[ad_1]

What number of instances have you ever approached the Union Funds with immense expectations and are available again empty handed? The motion lay elsewhere. There have been necessary bulletins however circuitously associated to placing extra money in your pockets.

Not this time.

The Union Funds 2023 was action-packed. So many bulletins that instantly impression the middle-class taxpayer. I listing among the funds proposals instantly impacting the taxpayers.

- Decrease tax charges below the brand new tax regime.

- Conventional plans with annual premiums over Rs 5 lacs introduced below the tax internet.

- Taxpayers set off long run capital positive aspects by buying a residential property. Set-off limits below Part 54 and Part 54F are actually capped.

- Improve in funding cap below Senior Residents financial savings scheme (SCSS) from Rs 15 lacs to Rs 30 lacs.

- Improve in Tax assortment at Supply (TCS) for remittance below LRS for journey and investments overseas.

- Antagonistic tax modifications for REITs and Market-linked debentures

All the above modifications should not beneficial however the unfavourable ones largely have an effect on the HNIs.

Not potential to cowl this big selection of matters in a single put up. Therefore, will cowl a few of these over the subsequent few weeks. On this put up, I concentrate on an important one, the modifications to the tax construction within the new tax regime.

Now that the brand new tax regime has been made extra engaging, does it make sense so that you can change from the previous tax regime to the brand new regime?

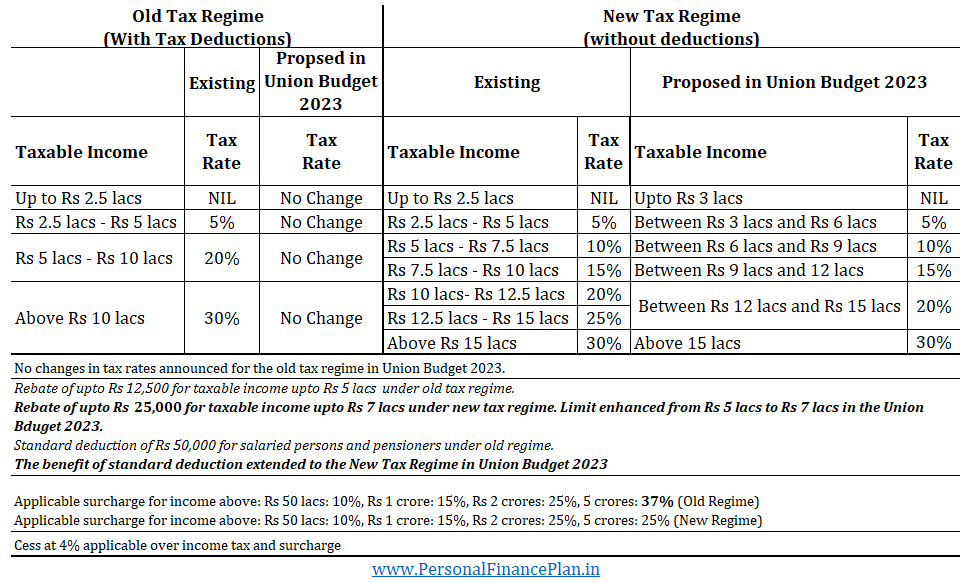

What are the brand new tax slabs?

The tax charges haven’t been modified below the previous tax regime (Greater tax charge however deductions).

The modifications are just for the brand new tax regime (decrease tax charges with out deductions).

Incentives for the New Tax Regime

- Enhancement of minimal exemption restrict from Rs 2.5 lacs to Rs 3 lacs

- The eligibility of rebate below Part 87A enhanced from Rs 5 lacs to Rs 7 lacs if choosing the brand new tax regime. This ensures no taxes in case your earnings doesn’t exceed Rs 7 lacs.

- Decrease tax charges

- Normal deduction of Rs 50,000 is now allowed for Salaried individuals and pensioners. Was not permitted earlier.

- Surcharge for earnings over Rs 5 crores decreased from 37% to 25%, if choosing the brand new tax regime.

- New tax regime shall be the default choice.

No taxes if the earnings is as much as Rs 7 lacs

In the event you go for the brand new tax regime and in case your earnings is as much as Rs 7 lacs, you shouldn’t have to pay any tax.

How does this occur?

Via a provision below Part 87A.

Underneath Part 87A, you’re eligible for a rebate of as much as Rs 25,000 (earlier Rs 12,500) if the whole earnings doesn’t exceed Rs 7 lacs (earlier Rs 5 lacs). This modification is just for the New tax regime.

