[ad_1]

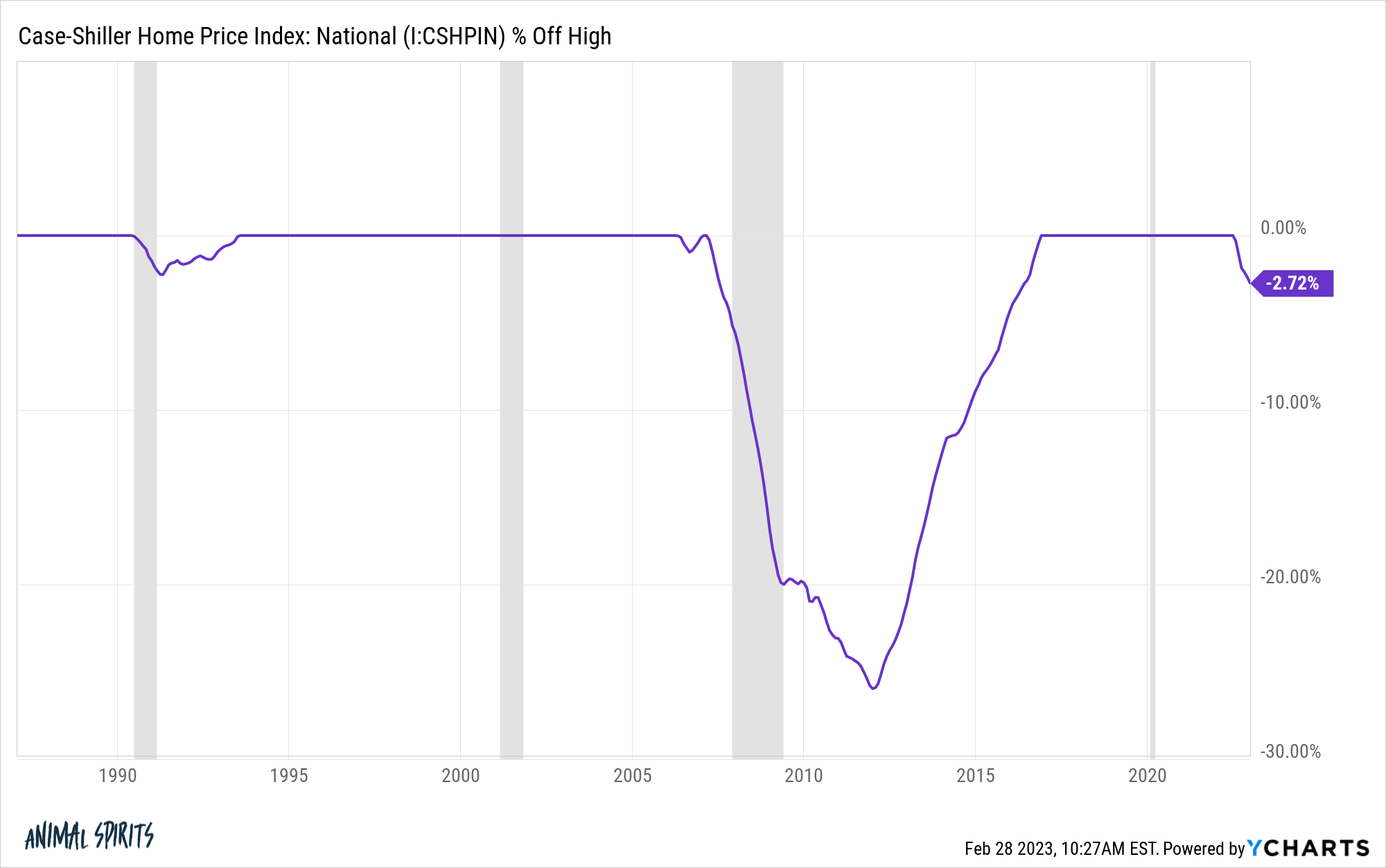

The most recent Case-Shiller nationwide residence value index knowledge was launched this week. Right here’s the place we stand when it comes to the drawdown from peak costs:

That is the third largest nationwide residence value drawdown since 1987 however I’m certain numerous individuals are shocked costs haven’t fallen extra what with 7% mortgage charges and unsustainable value positive factors in recent times.

