[ad_1]

Mark Twain wrote in 1907, “There are three sorts of lies: lies, damned lies, and statistics.” The variations in opinion about gentle or arduous landings middle on how tendencies are measured, information accuracy, revisions, seasonal changes, and which information to comply with. I present Chart #3 of what I’m monitoring over the subsequent six months because the story about gentle or arduous landings unfolds.

This text is split into the next sections:

Readers who need assist {that a} recession is coming ought to learn Recession Sign As Shoppers Battle To Pay Payments at RIA Recommendation by Lance Roberts. For individuals who wish to learn assist for a gentle touchdown, I recommend What recession? Inflation, GDP provide hope for ‘gentle touchdown’ by Tobias Burns at The Hill. Stacey Vaneck Smith at NPR factors out the center floor of a gentle recession in Is the Economic system Headed for Recession Or a Mushy Touchdown?

Lies, Damned Lies, and Statistics

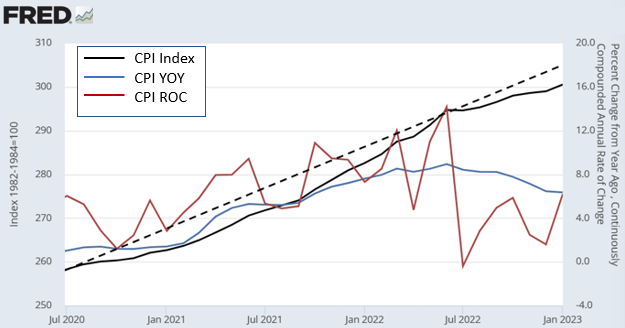

Chart #1 illustrates varied strategies of deciphering inflation utilizing the Client Worth Index. The strong black line is the uncooked CPI index, and the dashed black line is a pattern line from the beginning in July 2020 by way of the height in June 2022. Clearly, the development of inflation started to peak in June 2022. The year-over-year change in CPI (blue line) reveals that inflation is 6.4% in comparison with a 12 months in the past; nevertheless, the shortcomings are that it compares inflation as we speak to circumstances a 12 months in the past and doesn’t emphasize the short-term tendencies. The purple line is the constantly compounded annual charge of change within the CPI. The markets acquired the jitters in February as a result of the January studying was increased than anticipated, partially because of revisions. The fourth quarter pattern indicated inflation of three.3% setting excessive expectations for disinflation till the January quantity jumped to six.2%, impacting fears of upper charge hikes. Lions and tigers and bears, Oh My! The issue is there’s an excessive amount of noise within the information to depend on a single month.

Chart #1: Three Views of the Client Worth Index

Supply: Creator Utilizing BLS Information from the St. Louis Federal Reserve (FRED)

The bond market is now aligning extra with what the Fed has been saying about inflation, however the inventory market is slower to simply accept. Some costs are “sticky,” and it’ll take time to understand the lag within the impact of charge hikes as these costs, like labor prices, are sluggish to fall.

Paul Donavan at UBS provides an excellent, transient abstract of the calculations about seasonal changes and their large influence in “Please Alter Your Information Set.” He factors this out utilizing employment for instance, “In January, the variety of jobs within the U.S. fell by greater than two and a half million. It was reported as an increase of simply over half 1,000,000.” Critically?!