So, let’s say your earnings is Rs 6.5 lacs. As per the revised tax slabs/charges, your tax legal responsibility shall be Rs 20,000. Nevertheless, for the reason that earnings is beneath Rs 7 lacs, you’ll be eligible for a rebate of Rs 20,000. Decrease of (Rs 20000, 25000). Therefore, zero tax legal responsibility.

In case you are a salaried worker or a pensioner, you can even take normal deduction. This can push the tax-free restrict to Rs 7.5 lacs.

Observe: The principles haven’t been modified for the previous tax regime. Underneath the previous tax regime, the rebate continues to be capped at Rs 12,500 if the earnings doesn’t exceed Rs 5 lacs.

For willpower of whole taxable earnings, it isn’t simply your wage that’s counted. The capital positive aspects or curiosity earnings or every other taxable earnings should even be added to calculate the whole earnings. Even the LTCG on fairness/fairness funds of as much as Rs 1 lac have to be added since it isn’t exempt earnings however taxable earnings on which no tax have to be paid.

Aid for Excessive Revenue Earners

In the event you earn rather well, the Authorities asks you to pay extra taxes. The tax slabs don’t change however the surcharge kicks in.

Above 50 lacs: 10%

Above Rs 1 crores: 20%

Above Rs 2 crores: 25%

Above Rs 5 crores: 37%

Thus, in case your taxable earnings is greater than Rs 5 crores, your tax charge in your total earnings above Rs 10 lacs is 30% * (1+37% surcharge) * (1 + 4% cess) = 42.77%

The Authorities proposes a change right here.

For earnings above Rs 5 crores, the surcharge shall be decreased from 37% to 25%, however provided that you go for the brand new regime. This reduces marginal tax charge = 30% * (1+25% surcharge) * (1+4% cess) = 39%

No change in surcharge charge for the previous tax regime. And the speed of surcharge stays 37% if the whole earnings is greater than 5 crores.

Clearly, for such taxpayers with annual earnings above Rs 5 crores, new tax regime is a simple alternative regardless of the tax deductions taken.

How higher is the Proposed New Tax Regime in comparison with the Present New Regime?

The next illustration demonstrates the impression for salaried taxpayers.

Since the good thing about normal deduction is obtainable solely to salaried workers and pensioners, the distinction will scale back for professionals.

What do you have to choose: New Tax Regime or the Outdated Tax Regime?

Now to the actual query.

Between the previous and the brand new tax regime, which one do you have to choose?

The brand new Tax regime has decrease tax charges however doesn’t enable deductions.

Outdated tax regime has larger taxes however permits to scale back earnings by tax deductions.

Subsequently, when you can avail sufficient tax deductions, you would possibly nonetheless be higher off within the previous regime.

However what’s the tipping level? What’s “sufficient”?

What needs to be the quantity of tax deductions to make the previous regime extra engaging?

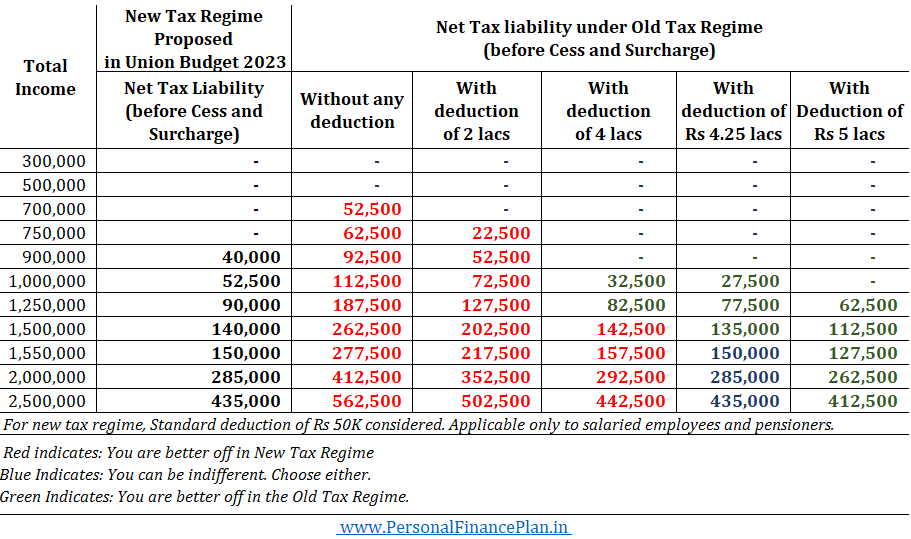

I in contrast the tax liabilities for varied ranges of earnings and tax deductions for salaried workers (who will get the good thing about normal deduction below each previous and new regime).