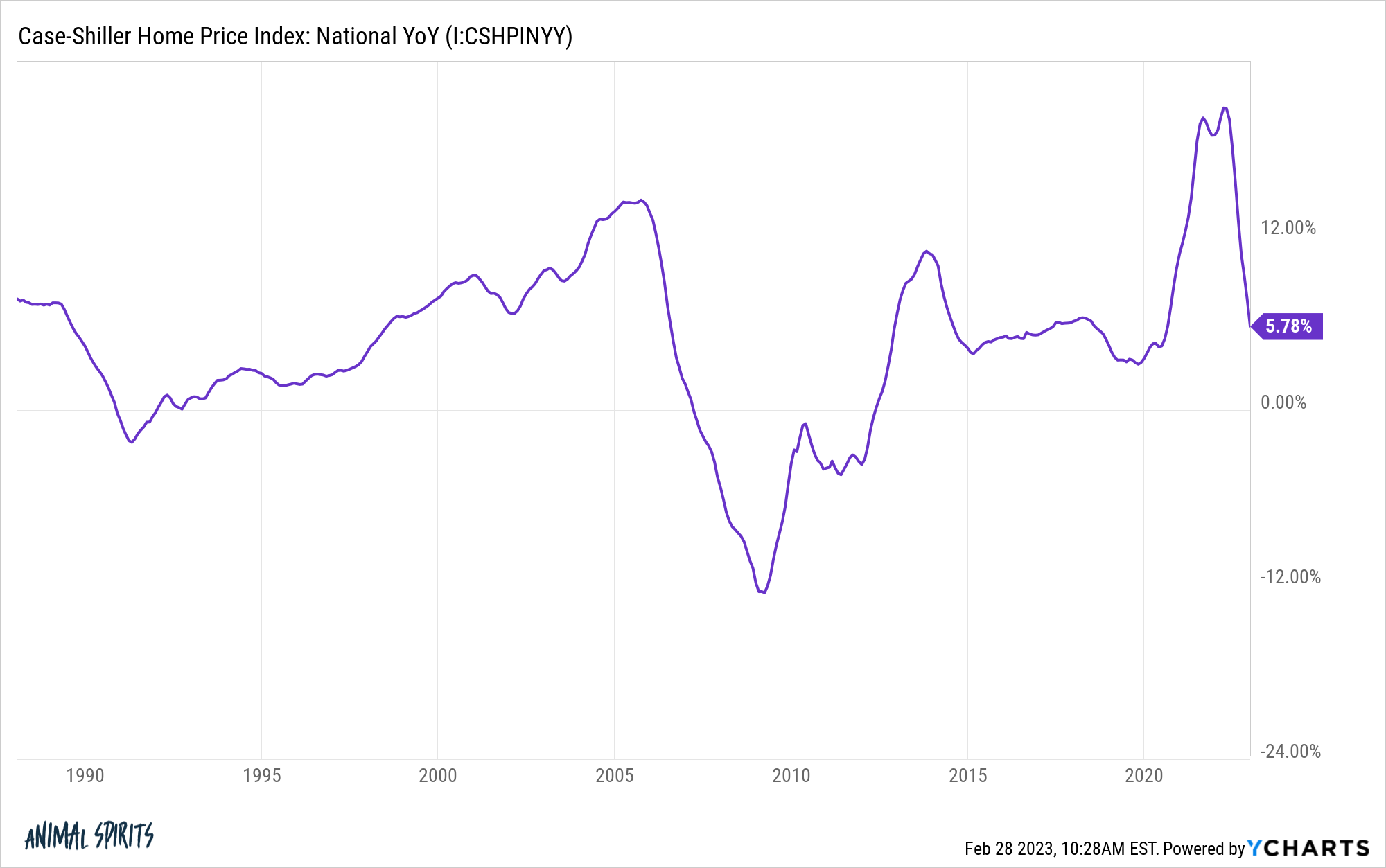

The most recent knowledge exhibits a year-over-year acquire of lower than 6%:

These sorts of positive factors are nonetheless comparatively excessive however coming down from nosebleed pandemic ranges.