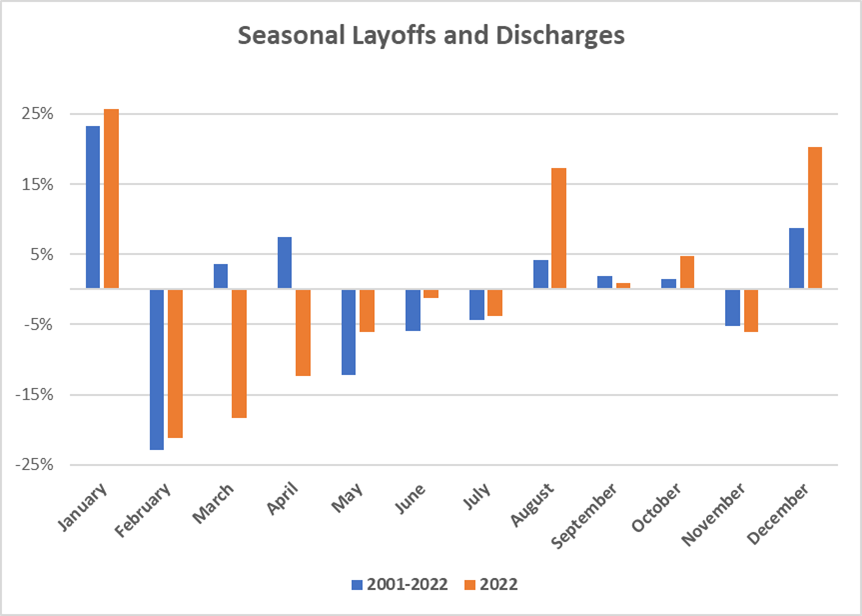

One of many causes for seasonal impacts on Labor is layoffs and discharges, which are typically highest throughout December and January and lowest in February and the summer time months, as proven in Chart #2. On common, since 2001, there have been a median of 1.9M layoffs and discharges per 30 days, however 2022 was uncommon, with just one.4M per 30 days. The pattern could also be altering, although. In December of final 12 months, twenty p.c of the layoffs from 2022 occurred in comparison with an extended historic common of 9 p.c for December. Is that this a one-month aberration or the beginning of a pattern? The U.S. Bureau of Labor Statistics will launch the Job Openings and Labor Turnover Survey for January on March 8.

Chart #2: Seasonal Layoffs and Discharges by Month

Supply: Creator Utilizing St. Louis Federal Reserve (FRED) Database

Frosted Crystal Balls

I attempt to filter out the noise from the media and hearken to the extra researched and unbiased opinions. The Convention Board is a company with an extended and respectable monitor document. I quote Ataman Ozyildirim (Ph.D.), Senior Director of Economics at The Convention Board:

“Among the many main indicators, deteriorating manufacturing new orders, shoppers’ expectations of enterprise situations, and credit score situations greater than offset strengths in labor markets and inventory costs to drive the index decrease within the month… Whereas the LEI continues to sign a recession within the close to time period, indicators associated to the labor market—together with employment and private earnings—stay sturdy thus far. Nonetheless, The Convention Board nonetheless expects excessive inflation, rising rates of interest, and contracting shopper spending to tip the U.S. economic system into recession in 2023.“

