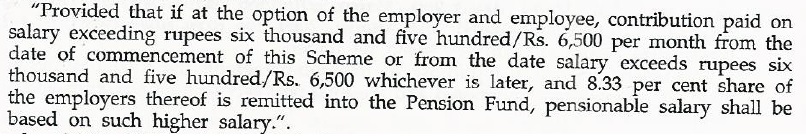

Nevertheless, there was a technical rule right here the place the worker and employer needed to convey this choice to EPFO inside sure timelines. Provision to Para 11(3) of the scheme earlier than modification in 2014. I reproduce the availability beneath.

Therefore, there have been cases the place individuals had contributed extra to EPS with out explicitly stating this alternative.

After they reached out to EPFO for larger pension, EPFO rejected their declare for larger pension (and gave pension as per the ceiling cap) since these staff didn’t specify this selection explicitly with acknowledged timelines. And refunded extra contribution within the EPS to the EPF accounts of the workers with curiosity.

Such staff challenged EPFO within the courts and gained. The Supreme Court docket discovered these timelines arbitrary and dominated in favour of such staff. Eligible for larger pension. You may examine this case about Mr. Praveen Kohli right here.

Case 3

Your employer doesn’t cap contribution. You contribute on precise wage (and never based mostly on wage cap). Precise base wage of Rs 50,000.

Your contribution to EPF = 12% X Rs 50,000 = Rs 6,000.

Your contribution to EPS is NIL.

Employer contribution to EPS = 8.33% X 15,000 = Rs 1,250 (whereas the employer doesn’t cap contribution to EPF, it caps the EPS contribution)

Employer contribution to EPF = 6,000 – Rs 1,250 = Rs 4,750

For the reason that EPS contribution has been made as per the wage cap of Rs 15,000, you’ll get pension solely as per the wage cap. Not larger pension.

When you belong right here, this latest EPFO round dated Feb 20, 2023 will curiosity you.

Why?

As a result of you’ve an choice to refill a type and ensure that you really want the next pension now. Since there may be free lunch, EPFO will switch a portion of cash (deficit contribution to EPS together with curiosity from EPF to EPS). In your future contributions additionally, you (your employer) must contribute extra to EPS.

So, larger pension however a decrease EPF corpus. Within the latter a part of the submit, we are going to see easy methods to consider these selections.

Who’s eligible for larger pension beneath EPS?

I reproduce an extract from EPFO round dated February 20, 2023.

The round refers to eligibility for exercising this new choice for larger pension by filling up a type.

- You have to have been a member of EPS as on September 1, 2014. Due to this fact, if you happen to began working after September 1, 2014, you’re NOT eligible. OR if you happen to retired earlier than September 1, 2014, you’re NOT eligible for larger pension.

- Your (and your employer’s) contribution to EPF (as on September 1, 2014) was on the wage that exceeded the wage ceiling cap of Rs 5,000 or Rs 6,500. Let’s say your base wage was 25,000 and also you had been contributing on the precise wage of Rs 25,000 (and never as per wage cap of Rs 15,000). You might be ELIGIBLE even when your EPS contribution was capped however your EPF contribution was on precise wage.

The best way to apply for Increased Pension beneath EPS?

The EPFO round lays down the strategy.

You have to make a joint software alongside together with your employer to EPF. As issues stand at the moment, you should apply earlier than March 3, 2023 (4 months from the Supreme courtroom judgement).

Given the confusion surrounding this matter, I hope the deadline is prolonged.

Counsel you attain out to the accounts staff of your employer for the operational particulars.

Must you go for Increased pension beneath EPS?

When you go for Increased pension, you’ll get larger pension. Danger-free. Assured for all times. And that’s the greatest benefit.

How excessive a pension will you get?

Nicely, that will depend on your common base wage within the ultimate 5 years of your work life (and years of pensionable service).

Now, you can not reply this query precisely, particularly if you’re within the non-public sector the place salaries can fluctuate drastically. In case you are working with a PSU and are nearer to retirement, you’ll have a firmer grip on the reply.

Nonetheless, take educated guesses. How a lot increment you’ve been receiving the previous few years? And with these assumptions, you possibly can arrive on the ultimate pension quantity.

And also you examine that towards the options? Don’t you?

Firstly, the upper pension comes at a value. Your EPF corpus will go down as a good portion of your EPF corpus might be shifted to EPS scheme. Your future contribution to EPF will even fall since you’ll now contribute extra to EPF.

After retirement, you’ll get this corpus and you’ll make investments this cash in financial institution mounted deposits, Authorities Bonds, SCSS, PMVVY and even annuity plans to generate common retirement earnings.