To be honest, this knowledge is just by means of the tip of December 2022. Housing costs have most likely come down just a little extra this yr.

There are particular areas which are seeing bigger value declines — locations like San Francisco, Phoenix, Boise, Seattle Austin, and so forth. However these are additionally the locations that skilled bigger positive factors in the course of the growth years.

There has but to be a whole collapse within the nationwide housing market regardless of the worst affordability ranges we’ve seemingly ever seen.

With the caveat that housing costs can and possibly will fall extra from present ranges if mortgage charges keep at 7%, let’s check out the info to see why costs have been comparatively sticky even in a rising price atmosphere.

The best purpose is the fast rise in mortgage charges has slowed housing exercise to a crawl.

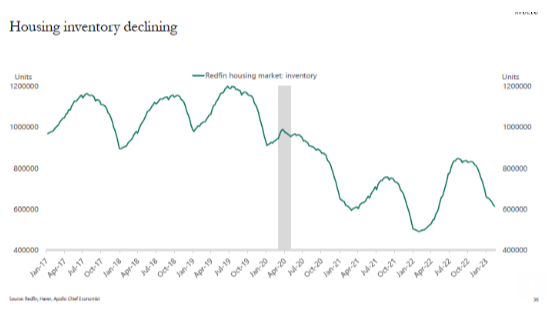

Stock ranges rose for a bit however are crashing once more so there simply aren’t that many homes available on the market:

Mortgage buy software exercise, principally the variety of loans getting began, has fallen off a cliff to the bottom ranges this century:

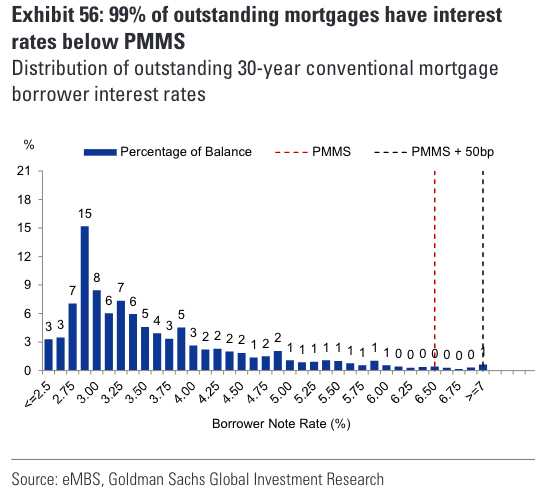

This is smart when you think about nobody needs to promote and nobody needs to refinance because the majority of house owners have mortgage charges which are nicely under present ranges:

House Depot’s CFO talked about how this dynamic has been a boon to their enterprise as a result of all of these individuals with 3% mortgages are opting to renovate moderately than transfer:

It’s onerous to see market clearing costs when there isn’t a lot of a market anymore.