Supply: The Convention Board, February 17, 2023

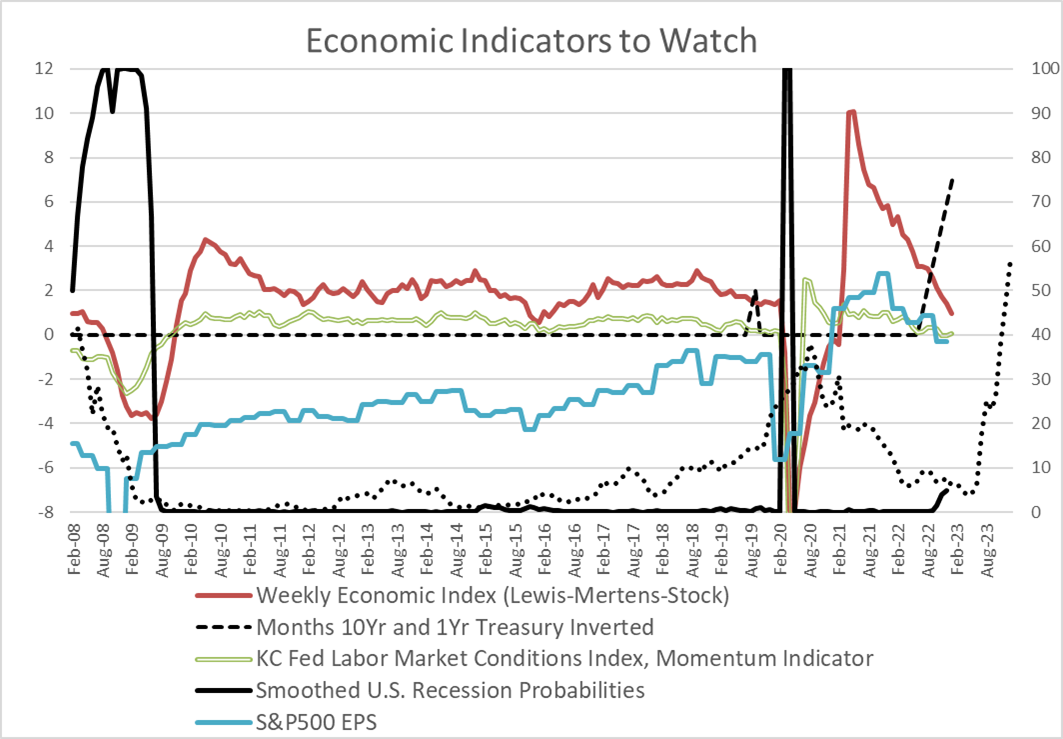

I created Chart #3 of the economic system and monetary markets to take away among the frost off my crystal ball. The Ok.C. Fed Labor Market Situations Index, Momentum Indicator (double inexperienced strains) reveals Labor Situations have peaked and are softening. The Weekly Financial Index (Lewis-Mertens-Inventory) (strong purple line) reveals that financial development is beneath historic tendencies. The S&P 500 Earnings Per Share (strong blue line) peaked within the fourth quarter of 2021 and is declining. The Federal Reserve Financial institution of New York Yield Curve Main Indicator (black dotted line) estimates the likelihood of being in a recession by January 2024 to be 57%. The Smoothed U.S. Recession Possibilities (strong black line) is the Marcelle Chauvet and Jeremy Max Piger mannequin, which is correct and coincident with out a lot lead time. It’s beginning to present that recession danger is rising. Lastly, there’s the dashed black line which is the variety of months that the 10-year/1-year unfold has been inverted. A Wells Fargo research discovered that there’s an 80% likelihood that the upcoming recession might be longer than historic whether it is inverted for 12 months or longer. It has been inverted for seven months now. The three black strains are the metrics that I’ll pay probably the most consideration to over the subsequent three to 6 months to gauge the likelihood and severity of a recession.

Chart #3: My Brief-Time period Crystal Ball

Supply: Creator Utilizing St. Louis Federal Reserve (FRED)

The Actual-Time U.S. Recession Possibilities might be up to date by Jeremy Piger, Professor of Economics on the College of Oregon, for January across the finish of February.

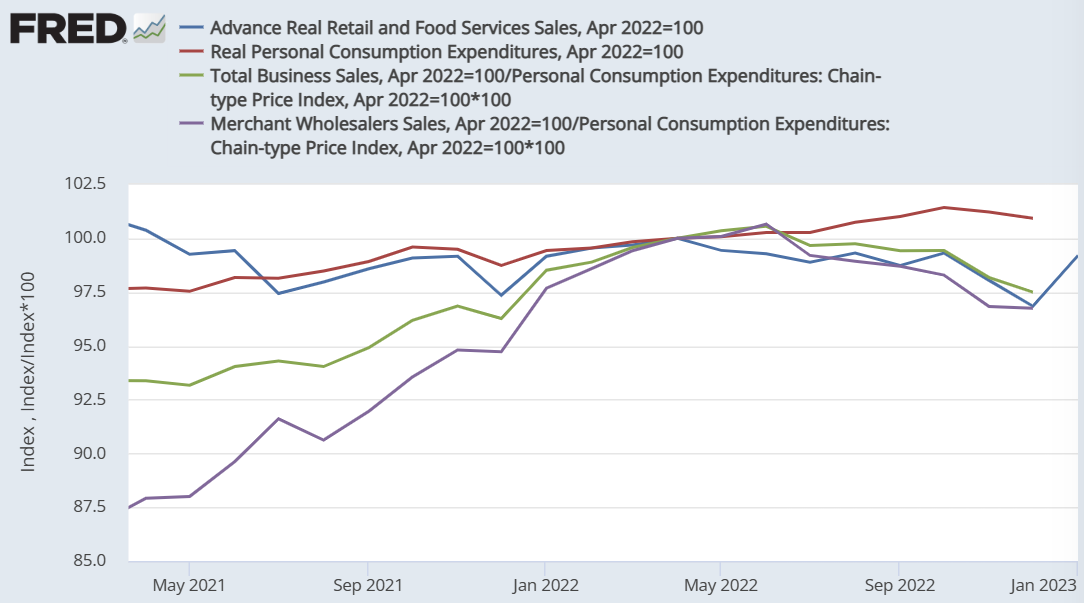

Okay, so how robust is the buyer? Chart #4 reveals the inflation-adjusted Retail Gross sales, Private Consumption Expenditures, Service provider Wholesalers Gross sales, and Complete Enterprise Gross sales, which comprise many of the sub-indicators in my Spending Indicator. They’re set to 100 in April of 2022 when Actual Retail Spending peaked. Inflation is taking a chew out of spending, and for the previous ten months, the buyer isn’t maintaining with inflation. Pandemic-era financial savings are being depleted, bank card purchases are rising, and delinquencies are rising, together with banks tightening shopper mortgage lending requirements. Slowing actual gross sales, softening labor situations, and falling earnings could lead to firms having extra layoffs or deferring hiring.