As you’ll be able to see above, the edge of tax deduction the place previous regime turns into extra engaging than the brand new regime is Rs 4.25 lacs (together with normal deduction).

Subsequently, when you can handle tax deduction of Rs 4.25 or extra (Rs 3.75 lacs excluding normal deduction), you’ll be higher off within the previous regime.

For non-salaried (who don’t get profit of ordinary deduction), the tipping level shall be Rs 3.75 lacs.

Now, you will need to see when you can take tax deductions to that extent.

Part 80C: As much as Rs 1.5 lacs (life insurance coverage premium, ELSS, PPF, EPF, and many others.)

Part 80D: As much as Rs 25,000. For medical insurance premium. In the event you (or your partner) are a senior citizen, the profit goes as much as Rs 50,000. As well as, in case you are paying the premium in your mother and father, you get a further 25,000 tax profit. If both mum or dad is a senior citizen, the extra profit goes to 50,000.

Part 80CCD(1B): As much as 50,000 for personal contribution to NPS.

Normal deduction of Rs 50,000.

These numbers add as much as about 2.75 lacs.

The opposite distinguished ones are as much as Rs 2 lacs for House Mortgage Curiosity (Part 24) and home hire allowance (HRA) adjustment . When you’ve got taken an schooling mortgage, you get tax profit for curiosity cost on schooling mortgage (no cap on the tax profit) below Part 80E.

So, in case you are staying in a home you personal (self-occupied) and you’ve got repaid the house mortgage in full, you’ll be able to’t take profit below Part 24 (dwelling mortgage curiosity) and home hire (HRA).

In such a case, it’s troublesome to the touch that magical mark of Rs 4.25 lacs (for salaried/pensioners) and Rs 3.75 lacs (for self-employed).

And when you can’t hit the mark, you’re higher off within the new tax regime.

Tax Advantages which can be nonetheless permitted below the New Tax Regime

Normal deduction of Rs 50,000. Allowed just for salaried workers and pensioners.

Employer contribution to NPS, EPF, and superannuation fund. Part 80CCD (2). Observe solely employer contributions are allowed as deduction. Not personal contribution. Therefore, when you’ve got been investing in NPS and taking good thing about as much as 50K below Part 80CCD(1B), you gained’t be capable to get that profit when you change to the brand new tax regime.

As well as, for a let-out property, you would possibly nonetheless be capable to take profit for dwelling mortgage curiosity.

The Verdict

It’s evident that the Authorities is making an attempt to extend acceptance of the New Tax regime by incentives.

By lowering tax charges for the middle-income earners.

And lowering surcharge for very high-income earners.

And probably progressively part out the previous regime. Or if only a few folks go for the previous regime, it should mechanically change into irrelevant.

And I feel the Authorities is doing it the appropriate manner. Somewhat than abolishing the previous regime or withdrawing tax advantages below the previous regime, they’ve simply made the New Tax Regime extra engaging.

The Authorities did the identical with crypto investments. It may have banned crypto investments. As an alternative, it discouraged the funding in cryptos by larger taxes, TCS, disallowing setoffs, or carry ahead of loss. So, not an outright ban however a nudge to not make investments.

Going ahead, if the Authorities needs to place extra money within the pockets of the traders, it should merely tweak the tax charges or tax slabs below the brand new regime. And never contact the previous tax regime.

With this, it’s truthful to NOT count on an enhancement within the Part 80C restrict. Not now and never sooner or later. Or every other particular tax advantages. I don’t count on any recent tax profit solely for the previous tax regime sooner or later. If a brand new tax profit (deduction) is introduced, it might be for each the previous and the brand new regime.

By the way in which, if we maintain including tax deductions to the brand new regime, we’ll beat the final word goal of the New Tax Regime. An easier tax construction. And the brand new regime turns into the New “Outdated Regime”.

The brand new tax regime is straightforward.

Will get you out of that tax-saving mindset.

Complete industries have mushroomed across the idea of tax-saving. Taxpayers purchase insipid funding merchandise simply to avoid wasting taxes. Underneath stress to make that tax-saving funding earlier than the tip of March, they purchase something with little regard to their wants and utility of their portfolios. Gross sales brokers construct their total gross sales pitch round tax-saving. Not anymore.

I don’t deny that taxation is a vital choice variable when deciding on an funding, but it surely shouldn’t be the one choice variable.

And sure, it’s nice to get out of the tax-saving mindset. Nevertheless, don’t let go of the investment-making mindset. You need to nonetheless make investments in your monetary objectives.

Featured Picture Credit score: Unsplash

[ad_2]