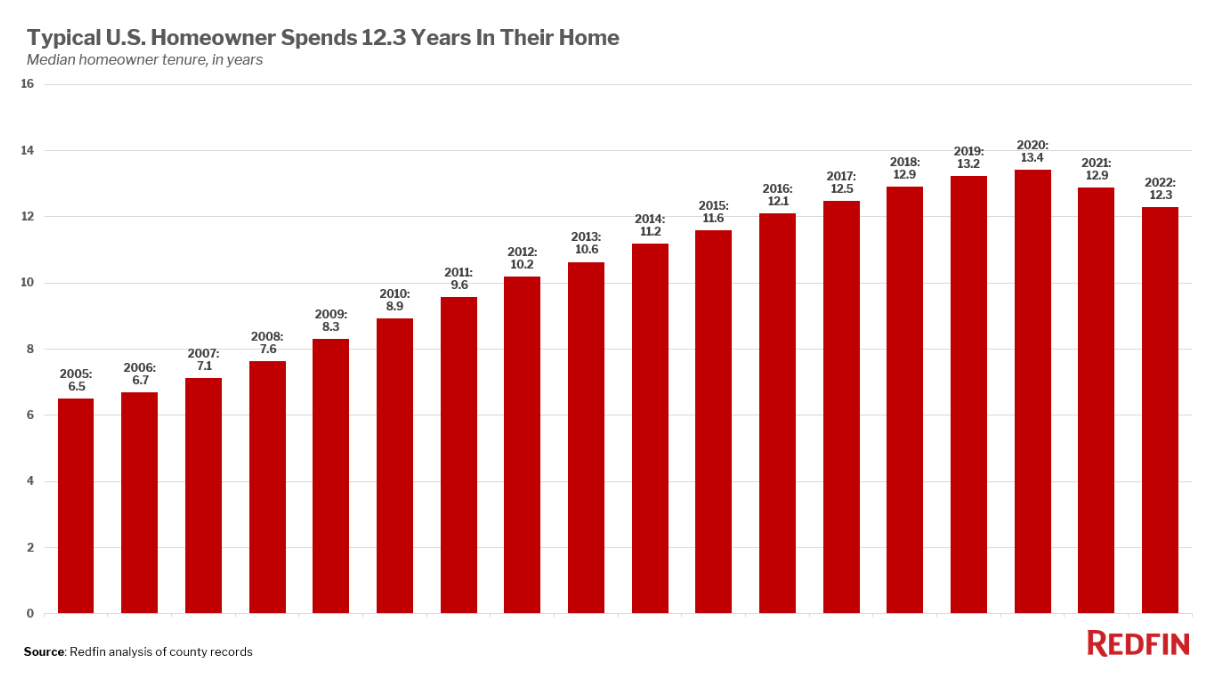

Householders had been already staying of their properties for longer than they did prior to now and it’s seemingly this pattern will proceed (by way of Redfin):