Chart #4: Client and Enterprise Spending Tendencies

Supply: Creator Utilizing St. Louis Federal Reserve (FRED) Database

Melissa Repko appears past the info tendencies by studying retailer firm stories in “Retailers Might Face Value Cuts and Slower Gross sales This Yr” on CNBC. She notes that vacation gross sales have been beneath expectations, retailers are rising cost-cutting measures, together with layoffs, bank card balances have risen, and shopper conduct is turning into extra conservative.

Stability Between Aggressiveness and Defensiveness

Howard Marks, the co-founder of Oaktree Capital Administration, wrote in Mastering the Market Cycle: Getting the Odds in your Aspect:

For my part, the best technique to optimize the positioning of a portfolio at a given time limit is thru deciding what steadiness it ought to strike between aggressiveness/defensiveness. And I imagine the aggressiveness/ defensiveness must be adjusted over time in response to modifications within the state of the funding surroundings and the place quite a lot of components stand of their cycles.

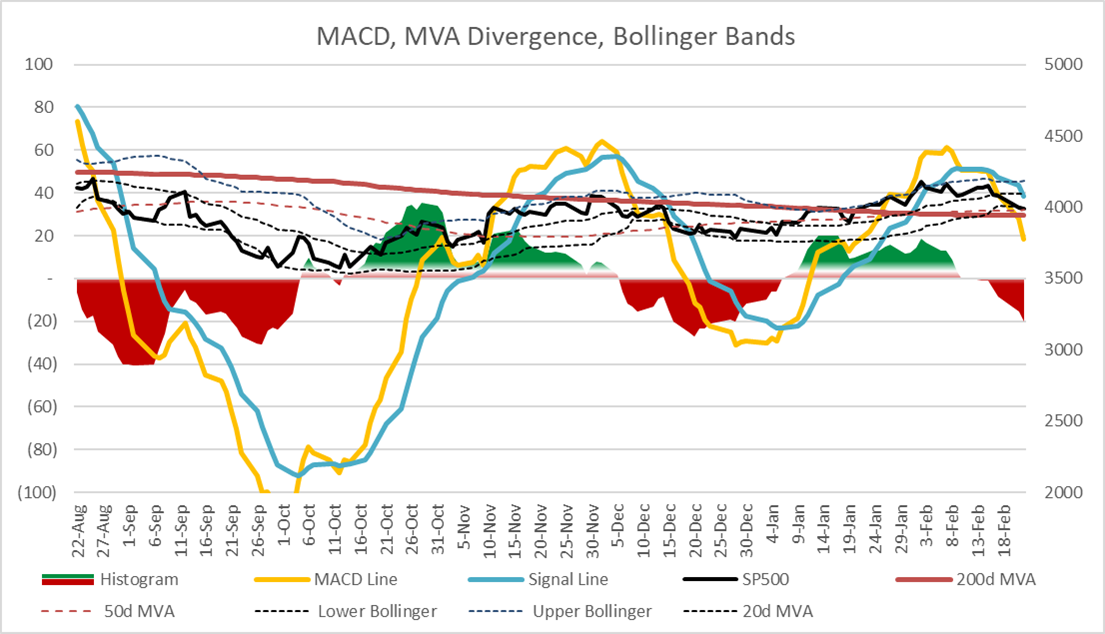

A number of years in the past, I created Chart #5 of my favourite momentum indicator, the Shifting Common Convergence Divergence (MACD), utilizing a spreadsheet linked to the St. Louis Federal Reserve (FRED) database. It’s primarily based on exponential shifting averages and produces a “Purchase and Promote” sign. The MACD generated a “Promote” sign on February 10. I don’t do short-term trades, however the MACD might be helpful for entry and exit factors in addition to a actuality test for “Worry of Lacking Out (FOMO).”