So, you should see, how a lot EPF corpus are you foregoing? And the way simple or tough it’s so that you can generate an analogous stage of earnings utilizing this corpus? If you are able to do that simply, then preserve the established order. When you can not (the speed of return might be fairly excessive), then go for the next pension.

When you go for Increased pension, what portion of EPF might be shifted to EPS?

Within the aforementioned EPFO round dated Feb 20, 2023, EPFO has talked about, “The strategy of deposit and that of computation of pension will comply with by means of subsequent round”.

Deposit means deposit from EPF to EPS. To be trustworthy, it’s unfair to count on staff to select till EPF comes out with these calculations. Bear in mind, the Supreme courtroom handed its judgement on November 3, 2022, and gave 4 months (till March 3, 2023) to members (staff) to make their alternative. And EPFO says on Feb 20, 2023, that they are going to subject a subsequent round for calculations.

Let’s do some crude calculations and see how a lot might be moved out of your EPS corpus.

Let’s say you began working within the 12 months 2001.

Your base wage originally was Rs 20,000 and grew at 5% every year. I’ve assumed that EPF returned 8.5% p.a. all through the tenure.

The wage cap was Rs 6,500 till September 2014 and Rs 15,000 thereafter.

Whilst you had been contributing to EPF on precise wage, the contribution to EPS was solely as per cap.

Within the first 12 months, Base wage =20,000

Worker EPF contribution = 20,000 * 12% = Rs 2,400

Employer EPS contribution = 8.33% * 6,500 = Rs 542 (if this had been on precise wage, employer would have invested Rs 1,667)

Employer EPF contribution = Rs 2,400 – Rs 542 = Rs 1,858 (if EPS contribution had been on precise wage, this may have been Rs 2,400 – Rs 1,667 = Rs 733

The deficit contribution to EPS = Rs 1,667 – Rs 542 = Rs 1,125

Now, this deficit contribution to EPS (that went to EPF) must be shifted again to the EPS scheme. And the curiosity on this deficit contribution too. And this have to be accomplished to your total previous service.

How a lot will this quantity be?

This can rely on the trajectory of your wage development. The upper your wage, the upper the deficit contribution. And the extra (in proportion phrases) you’ll have to switch from EPF to EPS.

Proportion of switch= Whole deficit contribution to EPS/Whole Contribution to EPF

On this instance, whole contribution to EPF (contains each employer and worker) = Rs 21.63 lacs

Whole deficit contribution to EPS = Rs 6.06 lacs

Proportion of EPF to be transferred to EPS = Rs 6.06/21.63 lacs = 28%

You can even examine the EPF corpus. Present vs the EPF corpus you’ll have with out EPS contribution being capped. You’d get the identical reply.

I did very crude EPF calculations (not precise). Present corpus = ~51.66 lacs

EPF corpus after eradicating EPS cap = Rs 37.14 lacs. A distinction of 28%.

Notice this distinction could be larger for the next base wage.

On this instance, if we alter the beginning base wage from Rs 20,000 to Rs 50,000, the switch proportion rises to 32%.

If beginning base wage drops to Rs 10,000, the switch proportion falls to 19.8%.

And that’s not it

When you go for larger pension, your employer’s future contribution to EPS will rise and to EPF will fall. That will even decelerate the expansion of EPF corpus.

Extending the instance to pending 10 years of service, if you happen to go for larger pension, you’ll finish with Rs 1.04 crores of EPF corpus after 10 years.

Had you caught with decrease pension, you’ll have Rs 1.46 crores.

What would be the pension?

Common base wage within the final 5 years = Rs 86,645

Month-to-month pension = 86,645 X 35/70 = Rs 45,798

Even if you happen to caught with decrease pension choice (establishment), you’ll get pension of Rs 7,500 (Rs 15,000 X 35/70).

Distinction of Rs 41.68 lacs in EPF corpus.

Distinction in EPS pension = Rs 45,798 – Rs 7,500 = Rs 38,298

Now, for this Rs 41.68 lacs to generate earnings of Rs 38,298 monthly, it must generate a return of 11% p.a. That’s not simple.

such an evaluation, choosing larger pension seems like a better option.

However EPS has its personal set of issues.

What are the issues with pension beneath EPS?

Firstly, you get the total pension till you’re alive. After you (the first pensioner passes away) your partner will get the pension however solely 50% of the unique quantity. And after the partner passes away, a most of two children will get 25% every till they’re 25.