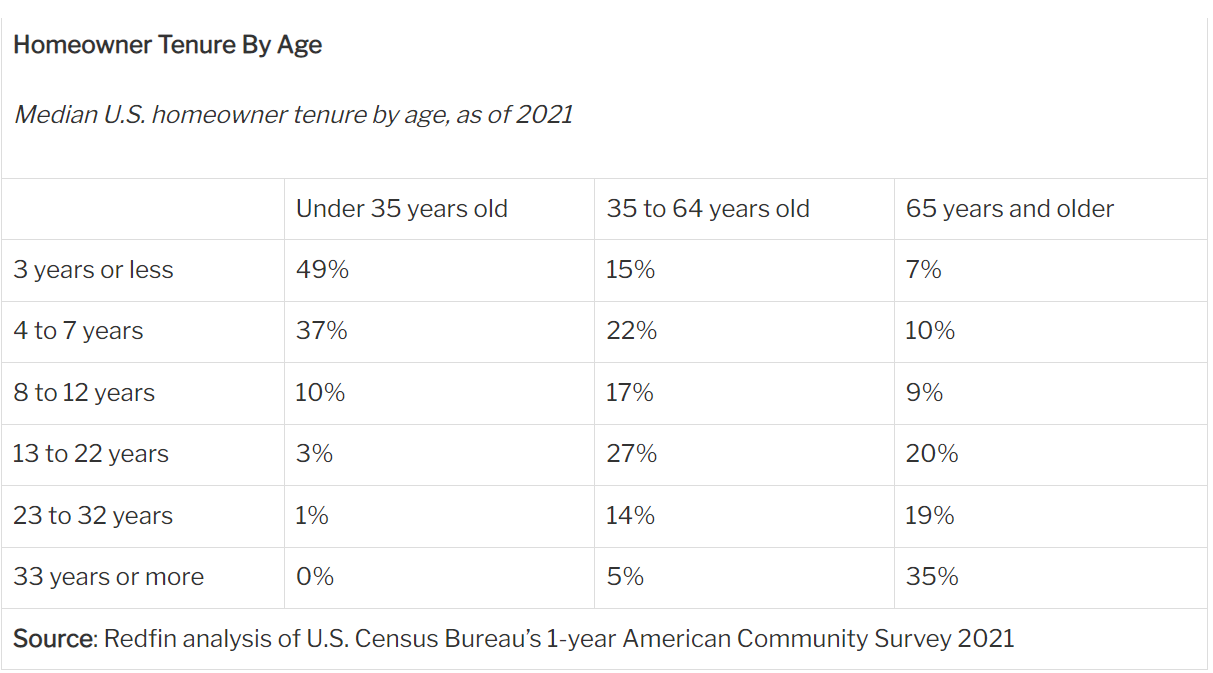

It’s potential youthful generations received’t keep of their properties so long as older generations have due to altering tastes however 3% mortgage charges are going to make that call tougher:

The excellent news is demographics will power individuals’s arms ultimately. Child boomers will downsize, transfer to Florida or die off.

Millennials will need bigger properties as soon as extra of them start having households.

Housing exercise will decide again up in some unspecified time in the future.

But when mortgage charges don’t get again down underneath 5% or 6% it’s troublesome to see the impetus for current householders to record their properties on the market in a giant means.

The endowment impact can be sturdy within the housing market. That is the inertia that causes individuals to put a better worth on one thing they already personal.

That home 4 blocks over is means overpriced however there’s no means I’m chopping the value on my home.

This behavioral bias might additionally imply people who find themselves ready for decrease costs are going to should be affected person.

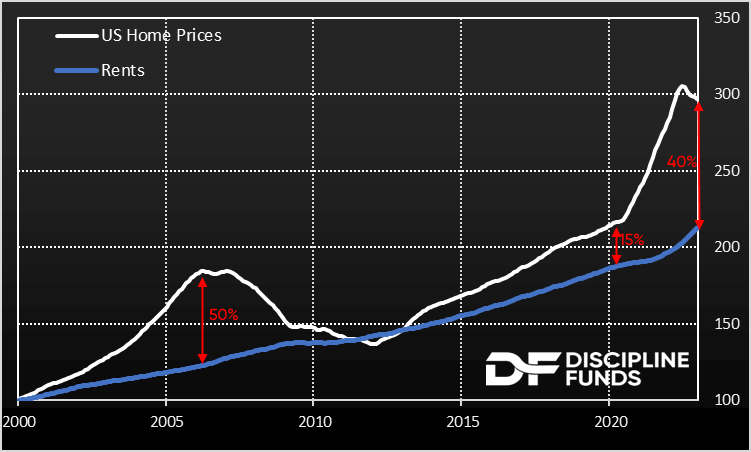

Cullen Roche had a chunk this week that compares housing costs to rents since 2000:

Logically, you’d suppose this hole must shut in some unspecified time in the future.

Cullen says we’ve got to be affected person to see costs fall:

If there are only a few sellers and even fewer consumers then it’s not unreasonable to imagine that the sellers will push costs decrease because the low variety of consumers demand decrease costs. Stated in a different way, to make use of a inventory market analogy, if we had been seeking to purchase a inventory with a skinny set of asking costs and a basic value that one bidder thinks is considerably decrease than the present market value then that single bidder has pricing energy although there are just a few asking costs. And if the asks get determined sufficient with a affected person bidder then costs will fall whatever the “low stock”.

I’ve been saying this for nicely over a yr now, however this atmosphere stays one the place endurance is required. Housing is an inherently gradual transferring beast and we can not anticipate something to occur quickly right here.

There may very well be one thing to this. You possibly can’t purchase and promote your own home as shortly as you should purchase and promote a inventory (and for good purpose).

It might simply be these individuals who really want to promote will take a while to deliver down costs to extra reasonably priced ranges.

If housing costs do fall in a significant means it’s most likely going to be extra of a gradual burn than a crash.

Michael and I mentioned the housing market and extra on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

What Occurs if Housing Costs Fall 20%?

Now right here’s what I’ve been studying these days:

[ad_2]