Chart #5: S&P 500 Momentum

Supply: Creator Utilizing St. Louis Federal Reserve (FRED)

Doug Noland’s Weekly Commentary on Searching for Alpha is a painfully detailed and extremely informative assortment of article summaries that dive into the small print of the info typically earlier than their tendencies turn into obvious. He summarizes an article on Bloomberg by Farah Elbahrawy on February 13 that explains why the S&P 500 is shedding its momentum. Ms. Elbahrawy states, “U.S. shares are ripe for a selloff after prematurely pricing in a pause in Federal Reserve charge hikes, in response to Morgan Stanley strategists.”

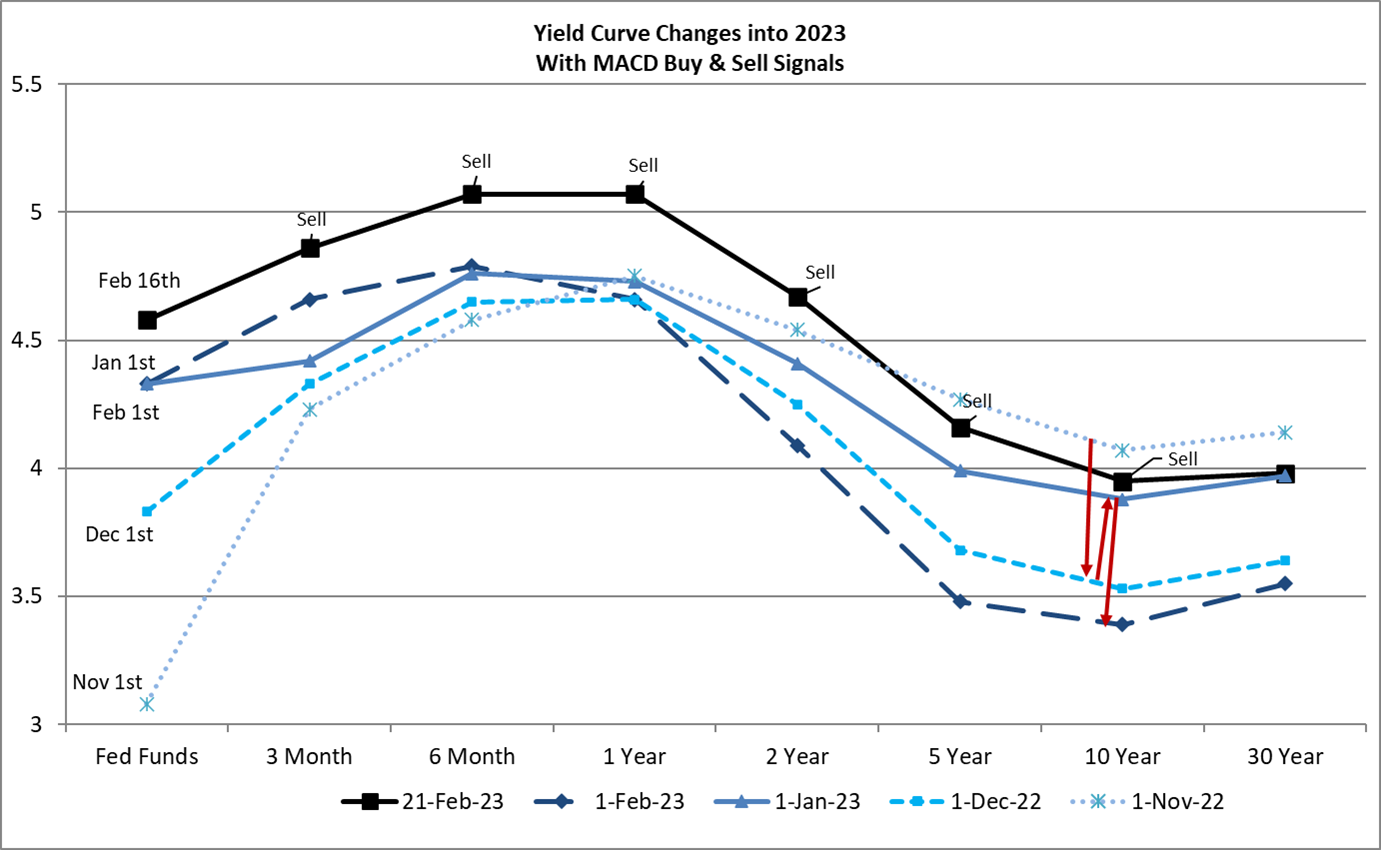

Curiosity Fee Alternatives Alongside the Yield Curve

This month, I created MACD momentum charts for Treasuries alongside the yield curve. Rates of interest have risen in response to the “hotter” than anticipated January CPI information level. Chart #6 reveals the modifications within the Yield Curve over the previous 4 months. The black line is the newest Yield Curve, together with the MACD purchase and promote indicators. The purple arrows present the volatility across the ten-year Treasury yields. My interpretation is that yields are nonetheless rising, which is hurting bond fund efficiency. The Fed Funds charge is prone to hit 5.25% by mid-year. I’ve a screener arrange at Constancy for bullish bond ETFs utilizing indicators resembling MACD. At the moment, most bullish bond ETFs are short-duration. Money is king.