I’m imagining a morbid state of affairs, however the household doesn’t get as a lot if you happen to (the first pensioner) move away too quickly after retirement.

Had you caught with a decrease pension, you’ll have gotten a a lot greater EPF corpus at retirement. Now, this EPF corpus belongs to you. And after you, it belongs to your loved ones. So, this extra EPF corpus might not be capable of generate as excessive earnings as EPS however this EPF corpus belongs to you and your loved ones.

Secondly, the pension will depend on the final 5 years (60 months) of base wage. So, if you happen to resolve to take a step off the accelerator when you cross 50 and choose up a job that pays much less, your common earnings in the course of the ultimate 5 years of your working life might fall. And therefore the pension might be decrease.

As an example, allow us to assume your common base wage between the age of 48 and 53 was Rs 2 lacs. And the common base wage between 53 and 58 years was 1 lac. The pension could be calculated for the common wage within the final 5 years i.e. Rs 1 lac. That you’re incomes extra earlier than that doesn’t matter.

Thirdly, if you wish to retire early, then your pensionable years of service might be much less, and the pension will accordingly be decrease. Plus, the pension quantity doesn’t begin earlier than the age of fifty. Allow us to take into account an instance. You began working on the age of 25 and labored till the age of 45. 20 years of service. Let’s additional assume that your common wage within the final 5 years was Rs 1 lac. Therefore, your month-to-month pension could be Rs 1 lac X 20/ 35 = Rs 57,142.

Nevertheless, if you would like this full pension, you’ll have to wait till the age of 58. However you retired on the age of 45. There may be an choice to start out drawing earlier however not earlier than you flip 50. The early withdrawal comes at a value. You get 4% much less for annually of early withdrawal. So, if you happen to begin at 50, you’ll get 8 X 4% = 32% much less. Rs 38,857 as a substitute of Rs 57,142.

Lastly (and I’m not positive about this), the choice for the next pension is a joint choice exercised by you and your employer. You might be in a non-public job and have opted for the next pension (and your present employer is pleased with this). You turn your job after just a few years and the brand new employer has a unique coverage about contributions. Caps the contribution as per wage ceiling. You may ask them to make an exception for you, however this can be a headache. This risk would make me extraordinarily uncomfortable.

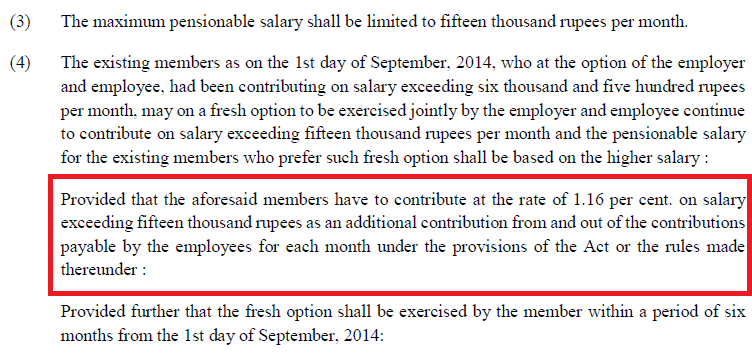

Notice: The newest EPS guidelines additionally present for workers to contribute 1.16% of Primary wage (for the portion exceeding Rs 15,000) to EPF in the event that they need to obtain the next pension.

In the interim, the Supreme Court docket has put this on maintain. For extra on this, confer with web page 7 of this doc. Since this pertains to funding of EPS pool, you possibly can count on this to return to you in some type or the opposite later.

What’s the ultimate verdict?

There isn’t any one-size-fits-all resolution.

Going by numbers (and as now we have seen above), choosing the upper pension will certainly offer you a really excessive pension. It will be tough to duplicate the identical stage of risk-free earnings out of your EPF corpus.

Nevertheless, the upper pension comes with many ifs and buts. Many caveats. You lose flexibility.

You have to weigh the upper pension towards these issues in EPS.

I get extraordinarily uncomfortable if you happen to take away flexibility from my investments. Therefore, please admire my biases in my ultimate feedback.

In case you are nearer to retirement and are pleased with all of the caveats (as talked about within the earlier part), you’ll possible be higher off by signing up for Increased pension. However examine the calculations earlier than taking a ultimate name.

In case you are youthful (35-40), connect higher weight to issues/caveats/lack of flexibility in EPS.

Disclaimer: Whereas I’ve tried my greatest to know and clarify the subject intimately, there could also be shortcomings in my evaluation or my understanding of the EPS scheme and the EPFO round.

Supply/Further Hyperlinks

[ad_2]