[ad_1]

It’s been powerful sledding for mortgage charges over the previous month.

They had been really on a roll to begin off 2023, falling for all the month of January earlier than issues took a nasty flip.

With out getting too long-winded right here, sturdy financial knowledge pushed charges again towards decade highs.

The culprits had been a CPI report and a jobs report, each of which got here in hotter than anticipated.

These principally derailed the argument that inflation had peaked. Nonetheless, you may come throughout 5% mortgage charges when the information is telling you they’re 7%. Why?

How It’s Nonetheless Attainable to Supply 5% Mortgage Charges

The newest weekly survey from Fannie Mae put the 30-year mounted at 6.65%, it’s highest stage of 2023. And its highest stage since November 2022.

Previous to that, 30-year mounted mortgage charges didn’t exceed 7% since April 2002. Sure, it was an excellent 20-year run people.

In early February of this 12 months, charges had been again under 6%, albeit simply barely, but it surely was nonetheless an indication that we had probably turned a nook.

Then there was the January jobs report, adopted by the CPI report in mid-February, which turned charges on their head.

All that progress from November was gone in a flash. At this time, you’re most likely seeing headlines that say mortgage charges are again at 7% (and above).

However in the event you do comparability procuring on mortgage web sites, you may nonetheless come throughout charges within the 5% vary? How? The reply is straightforward; low cost factors.

If You Pay Extra at Closing, You Can Get a Decrease Price

Merely put, lenders which can be nonetheless promoting mortgage charges within the 5% vary (name it 5.99%) are probably tacking on low cost factors.

These are a type of pay as you go curiosity, and that curiosity paid upfront at closing means you pay much less throughout the mortgage time period.

Usually, paying factors is completely elective, however due to the muddled mortgage market, lenders are sometimes requiring factors be paid.

Anyway, those that pay extra now can save later. So whereas the going charge for a 30-year mounted is likely to be 7%, you may nonetheless have the ability to snag a charge within the 5s.

Nonetheless, you’ll must pony up some critical money on the closing desk. Or ask for vendor concessions to get there.

Usually, you’ll have to pay a pair low cost factors to push your charge down under 6%.

On a hypothetical $500,000 mortgage quantity, we’re speaking $10,000 simply to cowl the factors.

You’ll probably produce other closing prices to fret about too, similar to a mortgage origination charge, together with third-party charges like title insurance coverage and a house appraisal.

It may well get fairly costly. And worst of all, you may not recoup that cash. For those who don’t maintain the mortgage lengthy sufficient, you may not hit the break-even level on these upfront prices.

Low Marketed Mortgage Charges Remind Me of Automotive Lease Specials

For those who’ve ever shopped for a automobile, particularly an auto lease, you may see a low marketed month-to-month fee.

For instance, $299 to lease X automobile for 36 months. That sounds superior and is likely to be a lot decrease than opponents.

However in the event you learn the superb print, you would discover that the low fee requires a $3,000 down fee.

Abruptly, the $299 doesn’t look as interesting. Utilizing basic math, if we add that $3,000 again equally over 36 months, the fee is $382. Then you definately add the tax and also you’re at $400+.

The distinction with a mortgage is you may really lower your expenses by paying factors upfront. In spite of everything, you get a decrease rate of interest in consequence.

And a decrease charge leads to much less curiosity paid every month. The secret is really conserving the mortgage lengthy sufficient, as famous.

But when there’s an expectation these 7% mortgage charges are going to settle again down, you may not need to go all in on that 5.99% charge.

Talking of, watch out chasing charges under a key threshold. It is likely to be comparatively cheaper to just accept the 6.125% charge versus the 5.99% charge.

And the distinction in month-to-month fee negligible.

Store Extra When Mortgage Charges Are Larger

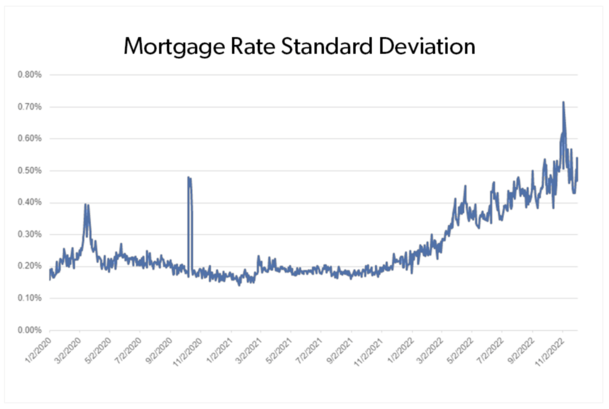

Freddie Mac ran a latest examine to trace “day by day dispersion of mortgage rates of interest” over time.

In brief, “related debtors might obtain notably totally different charges” on the identical precise day, primarily based on the lender they spoke with.

By related debtors, they imply these with close to similar mortgage eventualities, together with identical sort of mortgage, identical credit score rating vary, property sort, mortgage quantity, LTV, and many others.

Regardless of comparable credit score danger, common mortgage charge dispersion climbed roughly 50 foundation factors (0.50%) and surpassed 0.70% in October and November of 2022.

That’s the final time mortgage charges had been over 7%. Previous to that point interval, the everyday mortgage charge dispersion was lower than 20 foundation factors (.20%) from 2010 to 2021. See chart above.

In different phrases, mortgage charges weren’t a lot totally different from one lender to the subsequent. So in the event you didn’t store, it might not have mattered.

However in late 2022, dispersion skyrocketed, that means choosing the right lender price-wise was harder.

And your probabilities of touchdown that higher charge correlated with the variety of quotes acquired.

Again within the months of October and November 2022, debtors who acquired two charge quotes might have saved as much as $600 yearly, whereas those that acquired 4+ quotes might have saved $1,200+.

Even when mortgage charges had been averaging 6%, related debtors might have acquired quotes of 6.5% at some point and 5.5% the opposite, relying on the lender.

As a result of mortgage charges change day by day, gathering quotes over a span of days and even weeks might enhance your probabilities of timing it proper.

Positive, you would get fortunate in your very first quote. However why depart it to likelihood?

In brief, store extra when mortgage charges are excessive.

[ad_2]