Chart #6: Yield Curve Adjustments with MACD Purchase and Promote Indicators

Supply: Creator Utilizing St. Louis Federal Reserve (FRED)

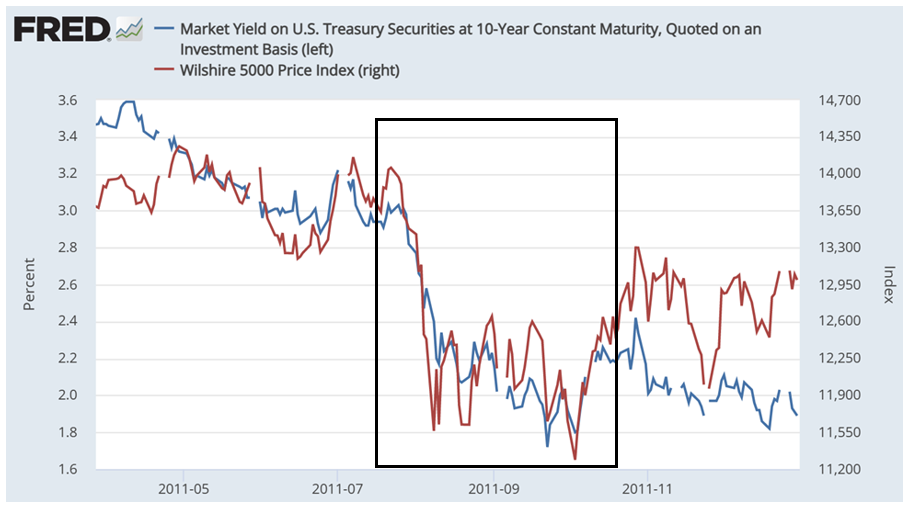

Let’s not overlook that the U.S. may default as early as June if the debt ceiling isn’t lifted. I imagine that neither political social gathering desires that, and it’s unlikely however not absolute that it’ll not occur. On August 5, 2011, S&P downgraded U.S. sovereign debt after issuing warnings. The U.S. didn’t default. In line with Wikipedia, S&P stated, “The political brinksmanship of current months highlights what we see as America’s governance and policymaking turning into much less secure, much less efficient, and fewer predictable than what we beforehand believed. The statutory debt ceiling and the specter of default have turn into political bargaining chips within the debate over fiscal coverage.” Sound acquainted? Round this time in 2011, the yield on the ten-year Treasury fell from over 3% to lower than 2% whereas the inventory market fell over ten p.c.

Chart #7: Time Surrounding S&P Downgrade of U.S. Sovereign Debt on August 5, 2011

Supply: Creator Utilizing St. Louis Federal Reserve (FRED)

As a precaution and in line with my 2023 technique, I count on to complete extending durations of Treasury bond ladders earlier than mid-year after which add to intermediate bond funds. Falling yields, like in August 2011, would profit bond costs.

Taking the Lengthy-Time period View

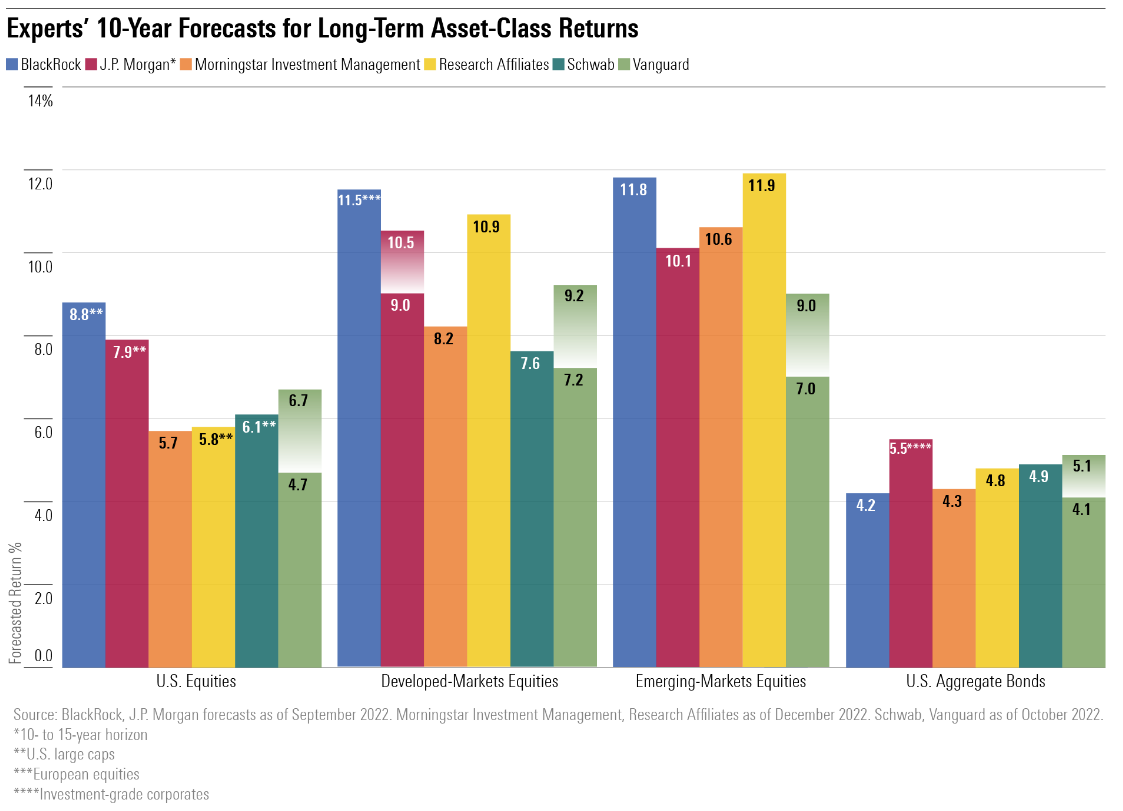

Trying past the short-term frost over our crystal balls, Christine Benz at Morningstar, wrote “Specialists Forecast Inventory and Bond Returns: 2023 Version,” the place she supplies the next chart of ten-year forecasts. It reveals that the chance premium of shares in comparison with bonds has diminished since charges have risen. Secondly, it reveals that there could also be alternatives in developed markets and rising markets. I count on that in some unspecified time in the future after mid-year, to start reinvesting short-term Treasuries as they mature into fairness mutual funds and ETFs.

Chart #8: Forecasts for Lengthy-Time period Asset-Class Returns

Supply: “Specialists Forecast Inventory and Bond Returns: 2023 Version” by Christine Benz, Morningstar

Closing Ideas

It can turn into clearer within the subsequent few months whether or not there might be a tough or gentle touchdown or someplace in between. Regardless, extremely rated bonds have turn into extra engaging. Harry Markowitz, Nobel laureate and creator of quite a few books, together with Danger-Return Evaluation, stated that “Diversification is the one free lunch.” My base case stays unchanged that the Fed will elevate charges by 1 / 4 level one or two extra occasions this 12 months, inflation will proceed to fall however stay above 2% for longer, the economic system will present extra weak point within the coming months, and a recession is probably going throughout the latter a part of the 12 months.

Particular thanks go to my pal, Dave Hogle, who began me on the investing journey by loaning me The 4 Pillars of Investing by William Bernstein twenty years in the past, for our quite a few long-distance Costco runs discussing all the things underneath the solar, and for his insightful options for these articles.

I discovered from a Reader and member of MFO (Thank You) in January that the MACD and Bollinger Bands can be found on the free model of Stockcharts.com for ten-year Treasury yields, utilizing the image $UST10Y. Bond costs transfer inversely with yields. I adopted up, and the Constancy Energetic Dealer Professional and Stockcharts.com are additionally able to operating these metrics for mutual funds, which is a great tool.

[ad_2]